December 2, 2024

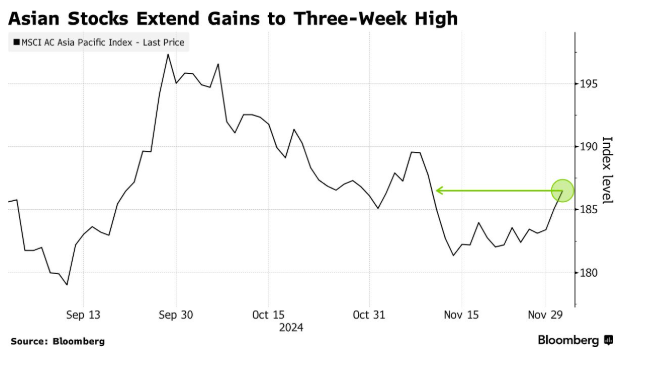

European stocks are set to build on a strong session in Asian markets, buoyed by tech-driven gains on Wall Street and the realization that new U.S. restrictions on Chinese access to key chip and AI technologies are less severe than initially feared.

Euro Stoxx 50 futures climbed 0.4%, signaling a positive start, while U.S. futures held steady. Across Asia, equity benchmarks rose across major markets, including Japan and Australia. Meanwhile, Chinese stocks rebounded from earlier losses following news that the nation’s top leadership will convene a critical annual economic work conference next Wednesday to outline growth targets and stimulus plans for 2025.

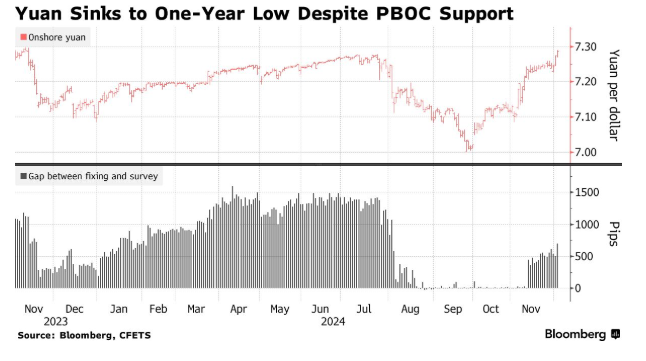

The upbeat sentiment in Asian markets was driven by relief over the Biden administration’s latest export restrictions, which stopped short of broader sanctions that could have affected more major Chinese firms. However, concerns about China’s economic outlook and heightened U.S.-China tensions linger, with the yuan hitting a one-year low against the dollar.

Attention is now focused on China’s forthcoming Central Economic Work Conference, especially after disappointment over the absence of detailed policy signals from a recent key meeting. Investors are hopeful this upcoming event will provide clarity on the nation’s economic strategy and measures to bolster growth.

“Asian markets are showing divergence, with China underperforming,” noted Charu Chanana, Chief Investment Strategist at Saxo Markets. “This trend suggests that ex-China Asian economies might face limited headwinds from U.S. chip curbs while benefiting from the tailwinds of a robust U.S. economy and global central bank easing.”

The dollar gained ground in Asian trading, breaking a three-day losing streak on Monday following President-elect Donald Trump’s stern warning to BRICS nations. Meanwhile, the euro held steady after tumbling by as much as 1.1% in the previous session amid political unrest in France, where pressure on bonds and stocks intensified.

Market participants are gearing up for a pivotal week packed with economic data and insights from Federal Reserve officials, which will play a critical role in shaping expectations for interest rate decisions. Key events include Friday’s payrolls report, anticipated to reveal robust hiring in November, and a moderated discussion featuring Federal Reserve Chair Jerome Powell on Wednesday.

“This week is the final crucial economic data week of 2024,” remarked Tom Essaye of The Sevens Report. “If the results strike a ‘Goldilocks’ balance, investors will likely anticipate a soft landing and a rate cut in December.”

Treasuries edged lower in Asian markets, following a recovery on Monday after Federal Reserve Governor Christopher Waller expressed his inclination to support a December rate cut, contingent on upcoming data. Current swaps market pricing suggests a more than 70% probability of a quarter-point rate cut later this month.

On Wall Street, the S&P 500 edged up 0.2%, while the Nasdaq 100 climbed 1.1%. Tesla Inc. saw a dip in after-hours trading after a Delaware judge once again rejected a massive compensation package for CEO Elon Musk. Meanwhile, the Dow Jones Industrial Average slipped 0.3%.

In Europe, political tensions flared as Marine Le Pen vowed to bring down Prime Minister Michel Barnier’s government following his failure to meet her demands on the proposed budget, raising concerns of financial and political instability in France.

In corporate headlines, Exxon Mobil Corp. is reportedly exploring the sale of its gas stations in Singapore, a move that could potentially generate around $1 billion, according to sources familiar with the matter.

In commodities, oil prices inched higher as traders awaited signals from OPEC+ regarding future supply plans ahead of a key meeting on Thursday. Gold also recorded gains amid market uncertainty.