February 18, 2024 at 5:00 PM GMT

In a modest second-floor office nestled within Dubai’s vibrant financial hub, Moelis & Co. bankers are immersed in their work, navigating a surge in activity that has prompted the firm to expand physically by knocking down walls and adding desks.

Amidst the understated ambiance, shelves adorned with Lucite deal tombstones proudly display the achievements of Middle Eastern companies, ranging from Saudi Arabia’s Aramco to Abu Dhabi National Oil Co. Observers in the industry marvel at Moelis’ transformation of its Middle Eastern arm into one of its most lucrative divisions per capita — a remarkable accomplishment considering the region’s reputation for modest fee structures.

This bustling scene mirrors the fervent dealmaking that has swept across the Middle East, contrasting starkly with the subdued business climate in other global financial centers. Over the past two years, Gulf initial public offerings (IPOs) have amassed a staggering $30 billion in proceeds, with Moelis — despite its relatively small stature on Wall Street — advising on more than half of the IPOs that engaged independent financial advisers.

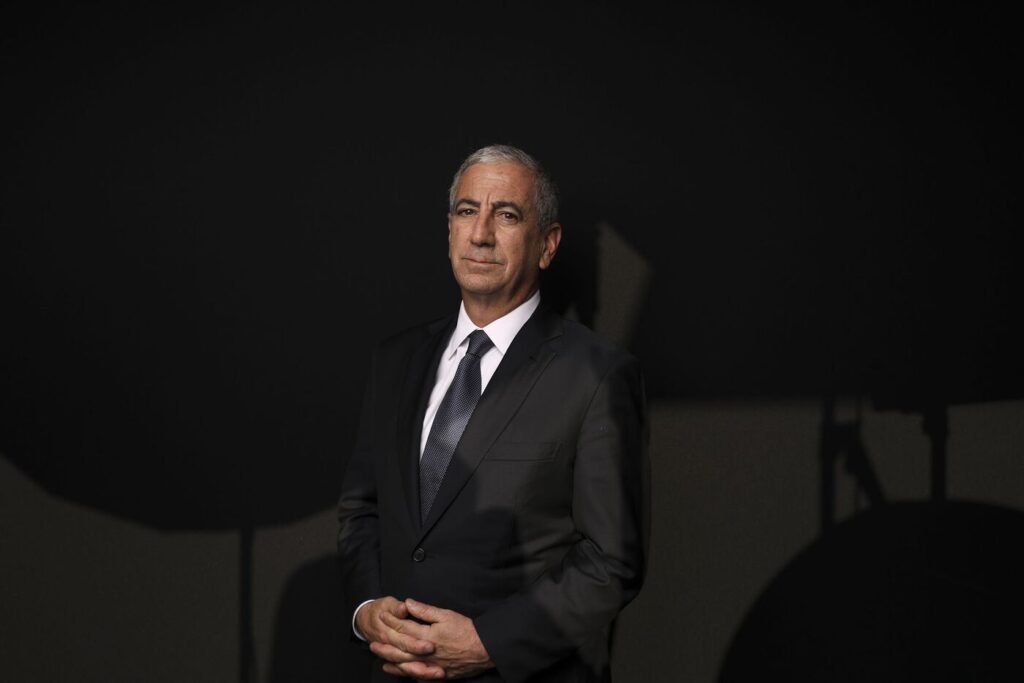

Ken Moelis, founder of Moelis & Co., at the Qatar Economic Forum in May.Photographer: Christopher Pike/Bloomberg

Ken Moelis’ persistence and dedication in building relationships over the years have indeed yielded significant returns, according to bankers. However, this success has come with substantial compromises and risks. Despite the fallout from the 2018 killing of government critic Jamal Khashoggi, Moelis chose to maintain ties with Saudi Arabia’s government. Additionally, he weathered through turbulent periods in Dubai’s economic landscape. The recent escalation of the Israel-Hamas conflict serves as a stark reminder of the region’s susceptibility to political instability and cyclical economic fluctuations.

According to George Traub, founder of Lumina Capital Advisers in Dubai, boutique banks like Moelis possess the agility to navigate diverse markets and capitalize on hiring opportunities as they arise. However, pricing in the risks associated with upheaval in the Gulf region can be particularly challenging due to the potential for non-linear outcomes.

Bigger Competitors

Ken Moelis remains steadfast in his commitment to the Middle East, considering it pivotal for his firm’s broader operations, as indicated by sources familiar with the situation. However, Moelis & Co. faces significant competition from larger rivals in other regions. In Europe, the firm ranked 22nd in M&A advisory last year, while its ranking dropped to 35th in the Asia Pacific region. Despite its global revenue of less than $1 billion annually, largely driven by its US operations, the Middle East presents a lucrative opportunity.

Despite a global downturn in IPO activity in 2023, the Middle East experienced one of its most successful years on record, with governments seeking to diversify their economies by selling stakes in state-owned enterprises. This trend persisted even amid the Israel-Hamas conflict, with the wealthiest Gulf nations remaining relatively unaffected.

Ken Moelis, aged 65, has demonstrated his enduring commitment to the Middle East. In 2009, he embarked on a mission to secure a $25 billion restructuring deal for Dubai World, a state holding company facing imminent default. His firm’s successful advisory role in the complex restructuring, involving over 70 creditors, earned him favor with top officials in the United Arab Emirates and paved the way for future transactions.

Furthermore, Moelis has capitalized on public relations opportunities that larger banks may find challenging due to their global exposure.

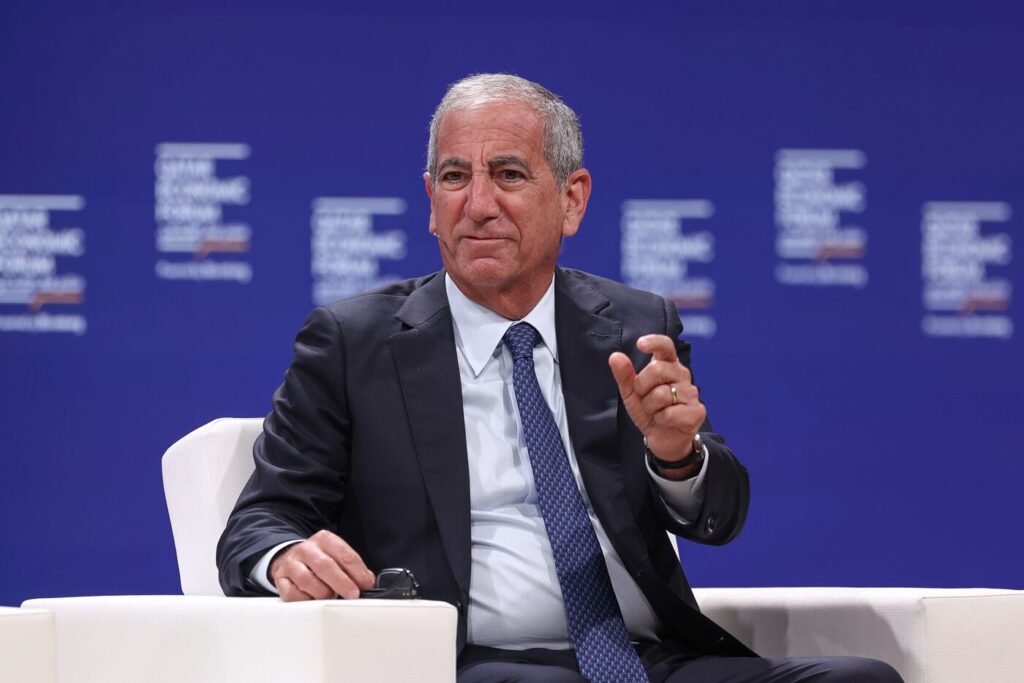

Eric CantorPhotographer: Chris Ratcliffe/Bloomberg

In October 2018, Ken Moelis and the firm’s Vice Chairman Eric Cantor made a notable appearance as two of the few top US financiers to attend Saudi Arabia’s flagship investment conference in Riyadh. This occurred just weeks after the murder of Jamal Khashoggi by government agents in the Saudi Arabian embassy in Turkey. Despite Crown Prince Mohammed bin Salman denying involvement, the gruesome killing led many businessmen and investors to boycott the country.

While most of Moelis’s Wall Street counterparts, including JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon and BlackRock Inc.’s boss Larry Fink, withdrew from the event amid the controversy, Moelis’s decision to attend earned him the trust of the kingdom’s top decision-makers. This move underscored Moelis’s reputation for loyalty, a trait highly valued in a region known for rewarding steadfastness, as per sources familiar with the matter.

According to Tom de Waele, managing partner for the Middle East at Bain & Co Inc., the firm’s proactive engagement has facilitated the cultivation of robust relationships with the region’s decision-makers. Moelis & Co. has been instrumental in facilitating landmark deals that have garnered significant attention, elevating the firm’s profile and influence in the region. Once a firm establishes a strong track record and engenders trust among key stakeholders, it sets in motion a positive feedback loop that further strengthens its position.

Biggest Advisor

The bank has emerged as one of the leading global investment banking entities in the Middle East, boasting a workforce of advisors that surpasses some larger Wall Street counterparts. In addition to handling IPOs, it actively engages in regional M&A activities and offers advisory services to firms undergoing strategic evaluations. Restructuring initiatives also constitute a significant aspect of its services in the region.

Despite its substantial presence, the bank’s regional operations are managed by only four managing directors, relying heavily on a cohort of junior executive directors, vice presidents, and associates. Leading the Middle East and North Africa office is Rami Touma, a former Credit Suisse banker known for his passion for Harley Davidson motorcycles.

The bank’s achievements in the Gulf region can be attributed in part to the unwavering commitment of its senior US management, according to insiders. Founder Ken Moelis and Vice Chairman Eric Cantor, a former US politician turned banker, make regular trips to the Middle East—three to four times annually—to pitch proposals. Their consistent presence resonates with clients in a region where decisions are often influenced by royals and a select group of top advisors.

However, despite its successes, fees in the region sometimes fall short of expectations. For instance, Moelis was involved in arranging Aramco’s $29 billion IPO in 2019. Initially anticipated to yield “tens of millions of dollars” in fees for Moelis, the final fee pool shared among banks amounted to just over $100 million, a notably modest sum relative to the deal’s magnitude.

Aramco's IPO in 2019.Photographer: Amr Nabil/AP

Moelis declined to provide comments for this article and does not disclose its revenue from the Middle East, which is overshadowed by its earnings from Europe and the Americas.

Ken Moelis, speaking at the 2018 event in Riyadh, emphasized the significance of relationships as a company’s most valuable asset, even if they cannot be quantified on the balance sheet.

Leaders in the Gulf region have expressed appreciation for Moelis’s loyalty. At the Qatar Economic Forum last May, Saudi Arabia’s energy minister, Abdulaziz bin Salman Al Saud, warmly referred to Ken as “my guy” and commended him for his superior advisory role compared to other bankers involved in the Aramco IPO.

During the same conference, the seasoned Wall Street professional lauded the Middle East’s capacity to make swift decisions, operate efficiently, navigate bureaucracy effectively, and prioritize long-term thinking, all without grappling with labor union issues.

He remarked, “This is one of the few places in the world that’s genuinely investing for the next five to 10 years.”

Recent Moelis IPOs

| Company | Revenue |

|---|---|

| Dubai Electricity & Water Authority | $6.1 billion |

| Adnoc Gas | $2.5 billion |

| Salik | $1 billion |

| Adnoc Logistics & Services | $769 million |

| Emirates Central Cooling Systems | $724 million |

| Investcorp Capital | $451 million |

Regional Bets

However, Moelis’s early lead in the Middle East is diminishing as more competitors vie for a share of the growing deal flow and the substantial funds exceeding $2 trillion managed by sovereign wealth funds. Rothschild & Co. has been actively involved in significant deals for years, competing closely with Moelis in both scale and client access. The boutique firm relocated a senior equity capital markets banker from Hong Kong to Dubai in late 2022 to capitalize on the expanding IPO market. Other advisory firms, including Lazard Ltd. and Jefferies Financial Group Inc., are also bolstering their teams in response to the increasing opportunities in the region.

The IPO market in the Gulf remains relatively shielded from regional geopolitical tensions and continues to attract new and burgeoning companies in sectors like local technology and services, which require capital infusion, as noted by Karen Young, a senior research scholar at Columbia University’s Center on Global Energy Policy.

Since establishing its hub in the Dubai International Financial Centre in 2011 and recruiting JPMorgan veteran Yorick Van Slingelandt, Moelis’s regional presence has expanded from an initial eight-person team to approximately 45 employees.

Nevertheless, not all of Moelis’s ventures in the region have yielded positive results. The company participated in several deals involving special-purpose acquisition companies, most of which were ultimately abandoned.

While competitors begrudgingly acknowledge Moelis’s achievements in the region, some assert that it has occasionally operated more akin to a consultancy rather than an investment bank to secure more lucrative contracts for major deals. Moreover, it employs a rolling fee structure for strategic counsel, a practice somewhat unique to the Middle East, where leaders with ambitious visions often seek advice from consultants, according to industry executives.

In the past year, Moelis appointed Moaath Alangari to oversee its Riyadh office following the acquisition of a license to operate in the kingdom, positioning the firm at the forefront of the crown prince’s ambitious initiatives.

“Boutiques like Moelis face the risk of heavily investing in Saudi Arabia and the broader region as a primary growth market, given its potential,” observed Lumina’s Traub. “It will be intriguing to observe whether, as deal activity intensifies in Europe and the US in 2024, this investment strategy remains viable and how key resources are allocated.”