“Surprising Drop in US Unemployment Claims: Lowest in Over a Year, Demonstrating Labor Market Resilience”

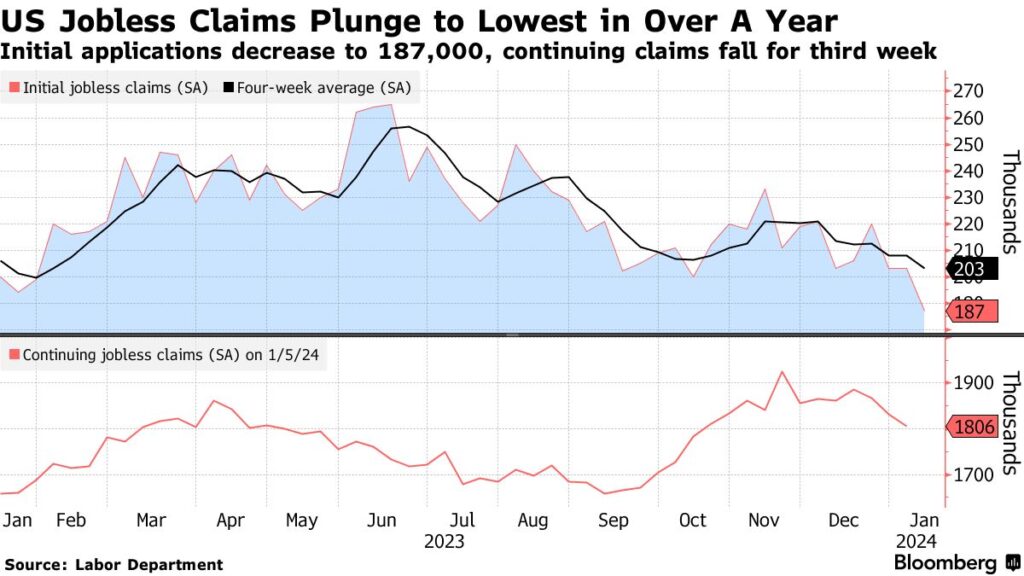

New data from the Labor Department reveals that initial applications for unemployment benefits in the US unexpectedly fell to the lowest level in more than a year, highlighting the labor market’s resilience at the beginning of the year. The figures, showing a decrease of 16,000 to 187,000 in the week ending Jan. 13, surpassed all estimates in a Bloomberg survey of economists.

The state of New York experienced the most significant decline, with over 17,000 on an unadjusted basis after a substantial increase in the previous week. Additionally, continuing claims, serving as a proxy for the number of individuals receiving unemployment benefits, decreased for the third consecutive week to 1.81 million in the week ending Jan. 6, marking the lowest level since October.

While weekly claims exhibit volatility, particularly around holidays, the four-week moving average of initial applications reflects a similarly robust trend, reaching 203,250, the lowest in 11 months.

Stephen Stanley, Chief US Economist at Santander US Capital Markets LLC, acknowledges the influence of seasonal factors on weekly readings at the beginning of the year. He notes, ‘I would not take this result literally, but, at a minimum, it seems clear that layoffs remain quite low and are not trending higher in a meaningful way.’

Despite elevated interest rates, the US job market has defied economists’ predictions over the past year, maintaining strength and curbing unemployment.

However, some reports suggest a slight moderation in the labor market, including the Federal Reserve’s latest survey of regional business contacts. As Fed officials consider potential interest rate cuts this year, they will closely monitor signs of any slowdown.

The unadjusted data on initial claims, not accounting for seasonal influences, saw a significant drop of nearly 30,000 to 289,228. While New York contributed over half of this decline, Michigan and Wisconsin also reported lower applications.

Eliza Winger, an economist at Bloomberg Economics, notes the volatility in New York’s numbers during winter and spring breaks, where workers in New York City can apply for benefits.

A separate report on Thursday indicated a rise in applications for new home construction in the last month of the year, reflecting optimism about future demand. However, starts declined, primarily due to a decrease in single-family home construction