The Importance of Tone and Transparency

Investor updates serve as a crucial tool for nurturing relationships, emphasizing the need for a genuine and relatable tone. Aim for transparency over a sales-driven or overly optimistic approach. Your update should resemble an insider report, presenting facts and figures impartially.

It’s perfectly acceptable to acknowledge areas where goals weren’t met. Some founders have effectively turned such situations into valuable lessons learned.

Considerations for Format

For startups at the seed or Series A stage, updates should range from 250 to 750 words, while quarterly and annual updates may extend to 1,500 words to cover more aspects of the business. Keep your update concise and direct, as investors often receive numerous emails. Information overload can obscure your main points.

Apart from charts and graphs, prioritize text in your updates. Utilize bullets and subheadings to enhance readability.

Tools for Writing, Sending, and Tracking

Various tools are available for drafting, sending, and tracking updates. If time is of the essence, begin with a simple email draft and BCC everyone. Advanced options include Paperstreet, Cabal, and HubSpot. Personally, I prefer Loops for its intuitive interface.

Dedicated sending tools offer improved deliverability and post-sending analytics, allowing you to track open and click rates to gauge investor engagement.

Timing and Consistency

Start preparing content one to two weeks in advance. Collaborate with your team to gather the latest information. Monthly and annual updates suit seed or Series A startups, while quarterly and annual updates become standard as your business matures.

Consistency is paramount. Adhering to your update schedule fosters trust with investors, encouraging their continued involvement.

Components of the Investor Update

Introduction: The CEO provides a brief, personal note. TL;DR: Summarize key points, including major news and top-line review numbers. Asks: Clearly state support needs, such as intros, advice, or resources. Performance Review: Share recent achievements, growth metrics, and lessons learned. Future Outlook: Outline goals for the upcoming period and any strategic shifts. Good Things: Highlight positive news and key hires, expressing gratitude for investor support. Closing: End with a call to action, such as scheduling a catch-up call.

Example Investor Update

Subject Line: FakeCo Update | July ’24

Hi all — I’m pleased to report on a pretty monumental last month here at FakeCo. Team morale feels high, and our customers can’t seem to get enough. Let’s dig in!

TL;DR:

- Achieved 15% month-over-month revenue growth, reaching ARR of $217K.

- Successfully launched our new product feature, enhancing user experience.

- Secured a strategic partnership with TechLeaders Inc., expanding our market reach.

Asks:

- [Intro Request] Bob Jones, VP of Product at GlobalFirm re: product partnership.

- [Advice] Looking to talk to folks who specialize in B2B marketing with experience in healthcare.

- [Boost] We’re hiring two full-stack engineers to optimize our platform. Please share this job post: <link>

FakeCo specializes in AI-driven analytics for healthcare providers, focusing on improving patient outcomes through data insights. For more information, please visit <link>.

July Performance Review

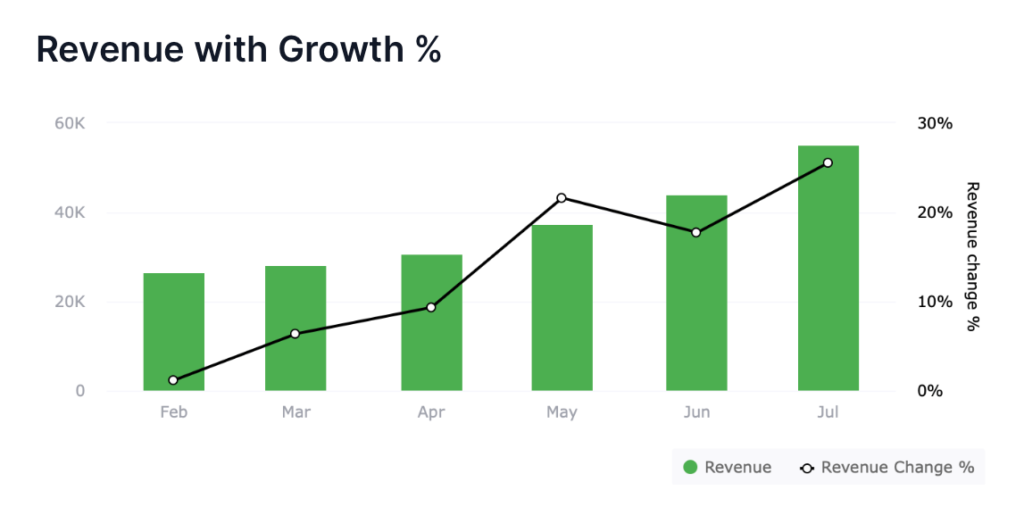

image Credits: Trulytell

Revenue increased by 15% month-over-month, reaching $217K in ARR. We saw a 20% uptick in MAUs, largely attributed to our activation partnership. While our growth was solid, we missed our customer acquisition target by 10%. Nevertheless, we’ve pinpointed areas for improvement in our marketing strategy and are actively implementing changes to bolster outreach efforts. Our NDR stands at an impressive 120%, indicating robust customer satisfaction and upsell rates. Lessons Learned: Targeted marketing campaigns have proven more effective in driving conversion rates compared to broader strategies. Looking Ahead to August:

We aim to roll out our new AI feature, which forecasts patient health trends. We’re targeting a 10% revenue increase and a 25% boost in new leads. Plans are in place to expand our sales team to explore new regions and medical practices.

Highlights:

Excited to announce the launch of our latest HealthBotAI feature, receiving positive feedback from early adopters. Welcome aboard Sally Rhodes, our new VP of Sales, bringing valuable experience and fresh perspectives from medical device sales. Special thanks to Sheldon Field from Healthy Capital for introducing us to the Head of BD at HealthyCo, resulting in a $1 million contract back in April! It’s been another remarkable month at FakeCo. Thank you for your ongoing support as we navigate this exciting journey! Let’s delve into these updates and our future plans further. Feel free to schedule a catch-up call with me here: <link> Until next time! Tim Johnson Founder & CEO, FakeCo

Please share this update or any information from this email thoughtfully.

Consider your investor update as an opportunity to showcase your startup’s essence. It’s not just about figures and milestones; it’s about offering investors insight into your mindset, attention to detail, and the potential of your startup. Embrace this tool, and you’ll witness its impact swiftly.