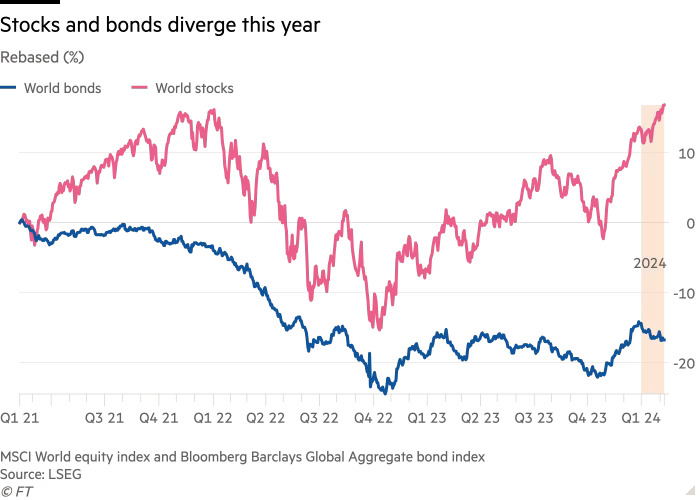

The recent market dynamics, characterized by a sell-off in global bond markets alongside a rally in stocks, suggest a potential shift in investors’ predominant focus from inflation and interest rates, according to analysts.

Developed market stocks have surged by 3.8 percent this year, led by Wall Street, buoyed by the robust performance of the US economy. Conversely, a global bond index has declined by 2.8 percent as investors recalibrate their expectations regarding interest rate cuts.

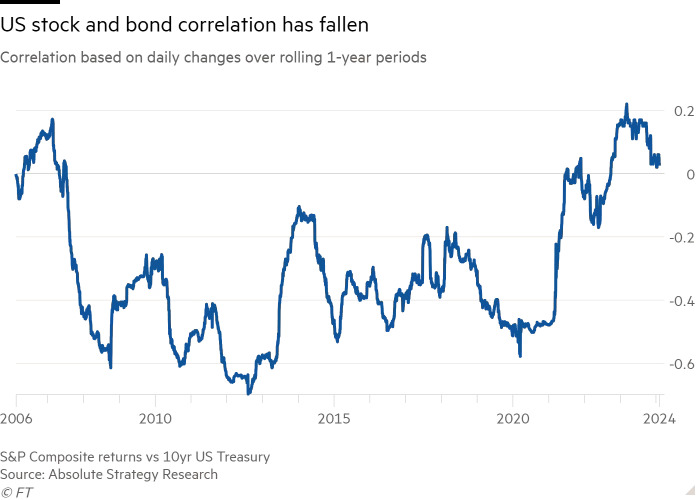

These contrasting movements signify a departure from the trend observed over the past year, during which stocks and bonds tended to move in tandem. This shift could signal a return to the conventional pattern where lower-risk fixed income instruments serve as a hedge against riskier equities.

This development is likely to be welcomed by investors who adhere to the “60/40” portfolio strategy, allocating 60 percent to stocks and 40 percent to bonds. This strategy aims to mitigate risk and offer diversification during market upheavals.

Ronald Temple, chief market strategist at Lazard, remarked, “60/40 is not dead, it was just taking a break.”

In 2022, such portfolios faced challenges when both stocks and bonds experienced declines—a scenario they were not explicitly designed to withstand. However, they exhibited resilience late last year when both asset classes surged amid expectations of swift interest rate cuts in 2024.

Stocks and bonds diverge this year Rebased (%)

Some analysts anticipate that the divergence observed this year between stocks and bonds will persist.

George Saravelos, global head of FX research at Deutsche Bank, remarked, “We see the bond-equity correlation shifting back to negative this year. We have indeed started to observe this since the start of the year with US equities making fresh record highs but US yields also rising.”

When interest rates were at historically low levels, bonds struggled to generate positive returns and incurred significant losses as interest rates increased. However, higher interest rates offer a stable income, with investors typically expecting them to rise if economic conditions deteriorate.

Analysts suggest that the shift in correlation reflects the market’s transition from concerns about inflation and the timing of future interest rate adjustments to apprehensions about economic strength.

This shift coincides with growing market confidence that inflation will retreat to levels targeted by central banks, coupled with an acknowledgment that policymakers may not reduce borrowing costs as swiftly as previously anticipated.

Investors are reassessing the significance of monetary policy, considering the resilient performance of the buoyant US economy, which has largely absorbed the impact of elevated rates maintained at a 22-year high between 5.25 percent and 5.5 percent since July last year.

According to economists surveyed by Bloomberg, benchmark 10-year US borrowing costs are expected to decline from the current level of 4.2 percent to 3.6 percent by 2025, still higher than the less than 2 percent observed at the close of 2019. Higher yields are advantageous for the 60/40 portfolio, as they provide greater room for price appreciation and potentially enhance the bond component’s performance.

us stock and bond correlation has fallen Correlation based on daily changes over rolling l-year periods

JbP Composile returns vs IOyr us Treasury Source: Absolute Strategy Research

Stocks have enjoyed a notable upswing this year, fueled by January’s robust job additions in the US, which surpassed initial forecasts.

Investors are increasingly recognizing the underestimated impact of fiscal policies on the economy. Noteworthy legislations such as the Inflation Reduction Act, the Bipartisan Infrastructure Deal, and the Chips and Science Act have injected over $1 trillion into the US economy in recent years, elevating the budget deficit to nearly 6 percent.

Luca Paolini, chief strategist at Pictet Asset Management, believes that the prevailing emphasis on monetary policy overlooks the substantial growth influence of fiscal measures. He notes the remarkable expansion of fiscal policy, which continues to exhibit extraordinary looseness and expansion.

Paolini anticipates a significant decline in the correlation between stocks and bonds this year as attention shifts from inflation to growth. He predicts accelerated growth in the coming quarters, coinciding with a softening of the US economy.

He explains that when growth risks overshadow inflation concerns, adverse economic data translates to a positive impact on bonds and a negative one on equities. This shift implies that bonds will once again offer diversification benefits.

Investors are now closely monitoring whether inflation will resurge as a major concern. In the US, consumer prices excluding food and energy items increased at a 3.3 percent annualized rate in the final quarter of 2023, down from over 5 percent in early 2023.

Analysts at PGIM observe that while market pricing for long-term inflation remains above the Fed’s 2 percent target, it remains contained.

Kamakshya Trivedi, head of global FX at Goldman Sachs, believes policymakers can manage inflation back to target levels without significant difficulty. He emphasizes the evolving market dynamics, where growth considerations have become as relevant as inflation. As inflation trends towards the target, positive growth prospects bode well for equities but pose challenges for bonds.