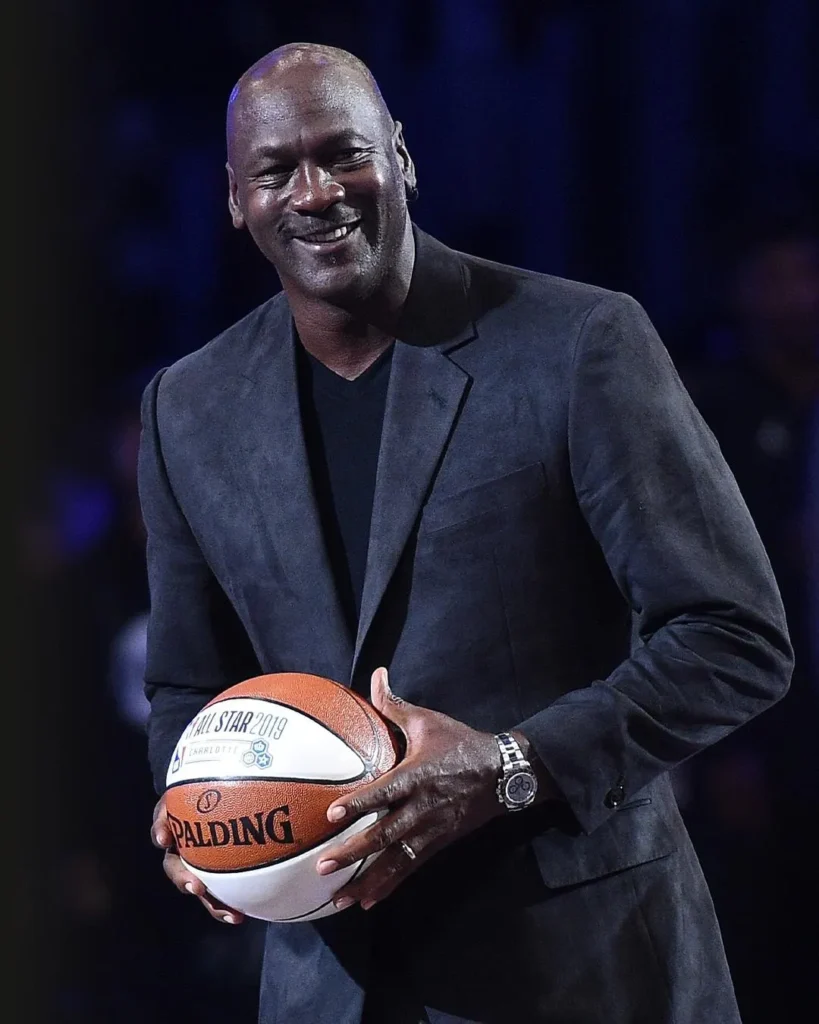

Thanks to the recent sale of the Charlotte Hornets, NBA legend Michael Jordan has achieved a historic milestone by becoming the first professional athlete to secure a spot among America’s 400 wealthiest individuals.

Since Michael Jordan first set foot on an NBA court in 1984, accumulating substantial wealth has been as effortless as a layup for him. Throughout his illustrious 15-season NBA career, he amassed an impressive $94 million in salary and signing bonuses, clinching the title of the league’s highest-paid player in 1997 and 1998. However, it was his off-court endeavors that propelled Jordan to unparalleled financial heights, raking in an estimated $2.4 billion (pre-tax) over his career through lucrative partnerships with renowned brands like McDonald’s, Gatorade, Hanes, and, notably, Nike, where his most recent annual royalty check reached an impressive $260 million.

Jordan’s most significant financial triumph came in August when he sold his majority stake in the Charlotte Hornets at a staggering $3 billion valuation. Even if he had sold at Forbes’ most recent valuation of approximately $1.7 billion in 2022, it would have still been a substantial victory for the 60-year-old Hall of Famer. Instead, the 27th-most-valuable franchise in the NBA changed hands for the second-highest sale price in league history, nearly 17 times its value when Jordan assumed the role of principal owner in 2010.

With an estimated net worth of $3 billion, Jordan now claims a coveted spot on The Forbes 400, marking a historic moment as the first professional athlete to be recognized among America’s wealthiest individuals.

Shoe Business: The first Air Jordans cost $65 in 1985. In 2020, a 1985 pair signed by their namesake sold for $560,000 at Sotheby's.FOCUS ON SPORT/CONTRIBUTOR/GETTY IMAGES

“Michael’s one of the few people that have had success three times,” notes Ted Leonsis, the owner of the Washington Wizards, Mystics, and Capitals, who has collaborated with Jordan on various investments and sports ownership ventures. “A lot of entrepreneurs, they make it once. They have a big win, take their winnings, retire, and [we] never hear from them again, or they try something a second time, and it doesn’t work.

“He’s had three mega-successes,” Leonsis adds, alluding to Jordan’s influence as a player and an owner, along with the remarkable growth of the Air Jordan brand at Nike.

The prospect of a professional athlete attaining billionaire status remains highly uncommon, with only three individuals having achieved it thus far. Jordan was the trailblazer in reaching that milestone in 2014, followed by LeBron James and Tiger Woods, who have done so while still active in their careers. With sports salaries soaring and off-the-field opportunities expanding, more are likely to follow suit, as evidenced by the seven athletes who, by Forbes’ assessment, have already amassed $1 billion in career earnings before taxes, expenditures, and agents’ fees.

Nevertheless, entering the three-comma club necessitates a fortuitous convergence of favorable circumstances. Or, as Mark Cuban, the billionaire owner of the Dallas Mavericks, puts it, “[athletes] need to get really lucky.” However, luck hardly seems a factor for Jordan, who experienced success almost immediately upon entering the NBA.

When the first Air Jordan sneaker hit the market during the latter part of his rookie season in 1985, Nike initially anticipated sales of $3 million. Yet, within two months, the brand had generated $70 million in sales, and by year-end, it had surpassed $100 million, according to a 2023 study from Temple University. Initially signing a five-year deal, Jordan earned $500,000 annually plus royalties. In its most recent annual report, Nike disclosed $6.6 billion in yearly wholesale revenue for the Jordan Brand, marking a 28.6% increase from the previous year.

Nike wasn’t the sole company seeking to capitalize on Jordan’s prowess and charm. “He was a brand before people discussed human beings being brands,” remarks Marc Ganis, president of the consulting firm Sportscorp. “It wasn’t Michael Jordan promoting Gatorade; it was Gatorade saying, ‘Drink Gatorade to be more like Michael.’”

Wizardry: In January 2000, Jordan (with Washington Wizards owners Ted Leonsis and Abe Pollin) became a minority investor in the team and became president of basketball operations.DOUG PENSINGER/STAFF/GETTY IMAGES

Jordan’s return to the court for two seasons meant relinquishing his ownership stake. Upon retiring for the third and final time in 2003, he wasted no time in acquiring another team. In 2006, Jordan bought a minority stake in the Charlotte Bobcats, and four years later, he became the NBA’s first player-turned-majority-owner. The deal, mostly financed by debt, valued the franchise at $175 million, a significant drop from the initial $300 million paid by BET founder Robert L. Johnson for the expansion team in 2003.

Despite Jordan’s intense competitiveness, on-court success eluded the Hornets (the team dropped the Bobcats name in 2014), experiencing early exits from the NBA playoffs three times in the past 13 years. Nevertheless, Jordan navigated the appreciating sports franchise market. In 2019, he sold a 20% stake to Gabe Plotkin of Melvin Capital and Daniel Sundheim of D1 Capital Partners at a $1.5 billion valuation. The team eventually sold for twice that amount when Jordan relinquished majority control to Plotkin and another hedge fund founder, Rick Schnall, two months ago. Among NBA teams, only the Phoenix Suns have sold for more when United Wholesale Mortgage CEO Mat Ishbia bought the franchise at a $4 billion valuation earlier this year.

Ted Leonsis comments, “Now people go, ‘Well, if Charlotte sold for X, and I’m in a bigger market and I do more revenue, that must mean my team is worth Y.’ He did a really great deal, and it helps everybody. If he had done a fire-sale deal, then people wouldn’t be happy with him.”

Jordan still holds a small stake in the Hornets, maintaining his connection to basketball while exploring new business ventures. Over the years, he has ventured into various businesses, including car dealerships, restaurants, a premium tequila brand, and more recently, equity investments. He has invested in companies like CLEAR, Mythical Games, and Dapper Labs, as well as in DraftKings and Sportradar, both facilitated by Leonsis.

Leonsis anticipates Nascar playing a more significant role in Jordan’s business life. In 2020, Jordan co-founded the Cup Series team 23XI Racing with Joe Gibbs Racing driver Denny Hamlin. Leonsis states, “I bet you it’s going to end up being a great business for him, too. It’s his competitiveness and desire to win.”