“Hedge Funds Thrive on Catastrophe Science, Achieving Unprecedented Returns in 2023”

The intricate analysis of catastrophes proved to be the most lucrative investment strategy for hedge funds last year. Focused on natural disasters like hurricanes and cyclones, firms such as Tenax Capital, Tangency Capital, and Fermat Capital Management reaped record profits, surpassing industry benchmarks twofold, as indicated by public filings, external assessments, and insiders familiar with the funds’ performance.

These remarkable returns were driven by strategic investments in catastrophe bonds and other insurance-linked securities. Catastrophe bonds, also known as cat bonds, serve as a risk transfer mechanism for the insurance industry, shielding itself from substantial losses. Investors in cat bonds willingly assume the risk of potential capital losses in the event of a disaster. However, they stand to gain substantial profits if a predefined catastrophe does not occur.

The convergence of favorable conditions in 2023 resulted in an exceptionally profitable scenario for these investors. Toby Pughe, an analyst at Tenax, remarked, “I don’t think we’ve seen a market like this since cat bonds were born in the 1990s.” Tenax, a London-based hedge fund with a portfolio of approximately 120 of these securities, achieved an impressive 18% return last year.

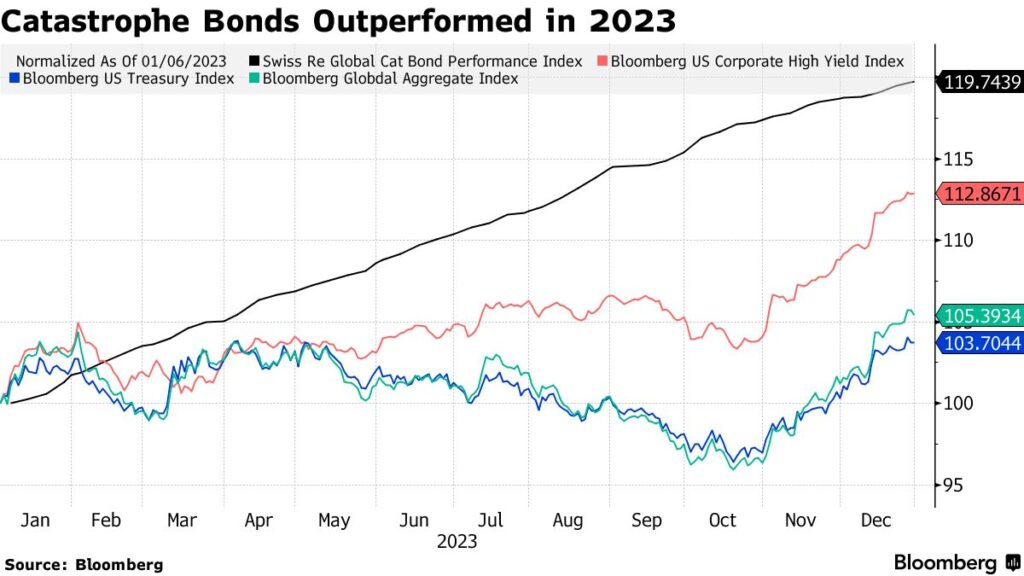

Insurance-linked securities emerged as the top-performing hedge fund sub-strategy in 2023, generating over 14%. This data, reported by Preqin, a consultancy specializing in alternative asset management industry data, outpaced the benchmark return for the industry across various strategies, which stood at 8%. Notably, this performance exceeded the 19.7% gain in the Swiss Re Global Cat Bond Performance Index Total Return.

2023 Investment Returns:

- Insurance-linked securities led as the top-performing hedge fund sub-strategy.

“Surge in Cat Bond Issuance Driven by Climate Concerns and Inflation Peaks”

The issuance of catastrophe bonds (cat bonds) has witnessed a notable upswing propelled by concerns surrounding extreme weather events linked to climate change and heightened inflation levels, reaching historic highs. This trend has further escalated the expenses related to reconstruction after natural disasters.

The outstanding performance of cat bonds in 2023 can be traced back to developments that transpired several years earlier. Until 2017, these securities were widely perceived as unsuccessful, particularly in the aftermath of significant hurricanes in the United States, necessitating substantial investor contributions to cover property losses. Lackluster returns were also evident in 2019 and 2020.

The pivotal moment occurred with Hurricane Ian’s devastating impact on Florida in September 2022. Acknowledged as the most destructive storm in the state’s history, Hurricane Ian resulted in $100 billion in losses, with only 60% of these losses insured, according to Munich Re. This occurrence prompted insurers to offload a larger share of risk from their portfolios to the capital markets. Combined with significantly higher reconstruction costs amid rampant inflation, the conditions were ripe for a resurgence in the cat bond market.

Jean-Louis Monnier, Global Head of Insurance-Linked Securities at Swiss Re, underscored the shift in insured values on the residential side, increasing from 8% to 20%, underscoring the imperative for insurance companies to expand their coverage.

In 2023, cat bond issuance skyrocketed to an unprecedented $16.4 billion, covering non-property and private transactions, as reported by Artemis, a market tracker for insurance-linked securities. These transactions propelled the total outstanding market to a record $45 billion, according to Artemis’s estimates.

To absorb the heightened influx of newly issued risk, cat bond investors pursued and secured substantially higher returns. Spreads, representing the premium over the risk-free rate that investors receive for shouldering catastrophe risk, reached their zenith in early 2023. The relatively calm U.S. hurricane season during the year contributed to fewer trigger events, resulting in more substantial returns for investors.

Greg Hagood, Co-Founder of Nephila Capital, a $7 billion hedge fund specializing in reinsurance risk, acknowledged that the spreads in the previous year were likely the highest in his career relative to the associated risk.

Dominik Hagedorn, co-founder of Bermuda-based Tangency Capital, notes a substantial increase in hedge fund interest in insurance-linked securities over the past 12 to 18 months. He anticipates this trend may persist for another year due to the current spreads. The impact of global warming on weather patterns is a crucial aspect of catastrophe bond modeling, paving the way for new loss patterns.

Karen Clark, a pioneer in catastrophe risk modeling, highlights the growing market interest in secondary perils like severe convective storms, winter storms, and wildfires. Climate change’s prominent impact on wildfires, with potential losses ranging from $10 billion to $30 billion per event, offers a growth opportunity for the cat bond market.

Brett Houghton, Managing Director at Fermat, emphasizes that secondary perils can help diversify portfolios but remain challenging to model, introducing an element of uncertainty. Global cat bond capacity has seen a consistent annual growth of about 4% for the past six years, aligning with the expansion of natural catastrophe exposures, according to Swiss Re Institute. Worldwide, insurance-linked securities (ILS) capital reached approximately $100 billion by the end of the third quarter of 2023, as estimated by insurance broker Aon Plc.

However, cat bond investors seeking another record year should be aware that tightened inflows have impacted spreads, as noted by Hagedorn. Tenax expects its return on cat bonds this year to be around 10% to 12%, compared to the previous year’s 18%, assuming 2024 experiences no significant natural disasters triggering the bonds’ payment clauses.

Greg Hagood of Nephila Capital emphasizes the historical highs in spreads, indicating that the market is well-compensated for the associated risks, even though uncertainties about potential disasters remain.