Why Private Equity Firms Are Targeting Your Retirement Savings

For decades, private equity has operated as an exclusive financial powerhouse—one that thrives on high-risk, high-reward investments, charging steep fees and catering only to the wealthiest investors. These firms specialize in acquiring businesses using massive amounts of debt, restructuring them for profit, and often selling them off with minimal oversight. But now, these same firms are looking for a new source of capital: your retirement savings.

Indicators Pointing Towards an Imminent Recession

Despite robust job growth, easing inflation, and ongoing stock market gains, certain economic analysts persist in predicting an impending recession.

Blackstone's Potential $80 Trillion Prospect

With $1 trillion in assets and unmatched returns, the private equity titan has triumphed on Wall Street, yet its 76-year-old founder, Steve Schwarzman, is not done. His ambition extends to total domination overseas, and the company’s crown prince, Jonathan Gray, has crafted a clever weapon aimed at harnessing immense global wealth.

Unmasking the Decentralization Myth

Despite the recent market surge, the crypto sector has spent a decade pitching the vision of decentralization—a fresh financial system devoid of intermediaries. However, numerous blockchain initiatives have inadvertently replicated the very structures they aimed to disrupt, while regulators remain resolute in maintaining the current status quo

The Jujitsu Champion Who Received Nearly $500 Million from Sam Bankman-Fried

Billions of dollars vanished with the collapse of Sam Bankman-Fried’s FTX cryptocurrency empire. Amidst the fallout, one individual finds himself perched atop a mountain of that wealth: Rashit Makhat, a robust jujitsu champion hailing from Kazakhstan.

Trucking Drama Concludes with an Awkward Twist

Recently, U.S. trucking firm Forward Air concluded its acquisition of Dallas-based freight forwarder Omni Logistics, marking the end of a saga that might find its way into business school textbooks. Initially announced last August, the deal triggered a negative response from Forward’s investors, prompting CEO Thomas Schmitt to attempt its cancellation.

Musk Reclaims Title of World's Richest Person as Tesla Shares Surge

KEY DETAILS:

- On Monday, Elon Musk’s net worth surged by $5.5 billion, surpassing $210 billion on Forbes’ real-time billionaires list.

- Despite this gain, 74-year-old Bernard Arnault, LVMH CEO, closely trails with an estimated net worth of $208.5 billion.

- Musk’s wealth jumped as Tesla’s shares rebounded nearly 4.2% to $190.93, recovering from the previous week’s drop to $180 post-disappointing quarterly earnings.

Chicago's affluent community rallies to raise $66 million for the battle against crime.

Chicago’s affluent families and prominent business figures have amassed $66 million to bolster the city’s fight against crime.

Contributions from esteemed foundations like the Crown and Pritzker families constituted just over 30% of the $200 million required for an initiative aimed at curbing gun violence. This generous support represents more than half of the $100 million pledged by the business sector. Spearheading the fundraising endeavors is the Civic Committee of the Commercial Club of Chicago

Mark Zuckerberg's fortune skyrockets by $27 billion as Meta experiences a remarkable rally.

Meta Platforms Inc. returns with a bang, propelling Mark Zuckerberg’s fortune to new heights.

Following Meta’s quarterly results surpassing Wall Street’s projections, the Facebook co-founder’s net worth surged by an impressive $27.1 billion. This surge lifted his wealth to $169.5 billion, marking his highest net worth to date and catapulting him past Bill Gates to claim the fourth position on the Bloomberg Billionaires Index.

The S&P 500 surged to new record highs primarily driven by a single sector.

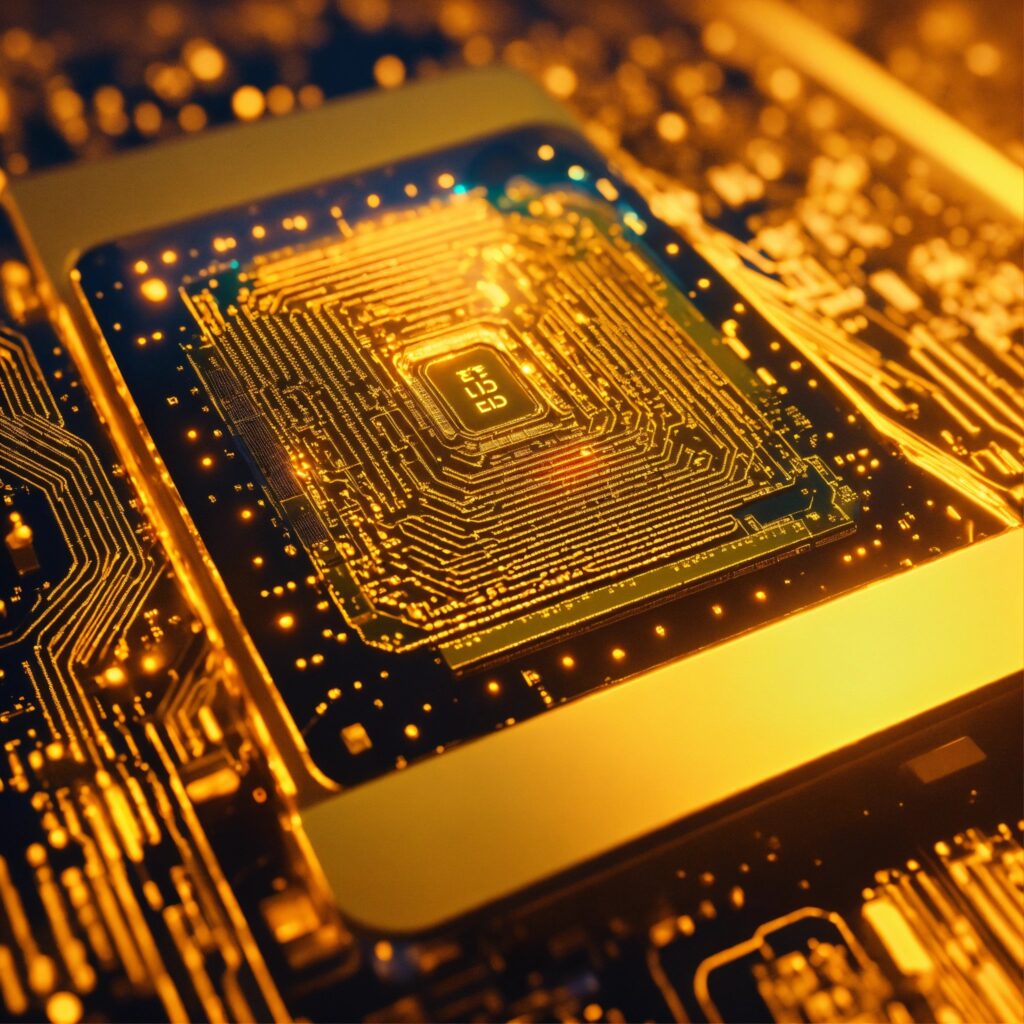

The S&P 500 has surged to record levels, marking its first ascent to such heights in two years. However, among the index’s 11 sectors, only information technology shares this achievement.

Featuring prominent names like Microsoft, Apple, and Nvidia, the technology sector is capitalizing on the fervor surrounding artificial intelligence, propelling the broader market to record highs in five out of the last six trading sessions.

Jamie Dimon Implements Changes in JPMorgan's Leadership Structure Again

Once again, the Jamie Dimon-led executive reshuffle is underway at JPMorgan Chase.

On Thursday, several key lieutenants were assigned new roles, a series of adjustments bound to ignite speculation about the succession plan for the renowned chief executive, although his departure isn’t anticipated anytime so

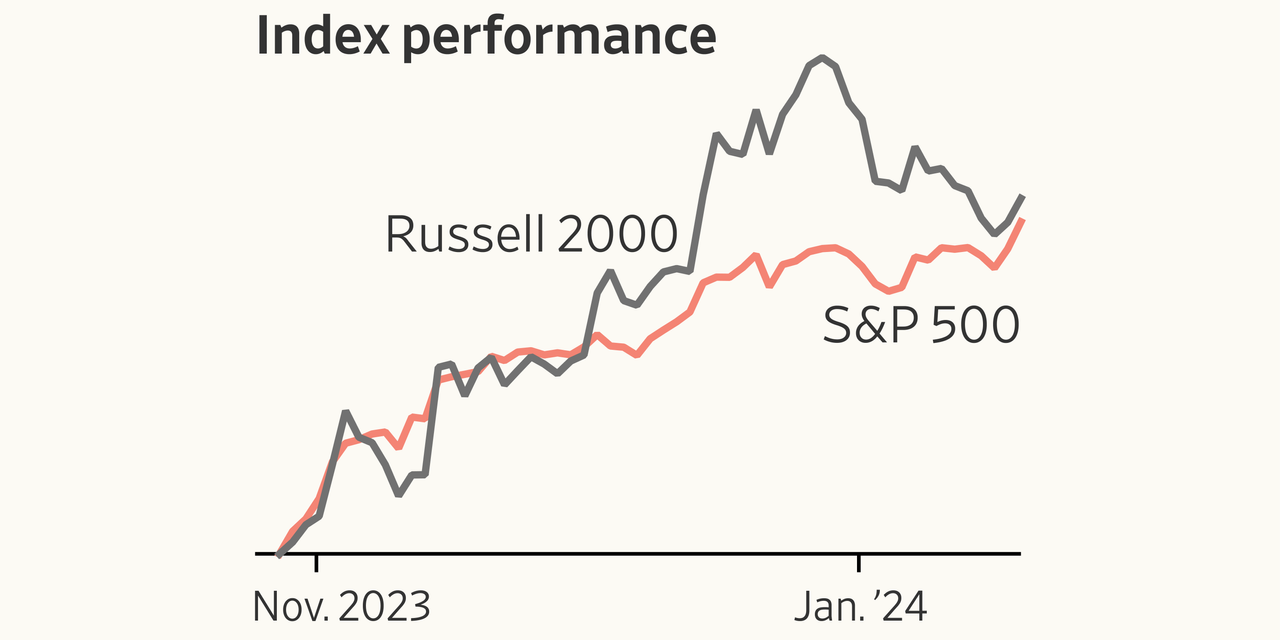

Regional banks faced another challenging quarter.

While the 2023 banking crisis has come to a close, the road ahead looks uncertain for several regional and community lenders.

Profits took a steep dive at regional banks during the fourth quarter, a trend observed even among the larger institutions, which have historically outperformed their smaller counterparts.

Steve Volk, a renowned dealmaker who provided counsel to corporate titans, has passed away.

Stephen Volk, the iconic dealmaker and former Citigroup vice chairman who provided counsel to generations of corporate leaders, passed away on Saturday at the age of 87.

Volk had been undergoing treatment for urothelial cancer, as confirmed by his wife, Diane Volk.

Elon Musk's AI Startup Secures $500 Million Toward $1 Billion Funding Objective

xAI, Elon Musk’s artificial intelligence company, has reportedly received commitments of $500 million from investors as part of a larger $1 billion fundraising goal, sources familiar with the discussions have revealed.

S&P 500 Achieves Record High in Historic Bull Market: Market Overview

The week concluded positively on Wall Street, witnessing stocks reach unprecedented highs amid speculation that the Federal Reserve will initiate rate cuts this year, thereby enhancing the outlook for Corporate America.

Hedge Funds Reap Unprecedented Profits by Wagering on 'Catastrophe' Risk

The intricate analysis of catastrophes proved to be the most lucrative investment strategy for hedge funds last year. Focused on natural disasters like hurricanes and cyclones, firms such as Tenax Capital, Tangency Capital, and Fermat Capital Management reaped record profits, surpassing industry benchmarks twofold, as indicated by public filings, external assessments, and insiders familiar with the funds’ performance.

The ongoing stock selloff in China, amounting to $6.3 trillion, is intensifying each day.

Chinese stocks concluded yet another challenging week, with an index of mainland companies listed in Hong Kong ranking at the lowest position among global equity index performances for the current year.

Artificial Intelligence (AI) Dominates Discussions at Davos. Is it the Right Moment to Sell?

The sentiment among the global elite convening in Davos, Switzerland, serves as a valuable signal for investors, but the key is to adopt a contrarian approach. Buy when the elite are downcast, sell when they are optimistic, and exit when their attention shifts to areas like crypto, as observed in 2021. This year, artificial intelligence was ubiquitous in the snow-covered resort, suggesting a cautious approach.

Morgan Stanley's CEO, Ted Pick, Takes Charge of a Bank That Has Reached Unprecedented Levels of Predictability.

In his initial quarterly earnings report to investors on Tuesday morning, the recently appointed chief executive officer initiated his presentation with charts illustrating the “15 years of transformation” undergone by the company. Between 2009 and 2014, the firm predominantly derived its revenue and profit from its Wall Street operations. However, the period from 2015 to 2019 saw a shift toward a more balanced split, although its institutional securities segment continued to generate more revenue from 2020 to 2022.

Qatar's $450 billion wealth fund has no plans to forsake Canary Wharf.

The leader of Qatar’s $450 billion sovereign wealth fund, known for its extensive acquisitions in European property, expressed apprehension about the commercial real estate market. Despite these concerns, the fund remains committed to supporting London’s Canary Wharf Group project as a steadfast long-term shareholder.

In 2024, these major players in the technology industry aim to secure the most significant market share in the field of artificial intelligence.

It’s challenging to envision a repetition of the remarkable year the chip and technology sector experienced in 2023, but both financial and technology analyst groups almost universally agree that 2024 is poised to be just as impressive.

The valuation of Apple stock appears high compared to the other members of the 'Magnificent Seven.'

Apple Inc.’s stock, which performed well in 2023, is starting 2024 with challenges that raise concerns about its valuation for investors. The company has shifted into a slow-growth phase, experiencing a lack of year-over-year revenue growth in the past four quarters, primarily relying on its iPhone business, which faces innovation stagnation, affecting consumer device upgrades amid economic uncertainties.

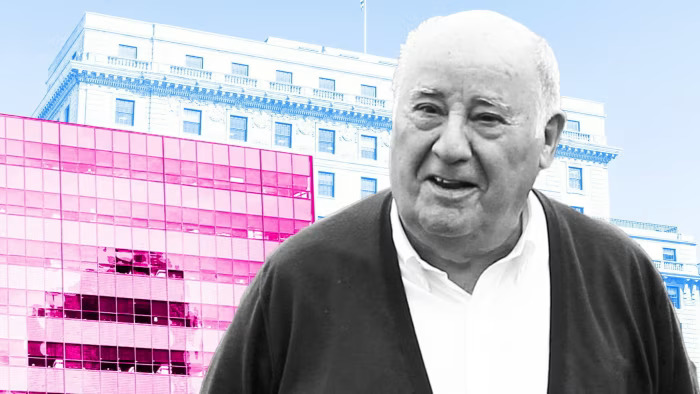

Billionaire behind Zara seizes opportunity to acquire discounted real estate.

Amancio Ortega, the billionaire founder of Zara, is capitalizing on the downturn in commercial property prices to acquire assets at a discounted rate, leveraging the advantage of low borrowing costs that debt-free investors currently enjoy.

Pontegadea, Ortega’s personal investment group with a value exceeding €90 billion, is implementing a “buy the dip” strategy to expand its real estate portfolio.