Dec. 18, 2024

Honda and Nissan, two of Japan’s leading automakers, have announced they are exploring a potential merger amidst challenges in the global automotive market, particularly in China. This move comes as both companies face significant pressures, including a downturn in Nissan’s performance and difficulties navigating China’s rapidly evolving auto industry.

The discussions, which were first reported by the Nikkei newspaper and later confirmed by the companies on Wednesday, involve a possible merger or other collaborative efforts. However, both automakers clarified that no final decisions have been made.

This year, Honda and Nissan have already strengthened their ties, announcing plans to collaborate on electrification technologies to share the high costs of research and development. The exploration of a merger underscores the growing need for cooperation as the automotive industry undergoes rapid transformation, driven by advancements in electric vehicles (EVs) and hybrid technologies.

China, the world’s largest auto market, has proven to be a challenging landscape for both companies. The swift shift towards EVs and plug-in hybrids has left them struggling to compete with local and international rivals. Nissan has also faced weaker results in the U.S. market, further compounding its challenges.

A merger could offer significant advantages, including cost synergies in procurement and technology development. However, the integration of two distinct corporate cultures and overlapping product lines would pose considerable challenges.

While no concrete decisions have been reached, the talks highlight how the rapidly changing dynamics of the global auto market, particularly in China, are prompting even long-standing competitors to consider closer partnerships to secure their future.

Last month, Nissan unveiled a major restructuring plan that includes cutting 9,000 jobs worldwide and reducing its global production capacity by 20%. The company also lowered its vehicle sales forecasts across key markets, particularly in China and North America.

In China, Nissan halted production earlier this year at its Changzhou plant in eastern China, while Honda has pursued voluntary buyouts to downsize its workforce at a local joint venture. Analysts believe the ongoing merger discussions between Honda and Nissan are fueled by intensifying competition from electric vehicle (EV) leaders like Tesla and China’s BYD. These companies, along with other Chinese automakers, are also advancing rapidly in autonomous driving and software, forcing traditional automakers to invest heavily to keep pace.

Nissan shares surged by 23.7% in Tokyo trading on Wednesday following news of the merger talks, while Honda shares fell 3%. Honda’s market valuation is more than four times that of Nissan, indicating that Honda would likely hold the upper hand in any potential merger.

Nissan has faced significant challenges since the 2018 arrest of its then-chairman, Carlos Ghosn, who was charged in Tokyo with financial misconduct—a claim he has denied. Ghosn fled Japan in 2019 before his trial. Tensions over Nissan’s alliance with Renault of France further complicated its recovery. Renault, which once held a 43% stake in Nissan, agreed to reduce its share to 15% last year, granting Nissan greater autonomy. However, Nissan’s financial struggles persisted, with operating income for the six months ending September 30 falling 90% compared to the previous year. U.S. group sales also dipped by 2% in the third quarter.

Honda has not been immune to difficulties, cutting its annual forecasts for vehicle sales and net profit after reporting a decline in earnings for the first half of its fiscal year. Weak performance in China’s auto market contributed significantly to this downturn.

China’s automotive landscape is rapidly shifting. In November, 52% of passenger cars sold were either full electric vehicles or plug-in hybrids, according to the China Passenger Car Association. Domestic Chinese brands have seized market share from their Japanese, German, and American competitors, accounting for 60% of passenger car sales in the first 11 months of this year—a jump of 8.5 percentage points compared to the previous year.

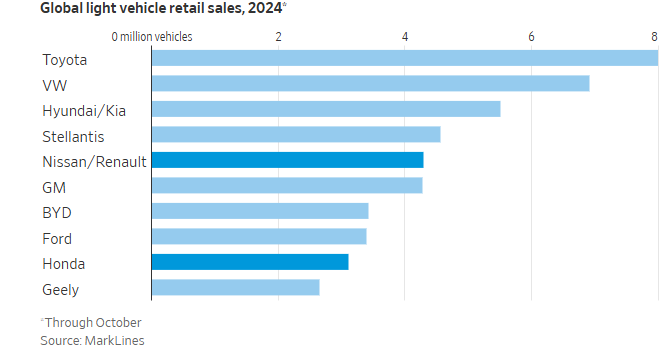

Globally, Honda sold approximately 4 million vehicles last year, while Nissan sold 3.4 million. If their merger proceeds, the combined entity would rank third in global car sales behind Toyota and Volkswagen, unless production cuts are implemented to eliminate overlaps.

The Japanese auto industry is increasingly consolidating into two main groups. One revolves around Toyota, which holds minority stakes in Subaru, Mazda, and Suzuki. The other consists of Honda, Nissan, and Mitsubishi Motors. Nissan owns roughly a quarter of Mitsubishi after reducing its stake in November.

A Honda-Nissan merger would mark a significant realignment in Japan’s automotive sector, reshaping the competitive landscape in response to evolving global market dynamics and technological demands.