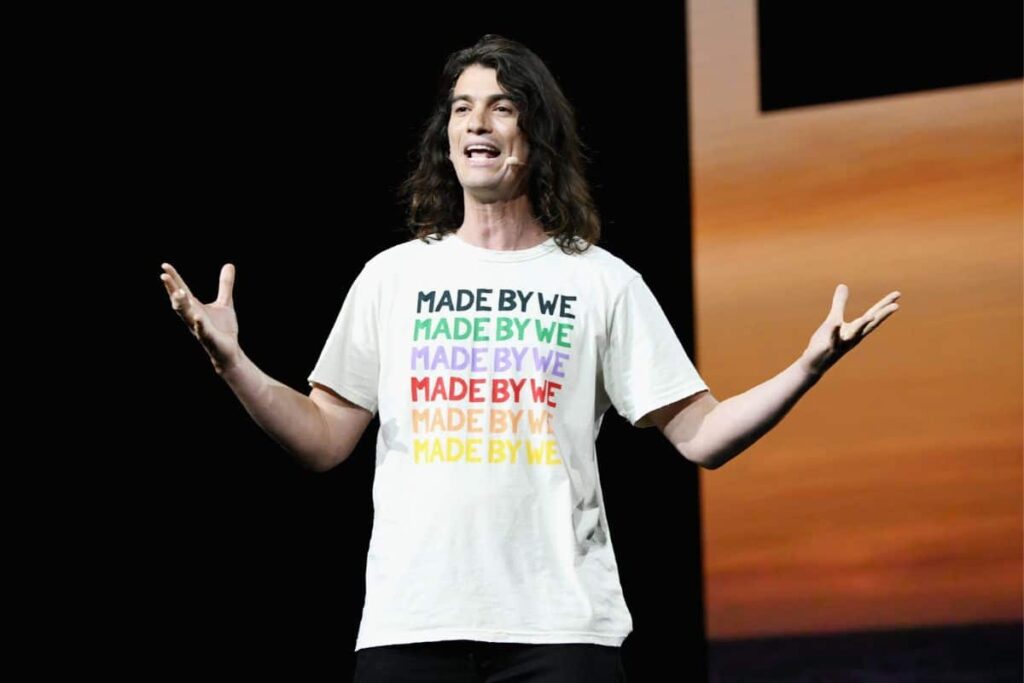

Reportedly, Adam Neumann, the founder of the bankrupt flexible workspace company WeWork, is making efforts to repurchase the company.

Following a significant decline in its valuation, WeWork filed for bankruptcy in November last year.

Neumann’s newly established real estate company, Flow Global, has expressed interest in acquiring WeWork or its assets, along with offering bankruptcy financing to sustain its operations, according to sources cited by Reuters.

WeWork may be forced to take new bankruptcy loan

The initial report from DealBook revealed that Adam Neumann’s legal team sent a letter to WeWork on Monday, asserting that Daniel Loeb’s hedge fund Third Point might assist in financing the transaction.

However, Third Point clarified to Reuters on Tuesday that it has engaged in only preliminary discussions with Neumann and his property entity, Flow, without making any financial commitments.

According to Reuters, Flow Global did not respond immediately to their request for comment.

WeWork stated that it routinely receives “expressions of interest” and evaluates them in the company’s best interests.

The company’s statement cited by Reuters emphasized ongoing efforts to address unsustainable rent expenses and restructure the business to ensure long-term financial strength and independence.

Meanwhile, a WeWork attorney mentioned on Monday that the company might need to secure a new bankruptcy loan due to slower-than-anticipated progress in rent negotiations.

Under Neumann’s leadership, WeWork ascended to become the most valuable US startup, valued at $47 billion.

However, his emphasis on growth over profitability and reports of his unconventional behavior led to his removal and derailed an initial public offering in 2019.

With more people working remotely during the pandemic, WeWork faced significant losses on its lease obligations, exacerbated by declining demand for office space.

Neumann expressed confidence in WeWork’s potential success through reorganization shortly before the company filed for bankruptcy.