Construction has often been labeled as a “dinosaur” industry, and this reputation isn’t entirely unfounded. With productivity growth averaging just 1% over the past two decades, compared to 2.8% in other sectors, there’s a clear need for change. However, after engaging with developers, builders, materials suppliers, construction tech entrepreneurs, and investors over the last year, it’s evident to me that the industry is more open to experimentation and technological adoption than commonly believed.

The built environment faces unprecedented challenges and opportunities, including increasing global demands for infrastructure and housing, a persistent labor shortage, rising costs, supply chain disruptions, and the need to meet ESG (environmental, social, and governance) requirements. These factors are driving the construction sector to evolve at an accelerated pace, presenting numerous opportunities for entrepreneurs to capitalize on emerging trends.

In the last five years, the construction industry has shown a marked improvement in its familiarity and sophistication with software. Notably, 84% of general contractors have implemented autonomous solutions in the past year alone. Innovative technologies are reshaping construction practices, enabling builders to achieve higher levels of productivity, profitability, and safety. However, tech founders may find that construction customers have become more discerning, demanding solutions that address core concerns such as budget adherence, timely project completion, and meeting project scope requirements.

For construction tech founders looking to thrive in 2024, focusing on solving the most critical priorities for general contractors—ensuring projects are completed within budget, on schedule, and as per specifications—is essential for success in the evolving landscape.

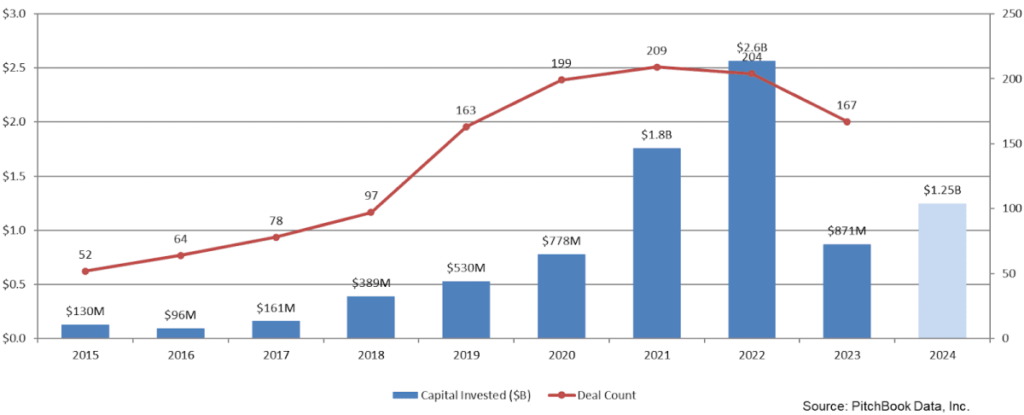

VC financings in the U.S. construction tech sector (2013–2023). Image Credits: Sorenson Capital

- Seize Opportunities in Growing Construction Tech Subsectors Amid a Booming Funding Market

Interest from venture capital in construction tech has reached unprecedented levels in recent years, with the final quarter of 2023 witnessing an exceptional surge in startup funding. Projections indicate that 2024 will surpass the previous year in terms of investment activity, with an estimated total capital injection ranging from $1 billion to $1.5 billion. Despite this influx of funding, IT spending in construction remains relatively low, comprising only 1% to 2% of revenue, leaving ample room for growth. As buyers increasingly prioritize digitized workflows and solutions powered by data, AI, and automation, the market presents favorable conditions for founders to launch construction tech startups and attract investments.

- Champion Sustainable Practices to Address ESG Goals in Construction

The construction and real estate industries are undergoing a profound shift toward sustainability, driven by mounting concerns over global energy consumption and emissions. Governments worldwide are implementing stringent regulations to curb carbon emissions, compelling industry stakeholders to adopt sustainable building practices. In response, construction tech startups are expected to focus more on ESG initiatives in 2024, offering innovative solutions ranging from green materials to AI-driven design tools. By integrating sustainability into their products, founders can align with industry trends and support customers in achieving their environmental objectives.

- Develop Modern Collaboration and Communication Tools to Enhance Operational Efficiency

In an era where operational efficiency is paramount, the construction industry stands to benefit from improved collaboration and communication platforms. Unlike other sectors that have embraced modern tools like Figma and Slack, many construction companies still rely on outdated software, hindering productivity and project management. In 2024, startups such as Planera will introduce real-time collaboration features tailored to the construction industry’s unique needs, facilitating streamlined communication and project coordination. By embracing modern technology, construction firms can foster transparency, reduce risks, and optimize project outcomes.

- Drive Automation and HR Technology Integration to Address Labor Shortages

Labor shortages continue to pose significant challenges for construction firms, prompting a shift towards automation and HR technology solutions. With skilled labor in short supply, startups like Field Materials and OnsiteIQ are leveraging automation and computer vision to streamline procurement processes and monitor building progress efficiently. Additionally, there is a growing demand for HR tech solutions that automate recruitment, onboarding, and training processes, enhancing the overall employee experience and enabling employers to attract and retain top talent. By addressing the people side of construction, founders can tap into a lucrative market segment and drive industry-wide innovation.

- Expand Market Reach to Serve Both Construction and Real Estate Customers

The data and insights generated throughout the construction process hold valuable implications for real estate owners and operators. Companies like Passive Logic are pioneering digital twin technologies that enable better building design, operation, and maintenance, blurring the lines between construction tech and proptech. In 2024, construction tech founders should explore opportunities to extend their products’ reach beyond the construction phase, offering solutions that cater to the entire building lifecycle. By aligning with broader industry trends and addressing evolving customer needs, founders can unlock new market opportunities and drive sustainable growth.

In Conclusion

As we are in 2024, the construction tech landscape presents a wealth of opportunities for entrepreneurs, investors, and industry stakeholders alike. Founders poised to succeed will demonstrate ambition, vision, and a deep understanding of customer needs, positioning their products as indispensable tools in the evolving construction ecosystem. As an investor, I prioritize founders who exhibit a clear understanding of the market landscape and offer innovative solutions that address critical pain points across the construction industry.