February 16, 2024 at 7:27 PM GMT

SoftBank Group Corp. founder Masayoshi Son is aiming to secure up to $100 billion to back a chip venture aimed at rivaling Nvidia Corp. and supplying semiconductors crucial for AI, according to individuals familiar with the matter.

Dubbed Izanagi, the initiative represents the billionaire’s next significant endeavor as SoftBank significantly reduces investments in startups. Son envisions establishing a company that can complement chip design unit Arm Holdings Plc and enable him to construct a formidable AI chip entity, the individuals said, requesting anonymity due to the private nature of the discussions. Under consideration is a scenario where SoftBank would contribute $30 billion, with potentially $70 billion coming from Middle Eastern institutions, one source disclosed.

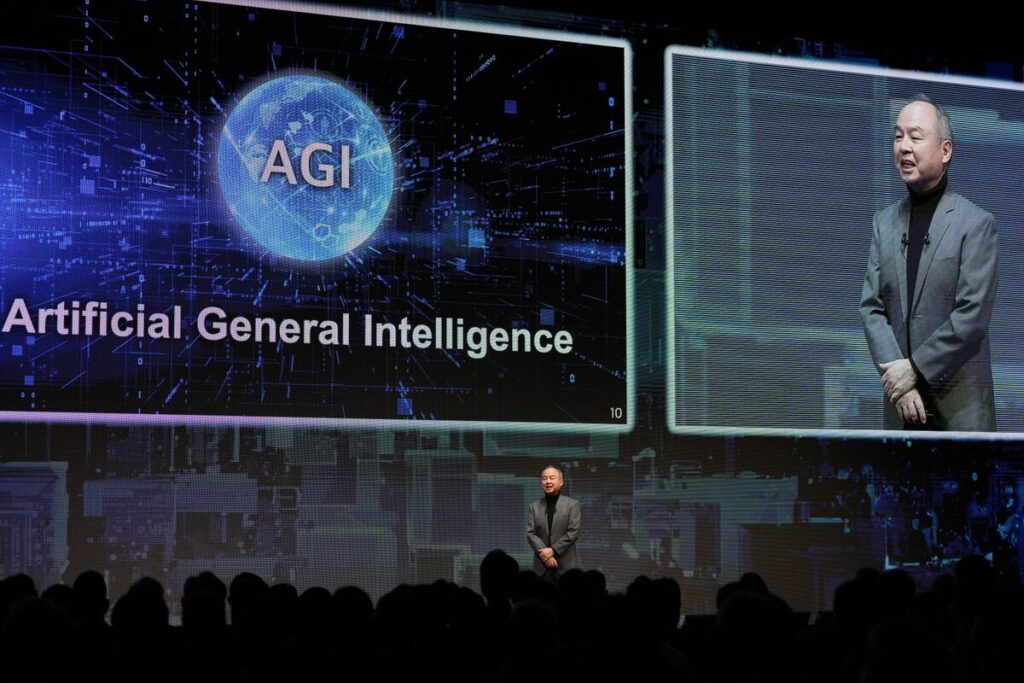

If successful, the chip endeavor would represent one of the largest investments in the AI field since the emergence of ChatGPT, surpassing Microsoft Corp.’s recent investment in OpenAI of over $10 billion. Son named the project after Izanagi, the Japanese deity of creation and life, partly because it incorporates the initials for artificial general intelligence (AGI), the individuals said. Son has long predicted the advent of AGI, asserting that a world inhabited by machines smarter than humans will be safer, healthier, and happier.

Details regarding the project’s funding and allocation of funds are yet to be finalized, and the project may undergo further evolution, the sources added. Son is continuously exploring various investment ideas and strategies to bolster Arm’s presence in the AI market, along with investigating different types of next-generation chips. It remains uncertain which company or companies will play a central role in developing the technology necessary to challenge Nvidia’s dominance in high-end AI accelerators.

Representatives from SoftBank and Arm declined to comment.

Following a series of setbacks in startup investments, Son is concentrating his efforts on Arm, aiming to establish a powerhouse company akin to the Magnificent Seven stocks. SoftBank boasted ¥6.2 trillion ($41 billion) in cash and cash equivalents as of Dec. 31, bolstered by a rebound in global equity markets and a windfall from T-Mobile US Inc. shares and Arm’s market value surge.

While discussions between Son and OpenAI’s Sam Altman have centered on collaboration and fundraising in semiconductor manufacturing, Izanagi, in its current form, is distinct from Altman’s aspirations. Son had previously explored investment opportunities in another company developing a foundational AI model, seeking assistance with the chip venture, but the leaders declined, according to one source.

Alongside Son’s pursuit of AI-related investments, SoftBank is exploring ways to leverage Arm’s chip designs. Arm CEO Rene Haas, as a SoftBank board member and tech expert, is advising Son on the project.

Son is leading Project Izanagi directly, having previously orchestrated the creation of SoftBank’s Vision Fund. Despite a slowdown in investment from the unit over the past 18 months, Son’s enthusiasm for AGI remains steadfast, with his conviction that AGI will become a reality within a decade.