Published: May 25, 2025 ✍️ Author: Global World Citizen Business & Health Desk 🌐 Source: GlobalWorldCitizen.com 📍 Category: Global Entrepreneurship & Biotech Innovation

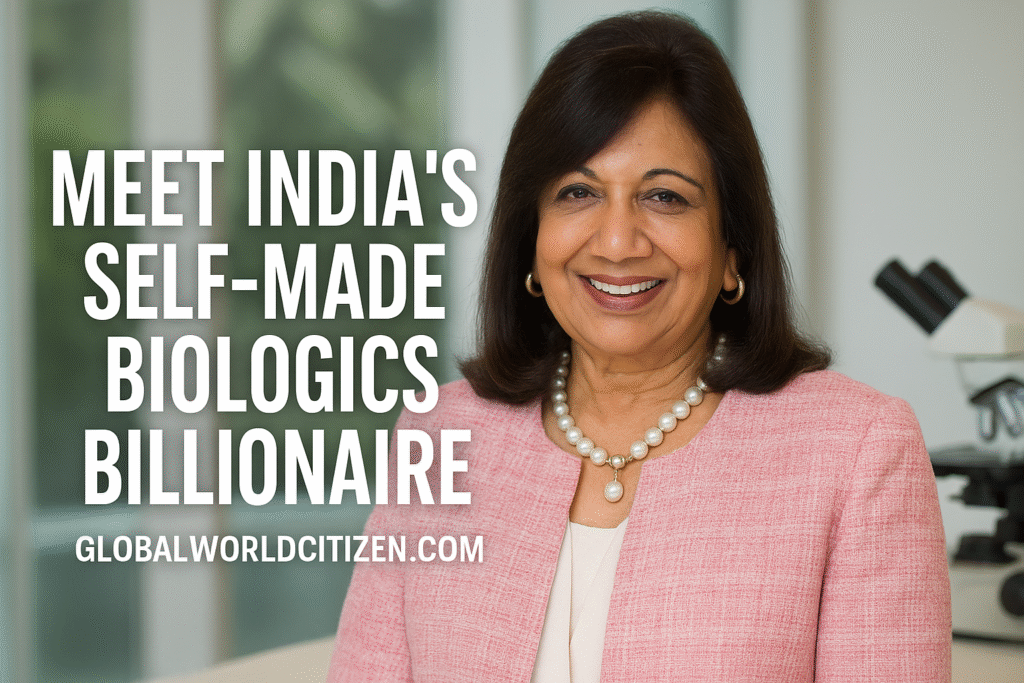

From a rejected brewmaster to one of the most influential female biotech entrepreneurs in the world, Kiran Mazumdar-Shaw transformed a setback into a billion-dollar legacy. Today, she’s the powerhouse behind Biocon, a global biologics and biosimilars giant delivering affordable life-saving drugs across continents — and challenging Western pharma dominance.

Humble Beginnings: From Brewing to Biotech

Humble Beginnings: From Brewing to Biotech

In 1978, fresh out of brewing school in Australia, Kiran returned to India dreaming of becoming a master brewer like her father. But the industry wasn’t ready for a woman at the helm. Denied opportunities, she pivoted — fermenting enzymes in a tin-roof shed in Bengaluru to supply food manufacturers like Ocean Spray. Partnering with Irish firm Biocon, she became an accidental entrepreneur — and never looked back.

Building a Global Biopharma Empire

Building a Global Biopharma Empire

By the late 1990s, Unilever had acquired Biocon, but Kiran and her late husband bought it back in 1998 for $2 million. She later sold the enzymes business to Novozymes for $115 million in 2007. Her new focus? Affordable pharmaceuticals.

Biocon’s Big Leap:

Biocon’s Big Leap:

-

2000: Enters the insulin market, producing human insulin at a fraction of global prices.

-

Today: Biocon generates $1.9 billion in revenue and operates in over 120 countries, with biosimilars as the core of its growth strategy.

What Are Biosimilars & Why Do They Matter?

What Are Biosimilars & Why Do They Matter?

Biosimilars are cost-effective alternatives to expensive biologic drugs. Like generics, they’re introduced after a drug’s patent expires — but require more investment and technical expertise.

Why Biosimilars Are Game-Changing:

Why Biosimilars Are Game-Changing:

-

Biologics spending hit $324 billion globally in 2023.

-

Biosimilars have saved the U.S. over $36 billion since 2015.

-

Over 118 biologic patents are set to expire by 2035.

Biocon’s portfolio includes biosimilars for blockbuster drugs like:

-

Stelara (Crohn’s disease) – Biocon’s Yesintek: $3,000/dose vs $25,000/dose

-

Humira (rheumatoid arthritis) – $21B peak revenue

-

Herceptin (breast cancer) – once $90,000 per treatment

Biocon Biologics: A Quiet Giant in Global Pharma

Biocon Biologics: A Quiet Giant in Global Pharma

The crown jewel of Kiran’s empire is Biocon Biologics, accounting for 55% of Biocon’s revenue. With nine biosimilar drugs already launched — and many more in the pipeline — Biocon is rapidly gaining ground in the U.S., Canada, Europe, and emerging markets.

Challenges & Global Competition

Challenges & Global Competition

Biocon faces stiff competition from:

-

Sandoz (Switzerland) – $10B

-

Samsung Biologics (South Korea) – $3.2B

-

Celltrion (South Korea) – $2.5B

-

Amgen (USA) – Recently launched Stelara biosimilar

Still, Biocon dominates in emerging markets, where it commands up to 80% share for some biosimilars.

Breaking into the U.S. Market

Breaking into the U.S. Market

Despite regulatory complexity and PBM (pharmacy benefit manager) barriers, Biocon is pushing forward:

-

New launches in the U.S. market every year until 2030

-

Upcoming biosimilar for Eylea (eye disease drug with $10B in sales)

-

GLP-1 biosimilar (for diabetes & obesity) launched in the U.K., with U.S. next

But looming 25% Trump-era tariffs on imported drugs may impact profitability unless policy shifts.

Vision, Impact & Global Mission

Vision, Impact & Global Mission

“I believe we are in a humanitarian business,” says Mazumdar-Shaw.

“We want to make biologics accessible and affordable to all.”

Biocon now operates 20+ drugs across oncology, diabetes, immunology, and ophthalmology — and expects to spin off Biocon Biologics as a standalone public company within 18 months.

Legacy of a Global World Citizen

Legacy of a Global World Citizen

Kiran Mazumdar-Shaw is more than a billionaire. She’s a visionary in affordable medicine, a trailblazer for women in STEM, and a global health equity champion.

At GlobalWorldCitizen.com, we recognize leaders who challenge borders, costs, and conventions to make the world healthier, smarter, and more just.