Amazon Launches New AI Shopping Assistant, Rufus

Amazon has joined the consumer chatbot arena with the introduction of a new artificial intelligence personal shopping assistant, marking the company’s endeavor to keep pace with other tech giants in the field.

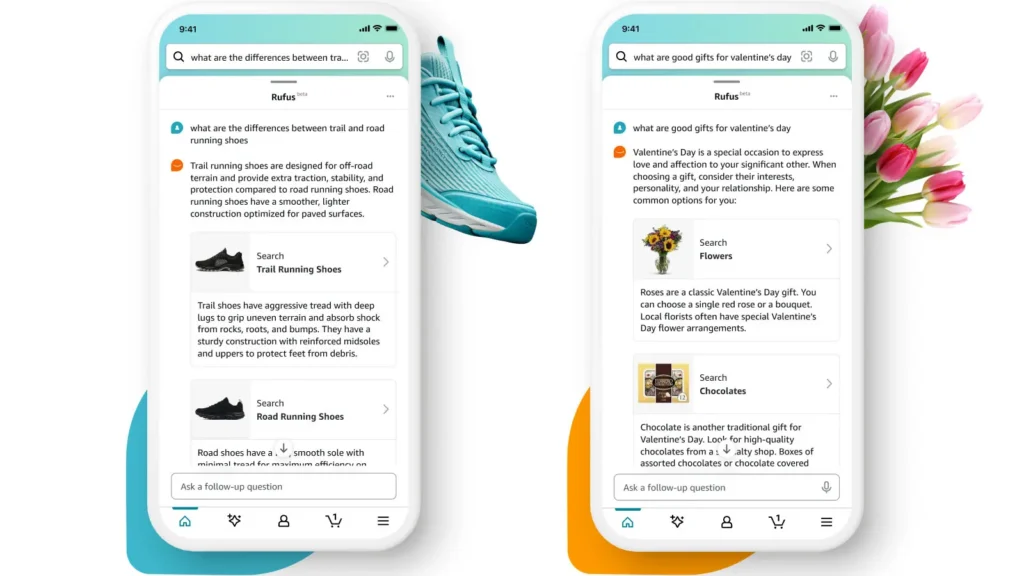

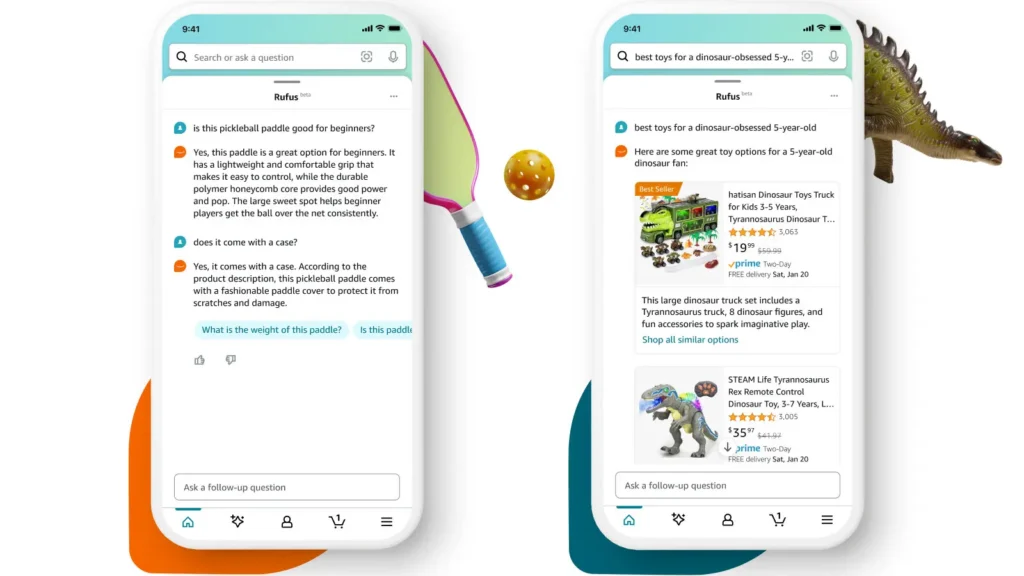

The newly unveiled tool, Rufus, allows customers to directly pose product-related queries within the search bar of Amazon’s mobile app, as outlined in a blog post by the company. Rufus responds to inquiries in a conversational manner, offering insights and recommendations. Examples provided in the announcement include comparing various coffee makers, gift suggestions, and inquiries about the durability of running shoes.

Initially, Rufus will be accessible to a “small subset of customers,” with plans to expand availability to more users in the following weeks, according to Amazon’s post. However, specific details regarding the initial rollout size were not disclosed by the company.

It’s worth noting that Amazon’s fondness for canines is reflected in the name of its new tool, with a dog named Rufus being among the first to wander the company’s offices during its early days.

In the realm of artificial intelligence tools, Amazon has been endeavoring to dispel any perception of lagging behind, particularly in the wake of the proliferation of AI-driven technologies over the past year, epitomized by the launch of OpenAI’s ChatGPT chatbot. With Rufus, Amazon aims to potentially revolutionize the product search landscape and further enhance the online shopping experience for customers.

During a call with investors, Andy Jassy, Amazon’s CEO, highlighted Rufus as a means for customers to explore items in a novel manner within the familiar Amazon ecosystem, offering a seamless integration that aligns with customers’ preferences and behaviors.

Amazon’s new chatbot Rufus in handout images provided by the company.Credit...via Amazon

Rufus will be available starting Thursday to a “small subset of customers.”Credit...via Amazon

Last spring, Microsoft and Google unveiled chatbots and AI tools tailored for their search engines, with a particular emphasis on shopping-related functionalities. Concurrently, startups like Perplexity have endeavored to revolutionize the search experience with AI-driven innovations.

In the fall, Amazon introduced its corporate chatbot, Q, designed for its cloud computing division’s customers, alongside efforts to enhance the conversational capabilities of its Alexa voice assistant.

Even devoid of generative AI, Amazon’s search bar and its top search results hold pivotal positions in online retail, drawing scrutiny from antitrust authorities. The product advertisements within search results form the bedrock of Amazon’s flourishing advertising business.

When consumers seek specific products to purchase, they are more than twice as likely to initiate their search on Amazon compared to other search engines. However, Amazon has long sought to engage customers at the exploratory stage of their shopping journey, where they often consult various sources, from TikTok to Google. Rufus represents Amazon’s endeavor to captivate customers before their preferences crystallize.

Brian Olsavsky, Amazon’s finance chief, explained during a press briefing that while customers can still utilize the search bar for precise queries, Rufus serves as an avenue for exploration and inquiry, fostering a conversational interaction with Amazon.

Rufus is equipped with knowledge gleaned from Amazon’s extensive product catalog, customer reviews, community Q&A sessions, and data aggregated from the web, the company explained.

During the earnings call, Mr. Jassy elaborated that customers can seek recommendations from Rufus on matters like selecting the best golf ball for enhanced spin control or the most suitable cold weather rain jackets, receiving insightful explanations and product suggestions.

If Rufus gains traction, Amazon stands to divert ad sales from platforms like Google and social media sites, where companies vie to influence purchasing decisions.

Separately, Amazon reported robust fourth-quarter earnings, buoyed by the holiday season, with sales reaching $170 billion, a 17 percent increase from the previous year, and profits totaling $10.6 billion, surpassing both analysts’ expectations and Amazon’s own projections.

The company’s services for third-party sellers and its advertising arm experienced notable growth, with advertising revenues reaching $14.7 billion, up 27 percent, and Amazon Web Services generating $24.2 billion, meeting investor forecasts.

Amidst strategic restructuring, increased operational efficiency, and a focus on profitability, Amazon remains committed to sustaining its impressive financial performance, underpinned by its lucrative cloud computing and advertising segments.