As Microsoft gears up for its quarterly earnings report this month, finance leases have become a critical metric for investors to watch.

Finance leases allow a company to spread the cost of an asset over several years instead of paying the full amount upfront. For a tech giant like Microsoft, which is aggressively expanding its massive data centers to support burgeoning artificial intelligence operations, these leases represent significant financial commitments.

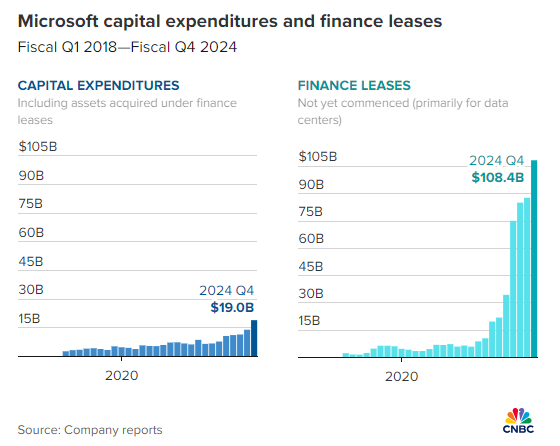

In its annual report released in July, Microsoft revealed in a footnote that its upcoming finance leases had surged to $108.4 billion, a jump of $20.6 billion from the previous quarter and an increase of nearly $100 billion over the past two years. These leases, scheduled to start between fiscal years 2025 and 2030, could extend up to 20 years, according to the report.

In the most recent quarter, Microsoft’s capital expenditures hit $19 billion, including assets acquired under finance leases. This figure marks a rise from $14 billion in the March quarter and equals the total expenditure for the entire 2020 fiscal year.

“The escalation is staggering,” commented Charles Fitzgerald, a former Microsoft executive who now analyzes capital expenditures on his blog, Platformonomics.

Investors are poised for more detailed insights into Microsoft’s leasing activities when the company announces its first-quarter fiscal results in late October. Over the past two years, executives at Microsoft and other leading tech firms have greenlit increased capital expenditures, particularly to enhance their capabilities in generative AI.

Recently, Microsoft confirmed its involvement in a funding initiative aimed at developing data centers and supporting energy infrastructure, predominantly in the U.S. Additionally, it entered into a 20-year agreement to reactivate a reactor at the Three Mile Island nuclear plant in Pennsylvania, underscoring its commitment to sustainable energy solutions for its expanding data center operations.

Tue, Oct 1 20249:00 AM EDT

The unexpected increase in Microsoft’s costs during the June quarter didn’t catch those who followed CFO Amy Hood’s April guidance off guard, as she had forecasted a significant rise in capital expenditures for the third time within a year.

Despite these warnings, Rishi Jaluria from RBC Capital Markets was surprised by the actual finance lease figures.

“I generally expect that capital leases and capital expenditures will surpass expectations, yet this time they even outdid my own,” Jaluria noted. “Honestly, I’m putting my trust in Microsoft on this one.” A capital lease, also known as a finance lease, involves Microsoft making incremental payments for assets over time.

Microsoft has found that constructing data centers from the ground up offers the best performance and cost efficiency. However, immediate needs for additional capacity sometimes necessitate the use of finance leases to speed up acquisition.

The urgency increased dramatically following the launch of ChatGPT by OpenAI in late 2022, which relies heavily on Microsoft for the computing power it requires, necessitating substantial server resources equipped with Nvidia graphics processing units to remain operational.

With the growing popularity of ChatGPT and other OpenAI services, Microsoft has expanded its partnerships to include additional cloud providers like CoreWeave and Oracle. A September report from UBS analysts suggested that Hood’s comments in January indicated these finance leases encompass relationships with both CoreWeave and Oracle.

Microsoft has opted not to comment on how these third-party cloud partnerships are reflected in their financial statements.

Jaluria pointed out that investors often overlook backlogs in capital leases because Microsoft does not detail when these will commence or their duration, making them seem less immediate than capital expenditures recorded within the quarter.

During earnings calls, CEO Satya Nadella typically lets Hood handle the financial queries. However, in July, Nadella responded directly to an analyst’s question about the strategy behind forming partnerships with other cloud providers that supplement direct data center spending by Microsoft.

“To me, it’s akin to previous leases we’ve undertaken,” Nadella explained. “You might even argue that sometimes purchasing from Oracle could be more cost-effective due to their shorter durations.”

Jaluria believes that investors must come to terms with the fact that these investments in capital expenditures and future finance leases will impact profitability.

“Margins are inevitably declining,” Jaluria, who maintains a buy rating on Microsoft’s stock, concluded. “The costs are here now, and the benefits haven’t yet materialized to offset them, but I believe that’s acceptable.”