Like numerous entrepreneurs, 29-year-old streamer Kaitlyn Siragusa, popularly known as Amouranth, generates revenue effortlessly as millions of followers watch her content. Renowned for her provocative streams and estimated $15,000 daily earnings, Amouranth made headlines by switching from Twitch, with over 30 million active daily users, to Kick in June. The upstart platform secured her a non-exclusive contract, estimated at around $7 million annually, with performance incentives potentially elevating the two-year total to a staggering $30 million.

Amouranth, who faced multiple bans on Twitch for NSFW content violations, views the move to Kick as a recognition of her as a person rather than just a brand risk. Unfazed by Kick’s association with the offshore crypto-backed online casino Stake.com, Amouranth emphasizes that dignity is a costly affair.

Kick, launched in December by founders Ed Craven and Bijan Tehrani, the minds behind the crypto-backed casino Stake, is gaining attention with its aggressive spending to attract creators away from Twitch. The platform successfully lured Twitch’s most-watched streamer, Felix “xQc” Lengyel, with a two-year contract estimated at least $70 million and potential incentives pushing it to $100 million. Kick, eyeing further expansion, plans to invest an additional $100 million to attract more creators.

While Kick aims to become a dominant streaming platform, questions arise about its revenue model and sustainability. Ed Craven has emphasized ads as the primary revenue stream, but Kick has yet to introduce pre-roll or mid-roll ads. The platform promises creators a 95% share of subscription fees, a significant disparity compared to Twitch’s 50% cut. Analysts speculate whether Kick is primarily a customer acquisition funnel for Stake.

The deals with xQc and Amouranth, reportedly not requiring them to promote gambling, are non-exclusive, allowing them to continue streaming on Twitch. The expectation is that these high-profile creators will gradually shift their audiences to Kick over time.

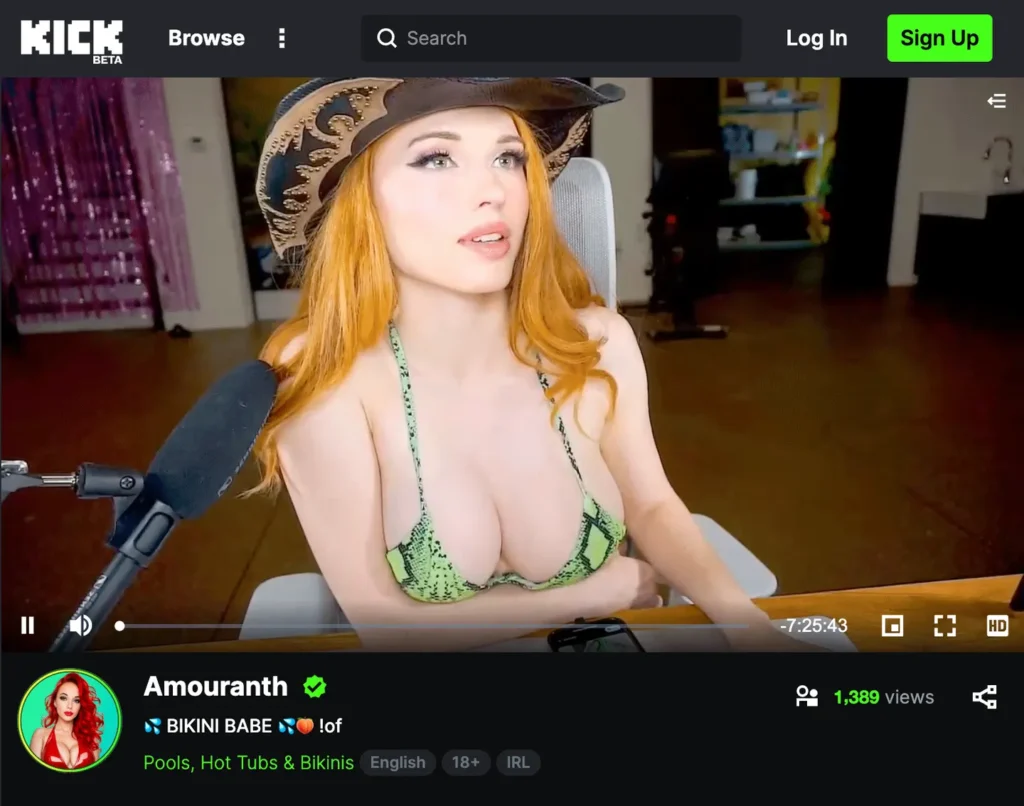

Adult Swim: With a reported $30 million contract to join Kick, Amouranth can stream without worrying about Twitch's censors.KICK

Kick’s strategic moves are paying off, with a significant boost in performance since signing xQc. In just a month, the platform has doubled its number of accounts, quadrupled active streamers, and seen a 44% increase in total hours watched, surpassing 84 million, according to Streams Charts data. While these figures are still dwarfed by Twitch’s dominance, Kick is emerging as a formidable competitor and a serious challenger.

This isn’t the first time a platform has sought to challenge Twitch’s supremacy. Microsoft’s Mixr and Google’s YouTube Gaming both made substantial investments, but their success was limited. Mixr, despite signing Tyler “Ninja” Blevins, closed down within a year, and YouTube Gaming faced declining market share and hours watched by Q3 2022. Now, Kick is entering this competitive space, attempting to succeed where major tech companies have struggled.

Kick’s CEO, Ed Craven, believes in managing operating costs efficiently by avoiding unnecessary staffing. The platform leases technology from Amazon Web Services, uses Stripe for payments, and employs AI tools for moderation. While facing challenges, Kick aims to compete despite lacking the preexisting advantages enjoyed by major tech companies.

Concerns about content standards linger, especially regarding explicit content, nudity, and gambling, impacting how advertisers perceive the platform. The early days of Kick witnessed minimal moderation, raising questions about its suitability for advertisers. The recent signings of creators like xQc and Amouranth, known for their association with gambling and adult content, may heighten these concerns.

For creators, the platform’s long-term viability is a secondary concern. Their primary focus is on maximizing earnings, and Kick’s open-ended contracts are appreciated. Despite uncertainties, creators value the platform’s responsiveness and collaboration, hoping it signifies a positive shift in the streaming industry where creators actively contribute to platform management.