Adam Neumann’s adeptness at attracting investors and financiers propelled WeWork from a modest startup to a continent-spanning co-working behemoth valued at $47 billion before a downturn precipitated his sudden departure in 2019.

Recently, the charismatic co-founder re-emerged, seeking to persuade a new cadre of financial powerhouses to entrust him with steering WeWork out of bankruptcy. However, this time around, their reception has been more skeptical regarding his prospects.

The revelation that Neumann and his investment entity were publicly urging WeWork to disclose financial particulars for evaluation before making a bid caught creditors off guard. This development has compounded the disorder within an already tumultuous bankruptcy process, where WeWork is negotiating with landlords to offload unprofitable leases.

Although none of the creditors, advisors, or individuals involved in WeWork’s bankruptcy process, with whom the Financial Times communicated, were willing to provide on-the-record statements due to ongoing legal proceedings, many doubt Neumann’s ability to regain control of a business that, despite its dominance in the co-working sector, is beset by challenges stemming from his tenure.

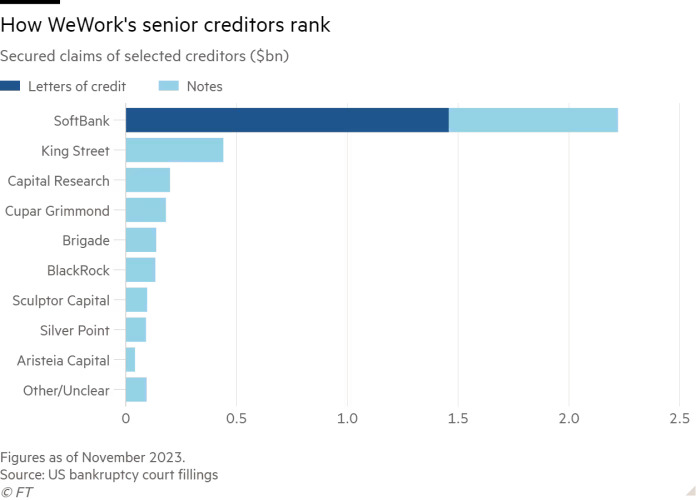

Neumann’s resurgence has presented complex dilemmas for creditors, including his former supporter, Japanese investor SoftBank, and its CEO Masayoshi Son. Moreover, it could further complicate a bankruptcy proceeding that is depleting WeWork’s cash reserves due to mounting legal expenses, advisory fees, and outstanding rent payments to landlords.

“His approach raises concerns because not only has it failed to achieve his objectives, which is premature engagement in a process, but it has also created confusion among landlords,” remarked an individual involved in the bankruptcy proceedings.

“He’s tardy, lacking a coherent plan, and his timing is inopportune. We’ve conveyed this to him, but he seems oblivious,” the individual continued.

On Sunday, WeWork submitted a preliminary restructuring plan in line with the agreement it reached with creditors at the onset of the bankruptcy proceedings in November. The company reported aggressively negotiating or rejecting leases since then, resulting in a reduction of over $330 million in annual rent expenses.

Sources close to WeWork stated that there were no advanced discussions with Neumann and that the company was proceeding with its prior strategy to transfer a restructured entity to creditors by eliminating nearly all of its $4.2 billion debt in bankruptcy. However, it is common practice for external parties in bankruptcy proceedings to issue public letters to attract attention from the court or other stakeholders.

Neumann’s initiatives, including those through his property venture Flow Global Holdings, have garnered support from some backers who recognize the potential value in collaborating with him. Dan Loeb’s Third Point and Seth Klarman’s Baupost Group, prominent names in the hedge fund industry, have had initial talks with Neumann’s team regarding potentially supporting his endeavors, as per individuals familiar with the matter.

The specifics of their plans have not been fully outlined to the creditors with primary claims on WeWork in the bankruptcy proceedings. However, these creditors have drawn their own conclusions from discussions with Neumann and his team.

Neumann, who departed WeWork as a billionaire when SoftBank assumed control of the struggling company, has proposed a $200 million financing, according to a letter from his legal representatives.

While such fresh bankruptcy financing could influence who gains control of the business, given its probable seniority to WeWork’s existing debts, there is considerable certainty that creditors — and the company itself — will likely reject the offer, despite having a fiduciary obligation to consider Neumann’s proposal if it offers the best chance for existing creditors to recover their funds.

Although the existing creditors, including SoftBank, King Street, Brigade Capital Management, BlackRock, Sculptor Capital Management, and Capital Group, previously reached an agreement with the company on debt restructuring, they may be hesitant to inject more capital into WeWork. Nevertheless, they recognize the importance of additional investment to maintain control if and when the company emerges from bankruptcy. They have expressed reluctance to relinquish control to someone they perceive as an outsider.

Baupost, headed by Seth Klarman, pictured, has held preliminary discussions about possibly backing Adam Neumann’s overture © Bloomberg

Regarding Neumann’s involvement, one individual engaged in the process expressed a sentiment: “I’m biased but I think they’re bottom fishing and hoped they could come in and buy people’s debt for cents on the dollar and own the company through the debt and I don’t think anyone is willing to entertain that.”

Although Neumann has not formally proposed a takeover deal for the company, he has been seeking information from WeWork since last year to evaluate the potential structure of an acquisition offer. However, WeWork has not cooperated thus far, as indicated by Neumann’s attorneys at Quinn Emanuel.

In a context of hybrid work models that are expected to increase demand for WeWork’s services, Neumann’s group believes that an acquisition could bring about value-creating synergies and management expertise.

Neumann’s legal representatives mentioned that the $200 million financing proposal was developed at the company’s suggestion, and they have prepared a non-disclosure agreement to facilitate ongoing discussions on a purchase proposal.

WeWork and its advisers have stated that they consistently review such approaches with the intention of acting in the company’s best interests.

Ultimately, it is anticipated that the proposed $200 million financing would be supplemented by an offer to buy out some debtors, allowing Neumann and his supporters to potentially gain control of WeWork post-bankruptcy, according to individuals familiar with the company’s current creditors.

“One person involved in the deal said, ‘The decision [creditors] have to make is would I rather take the equity [in WeWork] and play for that upside or would I rather take the cash offer I’m being given [by Neumann]? 2019 is still fresh in our minds.'”

The overwhelming majority of senior creditors have reached an agreement to collaborate, making it highly improbable for any single lender to opt out of the creditor agreement.

A source involved in the process suggested that landlords and unsecured creditors, facing potential elimination in the restructuring, might view Neumann’s involvement as a means to inject some dynamism into a challenging process. Notably, WeWork has yet to unveil a business plan or a valuation for a reorganized entity.

However, the influence of these junior creditors remains limited in the ongoing proceedings in a New Jersey courthouse.

Neumann faces the additional challenge that at least one of the potential financiers he mentioned in his letter—hedge fund Third Point—has characterized their discussions as “preliminary,” casting doubt on the durability of their partnership. Baupost declined to provide comment on rumors or speculation.

A successful bid by Neumann would not only mark his return to the company he founded but could also entail renewed collaboration with major investors he previously courted.

SoftBank, having injected over $16 billion into WeWork since 2017 and incurring significant losses, remains cautious about reengaging with Neumann, with whom it previously settled litigation less than three years ago. While SoftBank participated in a meeting involving Neumann and Third Point last year, there’s been no indication from Son’s firm of a desire to resume business ties.

Although SoftBank declined to offer comment, an individual within the Japanese group indicated their commitment to an objective, rational approach to the restructuring process. They emphasized engaging in discussions with various investors regarding WeWork’s recapitalization, highlighting a fiduciary obligation to maximize shareholder recovery.

Creditors, including SoftBank, are exploring an alternative option: selling WeWork following its emergence from bankruptcy. Preliminary discussions on this matter have commenced with other parties, but creditors do not anticipate Neumann’s involvement in such a sale.