In September 2023, Blackstone’s CEO, Steve Schwarzman, celebrated the opening of the private equity giant’s new office in Paris, marking the expansion of its global footprint. Schwarzman, alongside Gérard Errera, chairman of Blackstone France, immersed himself in the festivities at the elegant 18th-century building, following his keynote address at the International Private Equity Market’s annual conference. The expansion frenzy continued with Schwarzman inaugurating an office in Frankfurt, Germany, just a day before the Parisian event.

Expressing his excitement from his Park Avenue base, Schwarzman emphasized the challenge of maintaining consistent culture and risk standards as the firm ventures further from its headquarters. Blackstone’s President and COO, Jonathan Gray, echoes this sentiment as he constantly travels the globe, recently opening an office in Toronto and planning a visit to Blackstone Singapore, set to double its headcount within two years.

The firm’s global push is driven by the recognition that the real growth potential lies beyond U.S. borders. With 17 offices worldwide and a doubled overseas headcount in five years, Blackstone eyes international markets hungry for private assets. In India, a key focus for Blackstone, it owns 40 companies and is the country’s largest commercial real estate operator. The private equity giant’s international strategy is bolstered by the fact that global investment in private assets is still in its early stages.

The landscape of private equity is evolving, marking a departure from the traditional leveraged buyout model. In the United States, the once-dominant approach of acquiring companies with debt, cutting costs, and restructuring for quick profits is waning. Schwarzman, reflecting on the industry he shaped since Blackstone’s inception in 1985, sees a new era. While the U.S. market reaches saturation with over 2,000 private equity firms, the global arena, with its vast pool of individual investor wealth estimated

The latest game in the private equity arena, referred to as “alternatives,” revolves around a growth-centric approach. Unlike traditional leveraged buyouts, where companies were downsized, these firms acquire companies in sectors like logistics, infrastructure, life sciences, and e-commerce with the aim of expanding them. The key change is the shift from conventional fund lifespans to perpetuals, which have no fixed end date, fostering a buy-and-hold strategy akin to Warren Buffett’s Berkshire Hathaway.

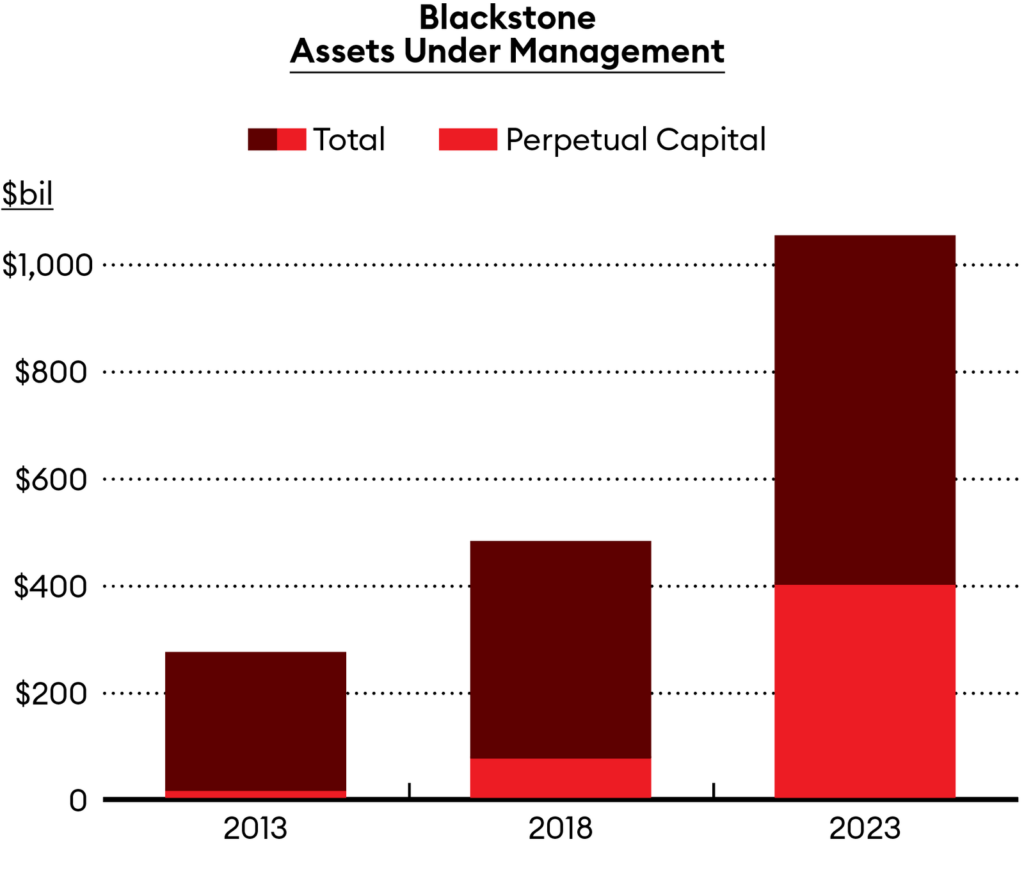

Jonathan Gray, Blackstone’s President and COO, pioneered perpetuals at the firm, representing a significant shift in their investment strategy. Perpetual funds now constitute 38% of Blackstone’s $1 trillion in assets under management, indicating a substantial transformation from a decade ago when they were nearly nonexistent. These funds focus on long-term investments, limiting redemptions and presenting a stark departure from the traditional private equity model.

Gray, at the helm of this evolution, aims to position Blackstone as the world’s leading full-service capital provider, challenging traditional mega money centers. The firm’s credit and insurance operation, with $319 billion in assets, is thriving, attracting capital from insurance clients seeking higher yields. The inclusion of Blackstone in the S&P 500 in September marked a significant milestone for alternative asset managers.

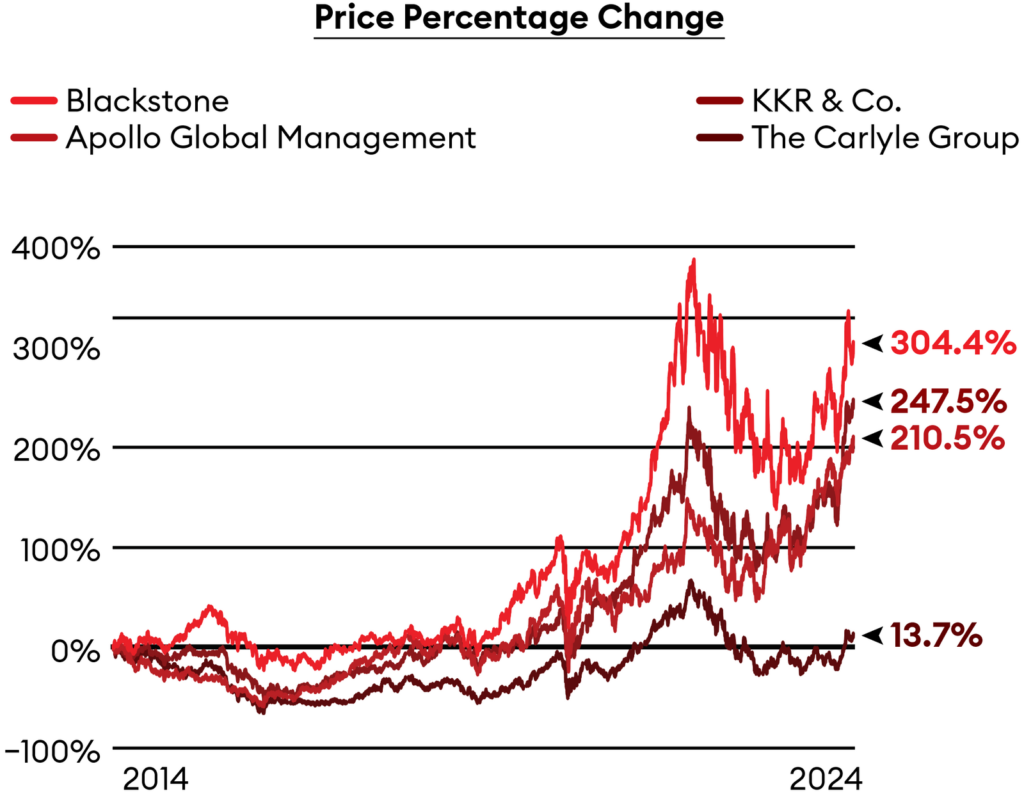

Gray emphasizes the changing landscape of private equity, highlighting the evolving nature of the business. Blackstone, with a portfolio of 230 companies globally and a dominant $337 billion commercial real estate portfolio, is outperforming competitors like Apollo and KKR. The company’s strategic shift aligns with the growing global market, indicating a promising future.

Jonathan Gray’s journey from a middle-class background in Chicago to becoming a key figure at Blackstone showcases his resilience and commitment. His early career at Blackstone began in 1992, and by 2005, he led the real estate division, contributing to two highly profitable deals. Gray’s ascent underscores his ability to adapt and innovate, positioning Blackstone at the forefront of the evolving private equity landscape.

Blackstone founder and CEO Steve Schwarzman: "What's the maximum we can make this?"GUERIN BLASK FOR FORBES

In 2007, during the peak of the real estate market, Blackstone executed two pivotal transactions. The first involved the acquisition of Sam Zell’s Equity Office Properties for $39 billion. Concerned about the market’s volatility, Steve Schwarzman instructed Jonathan Gray and his team to promptly sell nearly $30 billion worth of properties, mitigating most of the deal’s risk. Although Schwarzman’s strategy removed uncertainty, the firm retained key properties in New York, Boston, and California, leading to a threefold return on investment.

The second significant move was Blackstone’s $26 billion acquisition of Hilton Worldwide, which closed in October 2007 amid the global financial crisis. Despite a six-year recovery period, the deal taught Gray the value of overpaying for high-quality assets with strong brands. Through prudent management and financial support, Blackstone successfully navigated the challenges. After going public in 2013, Hilton generated a substantial $14 billion profit, showcasing the potential returns from strategic investments.

Jonathan Gray’s impact on Blackstone’s success became evident when Steve Schwarzman appointed him President and Chief Operating Officer in 2018. Gray’s innovations, particularly in the credit and insurance sectors, fueled significant growth. Blackstone’s credit and insurance business, with $319 billion in assets, attracted insurance clients seeking higher yields amid rising interest rates and reduced lending by banks.

Gray’s introduction of perpetuals, a departure from traditional private equity models, played a crucial role in transforming Blackstone into a full-service capital provider. The shift toward perpetual funds, which now constitute 38% of Blackstone’s $1 trillion in assets, marked a strategic evolution in the private equity landscape. The firm’s focus on growth extends to private credit and retail investor assets, with $240 billion originating from retail investors.

The success of Blackstone Real Estate Income Trust (BREIT), launched in 2017 as a mutual fund–like product, exemplified Gray’s innovative approach. The product, with assets climbing to $70 billion in 2021, attracted retail investors seeking exposure to institutional-quality commercial real estate. Despite a temporary dip in assets to $61 billion in 2022 due to market fluctuations, Gray asserts that BREIT performed as intended, delivering an annual rate of return of approximately 11%.

The expansion into perpetual products continued with Blackstone Private Credit Fund (BCRED) in 2021, accumulating $29 billion in assets. The firm’s pursuit of perpetuals aligns with a broader industry trend, with over $1.2 trillion invested in such products. Institutional interest in Blackstone’s perpetual offerings is evident in the success of funds like Blackstone Infrastructure Partners (BIP) and Blackstone Property Partners.

As Blackstone seeks to diversify its geographical footprint, particularly in Asia, the firm’s leaders, including Daisuke Kitta and Atsuhiko Sakamoto, are strategically positioning the company in regions with growth potential. The push into international markets aligns with Blackstone’s commitment to remaining at the forefront of global financial trends and capitalizing on explosive growth areas.

DOMINATING DEALMAKERS

Over the last ten years, innovative deals and products have helped Blackstone widen its lead over its publicly traded private equity peers.

“Our role is to bridge the gap between Japan and the U.S.,” says Kitta, describing the frequent emails he receives from Gray on various deals. Blackstone has invested nearly $7 billion in Japanese real estate, showcasing its commitment to the market. Despite challenges posed by the pandemic during the negotiations to acquire Alinamin Pharmaceuticals in 2020, Blackstone’s local team successfully closed the $2.3 billion deal, marking Japan’s largest healthcare transaction.

Japan, with the world’s fourth-largest number of high-net-worth individuals, offers a significant wealth management opportunity. The government’s reforms to open up the country’s $5 trillion asset management business align with Blackstone’s strategy. Collaborations with Tokyo-based Nomura Securities and Daiwa Securities reflect Blackstone’s efforts to tap into Japan’s financial landscape.

While London remains Blackstone’s primary overseas hub, continental Europe has become a thriving region for new business, especially in real estate. James Seppala, head of Blackstone European Real Estate, emphasizes the importance of building local relationships in the real estate industry. Europe constitutes a substantial portion of Blackstone’s real estate business, with over $100 billion in assets, emphasizing logistics as a key theme.

Perpetual funds, a significant aspect of Blackstone’s evolving operating model, are instrumental in its pursuit of global dominance. Jonathan Gray highlights that perpetuals are not just a financial tool but a transformative force, steering Blackstone away from transactional approaches toward long-term buy-and-build strategies. Families, such as those behind Carrix and Mundys, appreciate the idea of partnering with a perpetual vehicle for its stability and extended investment horizon.

Gray’s innovative introduction of products like Blackstone Real Estate Income Trust (BREIT) and Blackstone Private Credit Fund (BCRED) illustrates the firm’s adaptability to changing investor preferences. Despite market fluctuations impacting BREIT’s assets temporarily, Gray asserts that the product performed as intended, delivering consistent returns.

In 2022, Blackstone’s investments in businesses like Mileway and Lazeo reflect a growth-first approach. Recapitalizing Mileway in a $23 billion deal instead of selling out exemplifies Blackstone’s commitment to long-term ownership through perpetual funds. Similarly, the investment in Lazeo, a family-run business in Paris, highlights Blackstone’s role as a strategic growth partner.

As Blackstone reports its 2023 results, the firm’s scale, global presence, and data-driven approach position it for continued success. With an impressive $200 billion in dry powder, Jonathan Gray expresses his intent to actively pursue new deals. Blackstone’s emphasis on real-time data and macro insights derived from its extensive holdings enables the firm to adapt swiftly to changing market conditions.

The expansion into international markets is not merely a pursuit of wealth for Blackstone’s leaders, Steve Schwarzman and Jonathan Gray. Schwarzman, emphasizing his excitement about seizing incredible opportunities,