China is implementing stricter trading restrictions for domestic institutional investors and certain offshore units in response to a deepening stock market decline, according to sources familiar with the situation.

Authorities have recently imposed limits on cross-border total return swaps between some brokerages and clients, which could affect China-based investors’ ability to short Hong Kong stocks. Additionally, Chinese brokers utilizing this channel to purchase mainland shares for their offshore units have been instructed not to reduce their positions.

In a separate move, certain quantitative hedge funds have been prohibited from placing sell orders as of Monday, while others have been prevented from reducing stock positions in their leveraged market-neutral funds. These actions target Direct Market Access strategies, believed to have contributed to the recent downturn in small-cap stocks.

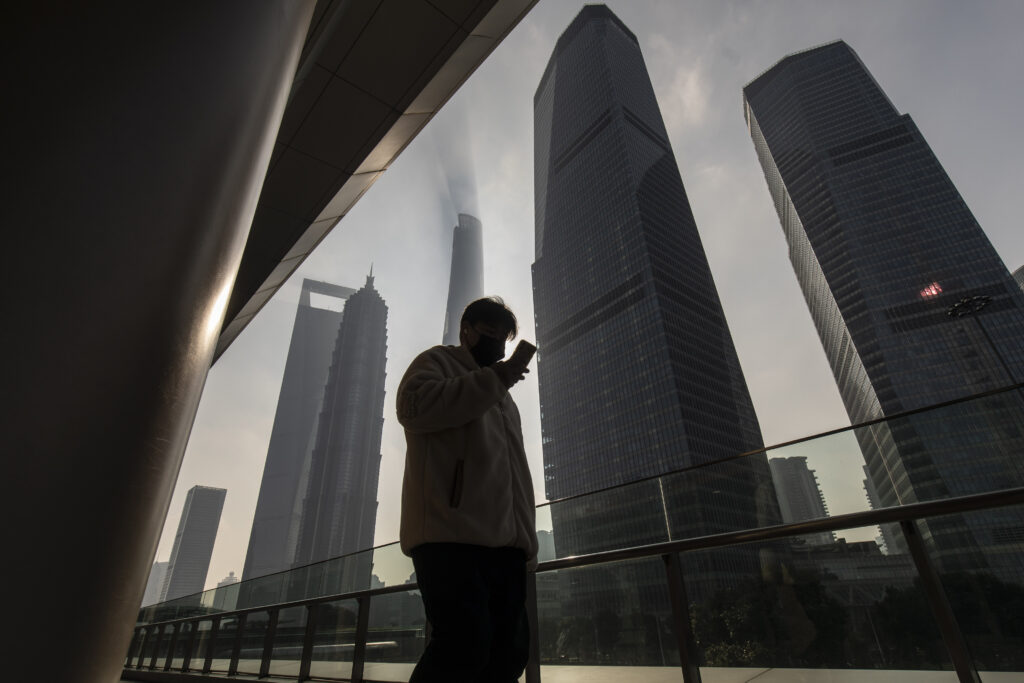

China’s efforts aim to stabilize markets following a sharp decline that saw shares reach a five-year low in tumultuous trading last Friday. These latest measures supplement the incremental steps taken by policymakers as they grapple with a three-year market slump, which has resulted in the loss of approximately $7 trillion in market value and undermined confidence in the world’s second-largest economy.

The China Securities Regulatory Commission (CSRC) announced on Monday that it has identified multiple instances of stock market manipulation and “malicious short selling.” The regulatory body emphasized its commitment to swiftly address illegal activities that disrupt stable stock market operations and harm investors.

Representatives from the Shanghai and Shenzhen stock exchanges did not provide comments in response to requests.

Investor sentiment has been dampened by various factors including weak economic data, ongoing geopolitical tensions with the US, a deteriorating property crisis, and an opaque crackdown on the financial sector. Margin calls and forced liquidation among shareholders have emerged as significant concerns following the recent announcement of support, which lacked detailed information.

Stocks experienced a rebound in Monday’s afternoon trading session after the securities regulator announced measures to mitigate risks associated with share pledges. The CSI 300 Index closed 0.7% higher after initially dipping 2.1%. Although small-cap shares recovered some losses, they still ended the day deeply in negative territory.

The Hang Seng Index in Hong Kong has declined by 9% this year, following four consecutive years of losses, while the onshore CSI 300 Index has dropped nearly 7% and is trading close to its lowest level since 2019.

Michael Hirson, China economist at 22V Research in New York, suggested that while measures to limit selling may offer short-term relief, they could also be counterproductive if investors become concerned about exiting the market. He mentioned the possibility of Beijing conducting large stock purchases, though the urgency for such actions remains unclear.

The CSRC’s latest curbs add to previous measures aimed at restricting short selling activities, including the suspension of share lending for short selling last week. Strategic investors are prohibited from lending shares during agreed lock-up periods under these measures.

Neo Wang, managing director for China research at Evercore ISI in New York, expressed skepticism about the CSRC’s ability to reverse the market’s downward trend, noting the unlikelihood of a complete ban on short selling.

The CSRC reaffirmed its commitment to preventing abnormal market fluctuations and pledged to guide more medium- and long-term funds into the market while cracking down on illegal activities such as insider trading.

However, concerns persist among investors who have been disappointed by the government’s gradual approach to stimulus measures. There are fears of a negative cycle where technical selling pressure triggered by margin calls and derivatives exacerbates the market downturn.

Liu Yuhui, an academic at a government think tank, proposed the establishment of a stock stabilization fund to bolster market confidence, with a target size of 10 trillion yuan ($1.4 trillion) or more.

In a separate announcement, the securities regulator stated its intention to assist brokerages in adjusting margin call levels and maintaining “flexible” liquidation lines to alleviate pressure on the stock market and limit forced liquidations.

In a sign of growing frustration, hundreds of thousands of individuals reacted to a social media post from the US embassy discussing giraffe preservation to voice their economic concerns and dissatisfaction with falling share prices. This underscores the challenges faced by Chinese internet users in finding avenues to express grievances about the economy or government performance, as official accounts often restrict or filter comments.