Amancio Ortega, the billionaire founder of Zara, is capitalizing on the current downturn in commercial property prices, seeing it as an opportunity to acquire assets at a reduced cost, especially as high borrowing costs provide an advantage to investors without debt.

Pontegadea, Ortega’s personal investment group valued at over €90 billion, is executing a “buy the dip” strategy to expand its real estate holdings. The Spanish fund, holding a 59% stake in Zara’s parent company Inditex, has announced 10 acquisitions totaling €1.1 billion in the past year, spanning logistics, offices, and residential properties.

Concentrated primarily in western Europe and North America, Pontegadea’s real estate portfolio boasts prized assets such as the Adelphi building and Devonshire House in London, along with Amazon’s Seattle headquarters.

Unaffected by high interest rates due to its abundance of dividends from the Inditex stake and its avoidance of debt, Pontegadea has remained resilient amid the more than 50% decline in transaction volumes in the US and Europe over the past year.

Roberto Cibeira, Pontegadea’s chief executive, noted a “price adjustment in Europe across asset classes” in recent months, expressing the belief that it’s a favorable time for investors with low debt. The tightening of credit conditions has reduced competition for potential acquisitions, with Pontegadea being offered assets through bilateral and off-market processes, particularly in logistics, retail, offices, and infrastructure.

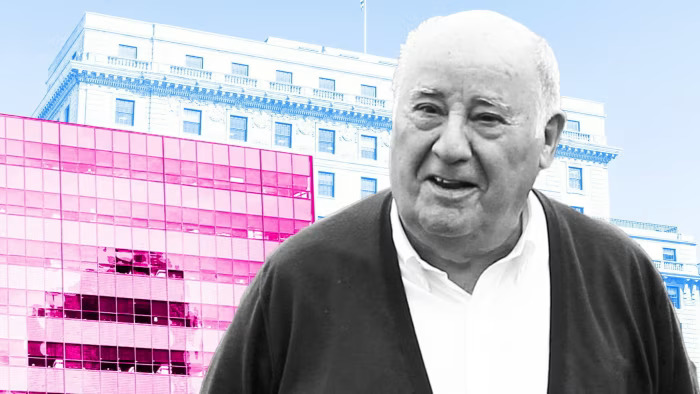

Amancio Ortega’s investment group’s prized assets include the Adelphi building in London © Alamy

Pontegadea, while trailing behind a few family offices like those of Bill Gates, Jeff Bezos, Sergey Brin, Chanel’s owners, and Walmart founder’s family, is still a substantial entity, as per the Sovereign Wealth Fund Institute. Recent acquisitions include a $113 million cold storage warehouse in Miami and a €100 million distribution center in the Netherlands serving Primark. These investments have propelled its property holdings to approximately €20 billion across 11 countries.

Despite the emergence of distressed sales in commercial real estate, many lenders are offering flexibility to indebted property owners, mitigating the need for fire sales. Savills, the global real estate group, suggests that lenders approaching the limit of forbearance could serve as a catalyst for more deals in 2024.

Pontegadea maintains optimism regarding the future of offices, constituting 40-50% of its real estate portfolio. Contrary to the belief that remote work diminishes their value, the fund notes that tenants have modified office spaces without seeking cuts. The fund refrains from investing in real estate development projects, emphasizing the need for immediate cash flow.

Founder Amancio Ortega, ranked as the world’s 13th-richest person with a $98 billion fortune, began his journey in 1963 with a small workshop in Galicia. Pontegadea, expected to receive about €2.2 billion in dividends from its Inditex shares this year, reinvests most of its income. Marta Ortega, Ortega’s daughter and Inditex’s non-executive chair, receives a portion, with her wealth estimated at €80 million by Forbes last year.

Competing with Fedesa, linked to the Ferrero chocolate business family, Pontegadea is in the running for the title of Europe’s largest family office.