February 13, 2024 at 5:01 AM GMT

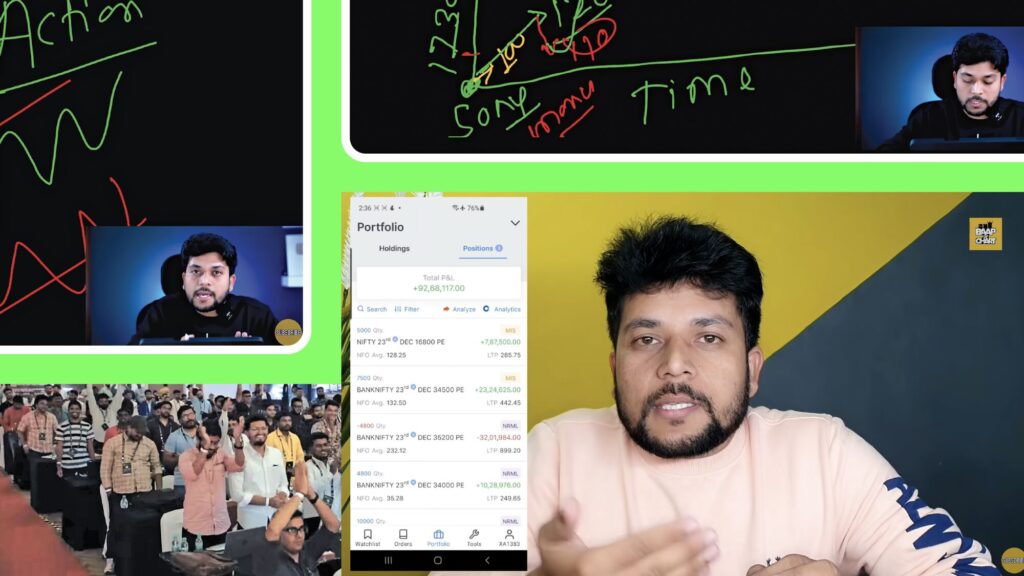

Resembling a celebrity at a red-carpet event, Mohammad Nasiruddin Ansari emerges from a white Mercedes, escorted by a group of black-clad bodyguards. Entering a lavish hotel lobby, he commands attention in a ballroom amid bursts of indoor fireworks. Amidst the spectacle, he proclaims to the audience, “If you don’t make money in three months, I will give you 2 million rupees [$24,000],” eliciting cheers from his devoted followers, an event still circulating on YouTube.

In Pune, located approximately 90 miles south of Mumbai, Ansari connects with his fans, selling them the vision of stock market success. With half a million social media followers, he promotes a particularly risky approach: trading stock options, often as high-stakes wagers on future share prices.

In 2023, Indian investors engaged in a staggering 85 billion options contracts, surpassing all other countries globally. Since 2019, India has led in annual trade volume, albeit the US retains the top spot in terms of dollar value traded.

At events like Ansari’s, promoters or influencers urge the masses to tap into India’s robust economy and stock market. Online platforms abound with video tutorials boasting titles like “Become a PRICE ACTION Beast” and “Easy Options,” enticing individuals to participate in speculative trading rather than pursuing traditional wealth-building methods like investing in stocks and mutual funds.

In India, retail investors drive 35% of options trades, while institutions manage the remainder to hedge risks or bolster company profits. Regulators express concern that everyday individuals are sidestepping conventional wealth-building strategies for pure speculation. The average Indian trader holds an option for less than 30 minutes, indicative of the high-risk, short-term nature of their investments.

Despite the allure of quick gains, statistics reveal a grim reality: 90% of active retail traders incur losses, amounting to $5.4 billion in losses for the year ended March 2022. Traders often bet on Indian stock indexes like the Nifty 50, facing significant risks with potential gains or total loss.

Regulatory efforts aim to curb risky trading practices. Initiatives include prohibiting regulated brokers from compensating influencers for referrals and establishing a new agency to verify traders’ claimed returns. Despite these measures, the allure of quick profits continues to drive retail investors into speculative trading.

Sebi took action against Ansari for improper self-promotion as a stock market expert, promising guaranteed profits, and acting as an unregistered investment adviser. This crackdown underscores the risks and regulatory challenges in India’s booming options market.

India’s burgeoning middle class, traditionally inclined toward real estate and gold, has largely overlooked stock market investments. However, the sector’s growth and lucrative opportunities have attracted widespread participation, driving substantial tax revenue and profit for brokerage firms and stock exchanges.

While concerns persist about the negative impact on retail investors, regulatory measures aim to balance market participation with investor protection. However, the enduring appeal of speculative trading poses ongoing challenges for regulators and investors alike.

Avadhut Sathe (second row, second from right) with trading students.Photographer: Subhash Sharma for Bloomberg Markets

During rush hour in Mumbai, India’s bustling financial hub, a lively jingle for an options-trading academy fills the subway cars, performed by two renowned Indian artists. “Money will flow,” they sing in harmony, “It’s the fastest way to grow.” For Sahil Kaurani, a recent college graduate navigating his first job, the infectious melody has piqued his interest in trading. “It has definitely made me curious,” he admits.

The mastermind behind this catchy tune is Avadhut Sathe, a prominent figure in India’s stock market surge. His Avadhut Sathe Trading Academy, with branches across 17 cities, uses the song to entice potential traders. Through online seminars drawing up to 10,000 participants, Sathe assumes a poised and professional demeanor, extolling the virtues of India’s burgeoning economy and the potential for trading to supplement income.

In one January session, over 100 individuals gather for a five-day trading seminar at a lavish resort nestled in the Lonavala mountains, a mere 50 miles from Mumbai. Banners proclaiming “Become a pro” and “Money will flow” adorn the venue. Among the attendees are doctors, software developers, consultants, homemakers, and even a cricket coach. Seated in rows with laptops before them, they watch as live stock and derivative prices illuminate a vast screen.

The seminar commences with a solemn prayer. Sathe encourages his followers to place their hands over their hearts, urging them to embrace the energy of the room. “Surrender to the market god,” he advises, “embrace your successes and failures with a smile.” A prayer in the local Marathi language flashes across the screen: “God bless us with knowledge, wisdom, and acumen.”

Sathe teaches at the January seminar.Photographer: Subhash Sharma for Bloomberg Markets

Sathe, aged 53, imparts to his followers the idea of exploiting trading patterns. Later, he indulges in photo sessions with his admirers, adopting what he terms the “market warrior pose,” a capitalist rendition of the formidable yoga stance.

As music reverberates through the hall, students sway to the rhythm, their arms moving in sync, reminiscent of a concert atmosphere. Sathe and a select few take to the stage, dancing to Hindi lyrics: “Oh, darling, love is now hurting me.”

Among the audience, Reeta Shah, a 57-year-old retired accountant, shares her journey of initial losses when she ventured into trading years ago but now boasts of turning a profit. “Either I park my money in a bank fixed deposit and earn 6% to 8% interest,” she explains, “or I must master this skill.”

Atharava Tandle, a 19-year-old pursuing a business degree, acknowledges the common belief that most retail traders lose money but maintains confidence in his ability to mitigate risks and emerge as an exception. “My aim is to achieve financial independence,” he asserts, “which I believe is feasible through disciplined trading.”

Infected with Sathe’s fervor for options trading, the students echo his enthusiasm. “Derivatives offer leverage, and leveraging with risk management is a potent combination,” Sathe expresses in an interview. “No other business can quadruple your earnings in a year, but with meticulously researched derivative strategies, it’s within reach.” Sathe distinguishes his academy from content

Love Pulkit trades options in his apartment.Photographer: Subhash Sharma for Bloomberg Markets

In Bengaluru, recognized as India’s Silicon Valley, Love Pulkit is venturing into index options trading. A data analyst at a tech company, he commenced his journey in August after immersing himself in YouTube tutorials. “You can easily earn up to 10%, 15% in a month if you’re good at it,” he remarks.

At 27, Pulkit resides with three roommates in a four-bedroom apartment, where he has arranged two screens alongside his laptop. “You’ll face losses initially,” he advises friends keen on trading, echoing his own experience. Despite setbacks, he remains undeterred. “I’m not about to abandon option trading,” Pulkit asserts. “I believe that with dedication and patience, I can succeed.”

He harbors no intentions of transitioning to more stable, secure investments. “Everyone aims to become a millionaire as quickly as possible,” Pulkit reflects. However, his track record since August suggests otherwise. By mid-January, he had incurred losses amounting to 400,000 rupees, or $4,400.