Food waste represents a significant global challenge, with approximately 30% to 40% of the supply in the U.S. alone ending up in landfills. According to a United Nations report, nearly one-third of the world’s food is wasted annually, amounting to 1.3 billion tons and nearly $1 trillion in value.

Given the immense scale and societal implications of food waste, numerous startups are emerging to address the problem from various perspectives. Yume helps manufacturers convert potential food waste into revenue, Divert aims to algorithmically address grocery store waste, Ida applies AI to prevent surplus in supermarkets, and Choco works to foster a more sustainable food system for restaurants and suppliers.

Among these ventures combating food waste is Los Angeles-based ProducePay, which seeks to provide fresh produce growers and buyers with increased transparency and flexibility in the grocery supply chain.

“ProducePay is dedicated to eliminating the economic and food waste resulting from the volatile and fragmented nature of today’s global fresh produce supply chain,” explained CEO Pat McCullough in an email interview. “Our platform empowers growers and buyers by granting them unprecedented access to capital, a global trading network, insights, and supply chain visibility.”

Pablo Borquez Schwarzbeck founded ProducePay in 2015, shortly after earning his MBA from Cornell University. Schwarzbeck’s early exposure to supply issues came from his family’s asparagus and grape farms in Mexico. Working for the Giumarra Companies, a fruits and vegetables grower, further illuminated the challenges faced by growers.

“A single shipment of produce typically travels 1,600 miles and undergoes handling by four to eight intermediaries,” Schwarzbeck noted. “Unpredictable weather, fluctuating markets, crop disease, and pests contribute to a state of instability across the supply chain. This volatility, combined with the fragmented, speculative nature of the supply chain, leads to significant inefficiencies and wasteful practices.”

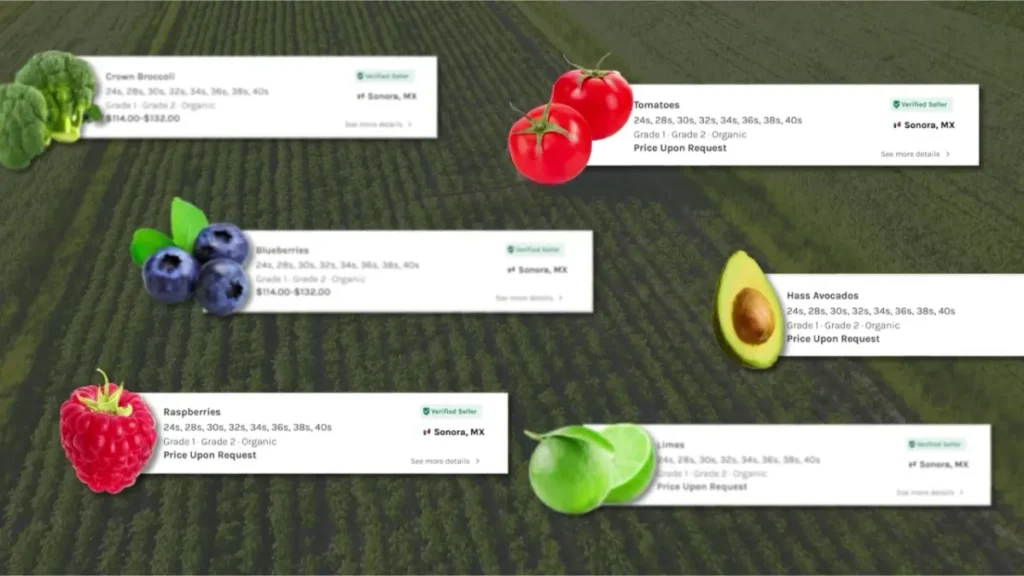

ProducePay’s platform helps connect — and fund — fresh produce growers and buyers. Image Credits: ProducePay

Schwarzbeck pointed out the numerous challenges that growers confront, with one of the most pressing being intense competition for buyer contracts. According to a report from the environmental organization Feedback, which delves into international food supply chains, six out of 10 farmers admitted to overproducing to prevent losing contracts. This overproduction leads to an excess of supply over demand and consequently contributes to food waste.

ProducePay addresses this issue with a two-pronged approach: supply chain monitoring and financing solutions for food growers and suppliers.

The company provides working capital to assist growers and distributors in covering operational expenses, technological upgrades, and land acquisitions. Moreover, ProducePay offers liquidity to growers and distributors after harvesting, enabling growers to strengthen their financial position for the upcoming growing cycle and allowing distributors to attract high-value growers by offering faster and larger payouts.

Are the loan terms favorable? According to McCullough, some customers believe they are. ProducePay now collaborates with over 60 commodities across 20 countries, having financed more than $4.5 billion in harvests to date.

“This success is rooted entirely in trust,” McCullough emphasized. “Growers trust that we are there to support their growth. We’ve established a strong network of growers and buyers who can fulfill their commitments.”

In addition to its financial services, ProducePay combines its financing products with supply chain visibility tools to establish “predictable commerce programs.” Retailers commit to fixed pricing and volume before the growing season begins in exchange for produce from vetted growers. ProducePay’s team of agronomists monitors and communicates order quality from the field throughout each program, from transportation to final arrival.

One of ProducePay’s clients, Four Star Fruit, leverages the program to connect with growers, advertisers, and retailers in ProducePay’s extensive client network while bypassing unnecessary intermediaries, as McCullough explains. “We’re mitigating volatility with capital, technology, and our team of agronomists to capture the value lost to intermediaries and other inefficiencies more efficiently,” he continued.

ProducePay’s business model, which involves taking a percentage of every transaction through its platform, has proven highly profitable. Revenue increased by 76% last year compared to 2022. Trade volume on the platform has nearly tripled, according to McCullough, while transaction volume is projected to reach $2 billion by late 2023.

Investors are evidently pleased with the company’s performance and are injecting more capital into Schwarzbeck’s venture.

Today, ProducePay announced a $38 million Series D round led by Syngenta Group Ventures, with participation from Commonfund, Highgate Private Equity, G2 Venture Partners, Anterra Capital, Astanor Ventures, Endeavor8, Avenue Venture Opportunities, Avenue Sustainable Solutions, and Red Bear Angels. With this new funding, which brings ProducePay’s total raised to $136 million, the company plans to expand into Europe, Asia, Africa, and Australia, as well as grow its team of approximately 300 full-time employees.

“Despite slowdowns in many industries, fresh produce remains essential and continues to grow as consumers demand healthier food choices,” McCullough remarked. “We witnessed this trend during the pandemic and continue to see its upward trajectory.”