David Rosenberg stands out as one of the few individuals who finds excitement in the Federal Reserve’s Beige Book, a publication that provides insights into the economy through anecdotes from business leaders and bankers. The founder and president of Toronto-based Rosenberg Research analyzed Beige Books from the past 40 years preceding recessions and concluded that the recent editions were exceptionally pessimistic, leading him to believe that the economy is already entering a recession.

While many economic experts have shifted away from recession forecasts due to positive economic surprises, Rosenberg and a small group of experts remain steadfast in their predictions. They argue that the optimism is based on the wrong numbers, potentially revised data, or a focus solely on statistics without considering the underlying realities described in the Beige Book.

Rosenberg, along with Danielle DiMartino Booth, Joseph LaVorgna, and Jeffrey Gundlach, provides 13 reasons to support their belief in an imminent recession:

- Discrepancy between nominal GDP growth (6%) and Gross Domestic Income (GDI) (-7%).

- Historical pattern where soft landings precede recessions.

- Diminishing impact of government stimulus on GDP growth.

- Rising consumer delinquencies on loan payments.

- Expected increase in commercial real estate losses.

- Lingering concerns for regional banks, as seen in New York Community Bancorp’s recent challenges.

- Potential government shutdown in early March.

- Inverted Yield Curve (IYC) since July 2022, signaling a potential recession if it persists into March.

These experts highlight the need to look beyond headline numbers and consider a broader range of indicators to understand the true state of the economy.

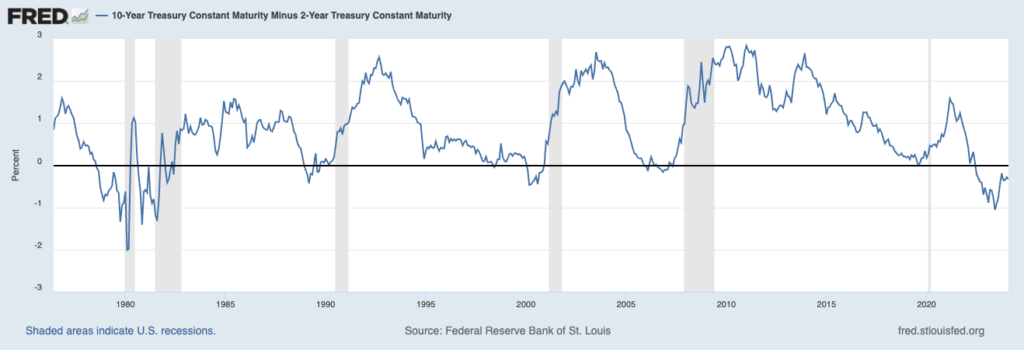

DEAD MAN’S CURVE

Every time the fever line dips below the horizontal line, a recession ensues. Except this time. So far. – 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

The absence of a recession thus far doesn’t guarantee its avoidance. Rosenberg illustrates this point by likening it to being in Minneapolis in December without snow and assuming winter won’t arrive.

Excessive optimism pervades the markets. Recent record highs in the S&P 500 and Dow Jones Industrial Average reflect a state of euphoria in the markets, according to Gundlach, who expressed concerns about this sentiment.

Key economic indicators raise alarm bells. The Conference Board’s Index of Leading Economic Indicators continues to indicate recession, following a 4.3% decline in the first half of 2023 and a subsequent 2.9% contraction.

Substantial layoffs are occurring. MicroEdge reports 103,500 job cuts announced in January, while DiMartino Booth notes net job losses in most states in October, potentially signaling the onset of a contraction. Gundlach predicts layoffs to be a prevalent theme in 2024.

Historical data suggests a lag between rate hikes and recession. Rosenberg points out a historical pattern where a recession typically follows rate hikes with a 27-month lag, with late spring or early summer identified as a critical period.

Despite differing viewpoints, even Furman acknowledges the possibility of the pessimists’ scenarios materializing, emphasizing that their concerns are not unfounded.