The uniformity of hipster coffee shops in Budapest, resembling those in Portland, Oregon, or São Paulo, Brazil, reflects the global reach of certain trends. However, beneath the surface, even seemingly identical elements can possess distinct characteristics.

Consider Software as a Service (SaaS), for example. Regardless of location, purchasing software in a box has become outdated. Yet, the SaaS businesses facilitating this transition navigate diverse landscapes based on their geographical roots, leading to divergent trajectories.

In India, where SaaS is rapidly expanding, projections suggest the local market could achieve $50 billion in annual recurring revenue by 2030, according to Bessemer Venture Partners. However, the dynamics of Indian SaaS companies differ from their U.S. counterparts. The former exhibit greater efficiency, potentially propelling them toward global leadership, as noted by Bessemer.

The State of SaaS LatAm 2024 report, conducted in collaboration with SaaSholic, highlights a similar trend in Latin America. Many SaaS enterprises in the region excel in efficiency metrics such as net dollar retention and customer acquisition cost payback. However, limited access to capital constrains innovation, although Artificial Intelligence (AI) could alleviate this constraint.

Efficiency Imperatives Customer acquisition cost (CAC) stands as a pivotal metric for SaaS startups, influencing critical indicators like CAC payback and the LTV/CAC ratio. The State of SaaS LatAm 2024 report reveals that numerous companies in its sample outperform global averages highlighted by the Capchase SaaS Benchmark Report 2023.

NFX principal Anna Piñol’s analysis underscores that top-decile respondents report CAC Payback Periods 32% lower than U.S. benchmarks, indicating the untapped potential of LatAm markets. However, stringent standards, influenced by higher interest rates and capital costs, pose challenges for venture-backed SaaS ventures in the region.

In light of declining venture capital inflows, many LatAm SaaS startups opt for bootstrapping, with one-third of the sample taking this route. Despite potential funding uncertainties, these startups demonstrate resilience, with median LatAm companies boasting longer runways compared to their U.S. counterparts.

Comparative Insights: Clicksign vs. DocuSign Examining specific cases like Clicksign offers illuminating insights. This Brazilian digital signature startup, akin to DocuSign, presents a compelling comparison. Clicksign’s co-founder Michael Belfer Bernstein highlights a significant contrast: while DocuSign’s CAC payback spans 79 months, Clicksign’s stands at 5.6 months.

Although Clicksign underwent layoffs in late 2022, its robust metrics position it favorably in its market. The company serves 28 million individuals, representing 13% of the Brazilian population.

Innovation Amidst Constraints Latin American SaaS startups often prioritize democratizing technology over groundbreaking innovation. Rodrigo Fernandes, CFO at Pingback, underscores this point, emphasizing the region’s emphasis on ‘go-to-market’ efficiency rather than revolutionary product innovation.

Franco Zanette, partner at SaaS-focused fund ABSeed, echoes this sentiment, noting the prevalence of copycat solutions tailored to regional needs. While this approach may limit deep tech innovations, it doesn’t preclude the emergence of global leaders, particularly those emphasizing efficiency and profitability.

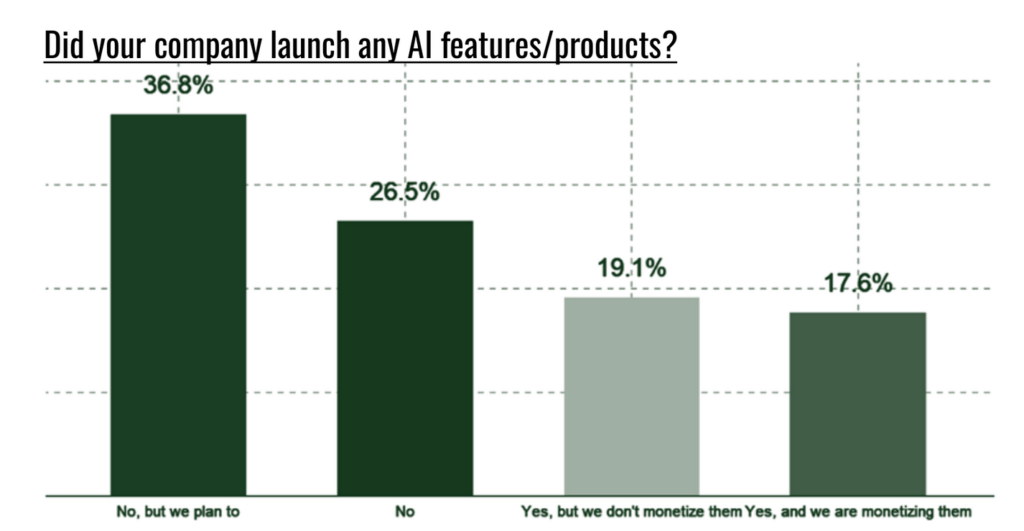

Despite these constraints, Latin American companies are embracing AI integration, signaling a promising trajectory toward technological advancement. While not all SaaS founders have adopted AI, many intend to incorporate it into their business models, aligning with global trends in the industry.

Image Credits: State of LatAm SaaS 2024

This presents a modestly positive outlook; despite facing relative capital constraints, the region may encounter challenges in leading AI innovation. However, it’s reassuring to note that the region is not poised to overlook this emerging trend. Instead, it stands poised to leverage AI’s potential, empowering its SaaS enterprises to expedite the digital transformation essential for the region’s advancement.