The Kremlin Adopts Innovative Strategies to Sustain Revenue

The windfall was bound to reach its limit. Despite facing Western sanctions, reduced production, and the challenges of navigating the Black Sea, Russia’s crude shipments experienced a decline, falling to 3 million barrels a day in August, a significant drop from the April-May average and beneath pre-war levels. The forecast suggests a continuation of this suboptimal performance. Russia announced an extension of a “voluntary” 300,000 barrels a day cut, initially declared for August, until the end of 2023, though the baseline for this reduction remains ambiguous.

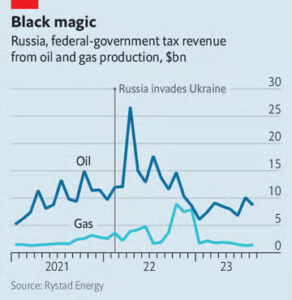

This decline in exports comes at a time when the Kremlin is keen on replenishing its military arsenal. Federal-tax revenues from crude sales saw a decrease, contributing to the devaluation of the rouble, which has reached its lowest since the invasion. These economic challenges have intensified Russia’s endeavors to maximize revenue from its crude production, employing three main strategies.

The initial strategy, seeking higher prices for the fewer barrels sold, encountered several hurdles. The price of Urals, Russia’s primary crude grade, averaged lower than the previous year, primarily due to a decrease in the global oil price. Western sanctions and the G7’s “price cap” also contributed to the pricing challenges. However, this approach has recently witnessed some progress. Factors such as anticipated peaking interest rates in the U.S., production cuts by Russia and Saudi Arabia, and the development of a “grey” fleet of tankers have contributed to a rise in the global oil price, benefiting Russia.

The West, aiming to maintain the flow of Russian oil to prevent supply shortages, is unlikely to enforce stricter adherence to its price cap. Consequently, gains in the price of Urals seem stable, although negotiating smaller discounts with customers may prove challenging. India, a significant buyer, has expressed concerns over the rising price of Urals, emphasizing its competitive disadvantage compared to Gulf crude, despite Urals continuing to trade at a substantial rebate.

In addition to selling less crude, Russia is focusing on selling more of its premium refined oil as a second strategy to sustain revenue. By utilizing idle capacity in its refineries and postponing scheduled maintenance, Russia aims to maximize the production of profitable products like diesel. The country has seen an increase in the export of such “clean” products, reaching a six-year high in August.

Lastly, Russia is exploring new distribution channels for its oil to compensate for lower crude shipments. There has been a discreet increase in piped flows to European countries like the Czech Republic and Hungary, which continue to purchase Russian oil. This trend is expected to persist until 2025. Additionally, Russia is increasing cargoes through the Arctic, a route significantly shorter than those from the Baltic and Barents seas, aiming to reduce shipment costs to China. Data indicates a substantial rise in Russian crude tankers utilizing this path in 2023. Russia aspires for year-round sailing through the Arctic by 2025, relying on global warming, although this may not align with the timeline to support the war effort.

Ultimately, several determining factors for Russia’s export receipts, including the state of the global economy, remain outside its immediate influence.