Wall Street traders experienced a downturn in both bonds and stocks as robust economic data suggested that the Federal Reserve remains cautious about declaring victory over inflation.

Treasuries faced renewed selling pressure amid speculation that optimism surrounding disinflation may have been overly optimistic. The Institute for Supply Management’s services index reached a four-month high, indicating the resilience of the largest economy, while prices showed signs of picking up. These developments disrupted trading, particularly as investors were already processing cautious remarks from several Fed officials, including Jerome Powell.

According to Jose Torres of Interactive Brokers, the combination of factors acted as a “one-two punch,” limiting further market gains. JPMorgan Chase & Co. strategist Marko Kolanovic noted that barring any significant shocks, this year’s easing could be more restrained than what the markets had anticipated.

US 10-year yields surged by 14 basis points to 4.16%, while yields on two-year notes approached 4.5%. Expectations for a March rate hike were nearly erased in Fed swaps, and the likelihood of a May cut also diminished. The dollar strengthened to its highest level since November. The S&P 500 recovered from session lows, buoyed by gains in chipmaker Nvidia Corp.

Pressure from a leading US watchdog prompted New York Community Bancorp to unexpectedly reduce its dividend and accumulate cash reserves to cushion potential losses from commercial real estate loans, as reported by individuals familiar with the matter.

Powell reaffirmed in an interview with CBS’s 60 Minutes, aired Sunday evening, that policymakers are likely to delay rate cuts beyond March. Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, stated that officials have ample time to assess incoming data before considering easing measures, while his Chicago counterpart Austan Goolsbee emphasized the importance of observing more favorable inflation data.

Thierry Wizman of Macquarie believes that the market’s revised assessment of when the Fed might initiate rate cuts appears reasonable. He noted that June had always been considered the more probable month for a cut given the Fed’s cautious approach. However, Wizman expressed concerns about whether the persistent strength of the US job market in January might sustain consumer resilience, potentially reversing the disinflationary trend and prolonging tight monetary policy.

The Institute for Supply Management’s services index rose to 53.4 last month, marking a year of expansion as it remained above the 50 level indicating growth. The latest figure surpassed all economist estimates surveyed by Bloomberg. The index’s component measuring prices paid for materials surged, indicating an acceleration in costs.

Jeffrey Roach of LPL Financial attributed the significant increase in prices paid primarily to rising shipping costs. He suggested that investors should anticipate a reversion in prices if conditions in the Red Sea improve.

“The ongoing strength of the US economy relative to most of its G-10 peers has been a key factor driving our counter-consensus bullish view on the USD since September 2023,” highlighted Dominic Bunning of HSBC. “The robust activity data makes it challenging for the Fed to be confident that inflation is fully under control. Consequently, we anticipate US rate pricing to be more inclined towards upside risks rather than downside ones.”

Bill Gross revealed his bet on a return to a more typical interest-rate curve, aiming to eliminate the inversion that has persisted despite the Fed halting interest rate hikes. Gross mentioned on social media X that he is purchasing September 2024 contracts tied to the Secured Overnight Financing Rate while selling the September 2025 ones.

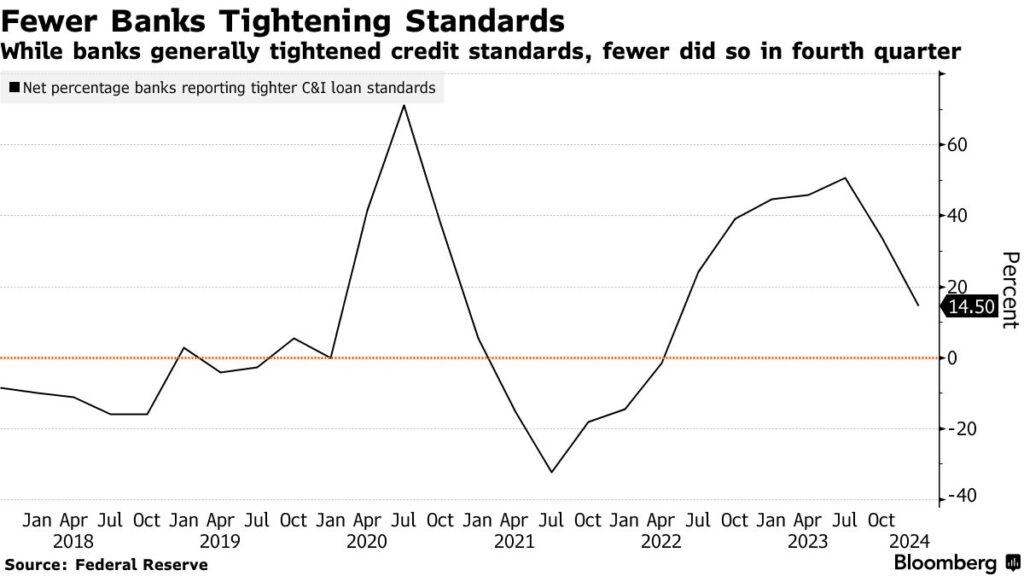

Meanwhile, the Fed disclosed that US banks tightened credit standards in the fourth quarter, albeit the proportion of institutions implementing stricter standards decreased from the previous period, as per the Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS).

The report indicates that the feared severe credit crunch following the collapse of four regional lenders last year did not materialize. Despite higher borrowing costs affecting households due to the Fed’s interest rate hikes to a two-decade high, the economy has remained resilient.

“In light of the trend seen in this series over the last few quarters, we are reassured by the Fed’s assessment that the regional banking crisis has been contained without contagion into the broader banking system,” remarked Ian Lyngen of BMO Capital Markets. “This contextualizes last week’s NYCB headline and reinforces investors’ belief that it may have been merely an isolated event lacking systemic repercussions.”

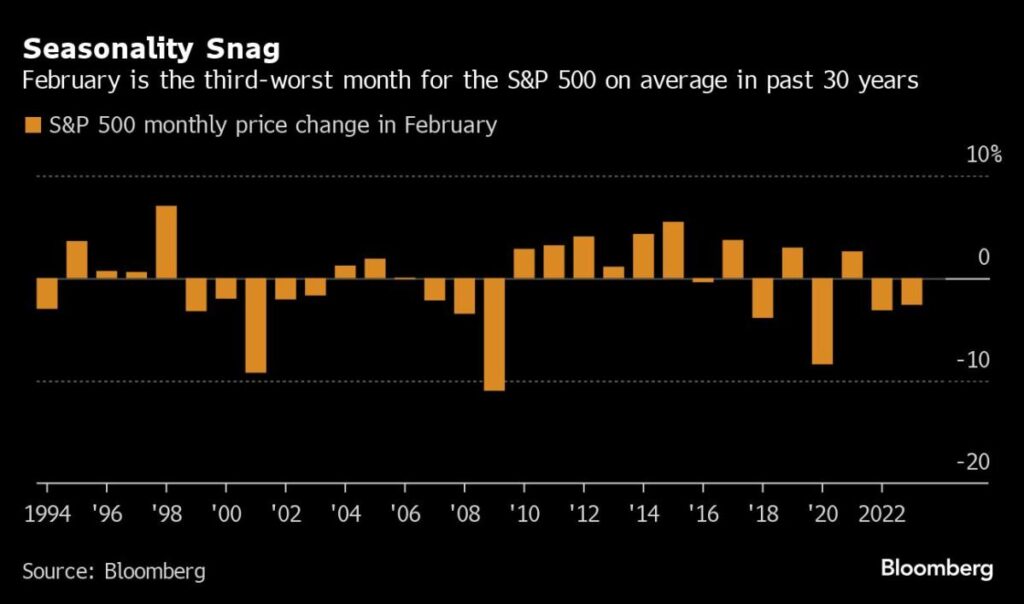

As the S&P 500 comes off its best stretch in nearly four decades, investors brace for a tougher road ahead as February unfolds. Historical data compiled by Bloomberg indicates that February ranks as the third-worst month for the gauge in the past 30 years, behind September and August.

Following a robust rally of nearly 20% since October, which propelled the S&P 500 to its first records in two years, concerns arise: The hype surrounding artificial intelligence received a reality check with the latest big-tech earnings; speculation regarding Fed easing next month has cooled off; and valuations remain elevated compared to historical levels, reminiscent of the dot-com bubble for some strategists.

“It’s worth asking ourselves, have we priced in a little too much good news, at least in the near term?” questioned Mark Hackett at Nationwide. “Over the last two years, and especially during election years, this point on the calendar – February through March – tends to take a dip. Coupled with elevated sentiment and positioning, I expect to see a sideways to slightly negative move over the next 6-8 weeks as we get through seasonal choppiness.”

“After that, my longer-term outlook for the year remains positive,” he added.

Corporate Highlights:

Palantir Technologies Inc. reported strong demand for its artificial intelligence products, which drove sales, and provided a profit outlook for 2024 that exceeded expectations.

US securities regulators are investigating RTX Corp. over its disclosures regarding a manufacturing flaw that led to a costly engine recall for Airbus SE’s top-selling aircraft.

Reddit Inc. experienced a revenue increase of over 20% in 2023 compared to the previous year, setting the stage for one of the most highly anticipated potential initial public offerings in the US.

Microsoft Corp.’s video-game chief, Phil Spencer, announced plans to reveal more information about the company’s future endeavors next week, following online backlash from gamers regarding reports that Xbox-exclusive titles may be made available on Sony PlayStation and Nintendo Switch consoles.

Boeing Co. encountered additional issues with holes drilled in the fuselage of its 737 Max jet, potentially further delaying deliveries in a critical program already under scrutiny by regulators for quality concerns.

Caterpillar Inc. allayed concerns of a global economic slowdown by reporting higher fourth-quarter sales in its energy and transportation business, leading to profits that exceeded analysts’ forecasts.

The US Attorney’s Office in Manhattan initiated an investigation into the accounting practices at Archer-Daniels-Midland Co., according to sources familiar with the matter.

Key Events This Week:

- Reserve Bank of Australia’s rate decision on Tuesday

- Eurozone retail sales on Tuesday

- Germany factory orders on Tuesday

- UBS earnings on Tuesday

- Bank of Canada Governor Tiff Macklem speaks on Tuesday

- Fed’s Loretta Mester and Patrick Harker speak on Tuesday

- Germany industrial production on Wednesday

- Walt Disney earnings on Wednesday

- Fed’s Adriana Kugler and Tom Barkin speak on Wednesday

- China PPI, CPI on Thursday

- US wholesale inventories, initial jobless claims on Thursday

- Treasury Secretary Janet Yellen speaks at a Senate banking committee hearing on Thursday

- Pharma CEOs speak at a Senate panel on Thursday

- ECB Chief Economist Philip Lane speaks on Thursday

- ECB publishes economic bulletin on Thursday

- US CPI revisions on Friday

- Germany CPI on Friday

- President Joe Biden hosts German Chancellor Olaf Scholz at the White House on Friday

Market Moves:

Stocks:

- S&P 500: -0.3%

- Nasdaq 100: -0.2%

- Dow Jones Industrial Average: -0.7%

- MSCI World index: -0.4%

Currencies:

- Bloomberg Dollar Spot Index: +0.4%

- Euro: -0.4% to $1.0742

- British pound: -0.8% to $1.2536

- Japanese yen: -0.2% to 148.66 per dollar

Cryptocurrencies:

- Bitcoin: -0.9% to $42,361.51

- Ether: -0.4% to $2,289.39

Bonds:

- 10-year Treasuries yield: +14 basis points to 4.16%

- Germany’s 10-year yield: +7 basis points to 2.32%

- Britain’s 10-year yield: +9 basis points to 4.01%

Commodities:

- West Texas Intermediate crude: +0.7% to $72.82 a barrel

- Spot gold: -0.7% to $2,024.86 an ounce

This story was generated with the assistance of Bloomberg Automation.