Former Executive of Collapsed NYC Development Firm Arrested in Connection with Massive Fraud Scheme

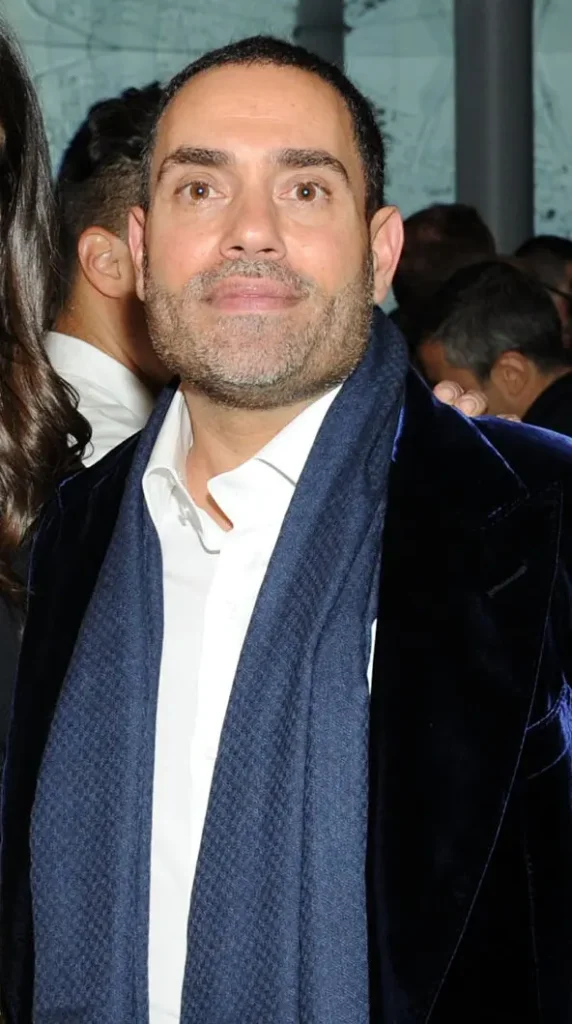

A former executive at a prominent New York City development firm, embroiled in investor lawsuits and foreclosures following its collapse, was arrested this week. Nir Meir, the developer in question, was apprehended at the 1 Hotel South Beach in Miami on Monday. He is expected to face charges related to a multimillion-dollar fraud scheme linked to his former company, HFZ Capital Group, according to sources familiar with the case.

The charges, spearheaded by the Manhattan district attorney’s office under Alvin L. Bragg, are anticipated to implicate at least 10 individuals and businesses. This legal action forms part of a broader investigation into suspected criminal activities surrounding HFZ’s luxury condominium project in Manhattan known as the XI.

Among those anticipated to be charged are individuals associated with Omnibuild, a construction firm involved in HFZ projects, including Omnibuild’s CEO, John Mingione, as per insiders.

The indictments are expected to allege a conspiracy to embezzle millions of dollars from XI investors by inflating construction costs between June 2019 and September 2020. Some defendants are scheduled for arraignment as early as Wednesday.

Representatives for the district attorney’s office and Mr. Meir declined to comment. Charges against Mr. Meir are likely to include tax fraud, falsifying business records, and grand larceny, with prosecutors alleging theft persisted until late last year.

HFZ’s lawyer, Charles E. Clayman, reserved comment until the indictments were reviewed. Omnibuild, through spokesman Josh Vlasto, maintained innocence, portraying the company and its executives as victims of HFZ’s alleged misdeeds.

HFZ Capital Group, once aspiring to prominence in the NYC real estate scene, sought to establish itself by developing and acquiring thousands of luxury condominiums in Manhattan.

At the company, Mr. Meir played a key role in securing millions of dollars from investors, frequently targeting affluent foreigners. By 2019, the firm boasted a portfolio of properties valued at over $10 billion, according to its reports.

Nir Meir, a former executive at HFZ, was arrested in Miami and will be extradited to New York City. Mr. Meir helped raise millions of dollars from wealthy investors. Credit...Craig Barritt/Getty Images for XI Gallery

The downfall of the company began with the inception of its most ambitious venture, the XI, situated in Manhattan’s Chelsea neighborhood. This project encompassed a pair of striking glass towers featuring upscale condominiums and a luxurious hotel. HFZ invested $870 million in acquiring the development site, commencing construction in 2016 under the direction of Omnibuild.

However, prior to its completion, HFZ faced accusations from investors and contractors regarding missed payment deadlines, resulting in owed sums totaling millions of dollars. In 2020, Omnibuild withdrew from the project, citing HFZ’s outstanding debt exceeding $100 million.

Among HFZ’s investors, Yoav Harlap from Israel filed a lawsuit against Mr. Meir in 2021, alleging the refusal to repay a nearly $20 million loan and the diversion of funds across personal accounts to evade repayment.

Following his departure from HFZ in late 2020, Mr. Meir, aged 49, filed for bankruptcy in Florida last week, where he had relocated.

In 2021, the XI project faced foreclosure before its completion and was subsequently acquired by two other developers, rebranded as One High Line, and opened late last year. HFZ experienced further losses in 2021, including four other condominium buildings in Manhattan.

HFZ, established in 2005 by Ziel Feldman, is not anticipated to face charges in the scheme, according to informed sources. Ziel’s wife, Helene Feldman, declined to comment on Mr. Meir’s arrest, stating that the couple has no remarks regarding the matter. In legal actions against the firm, Mr. Feldman asserted that he delegated day-to-day management of HFZ to Mr. Meir and attributed the mismanagement of funds and subsequent downfall to him.