3:18 PM GMT•February 12, 2024

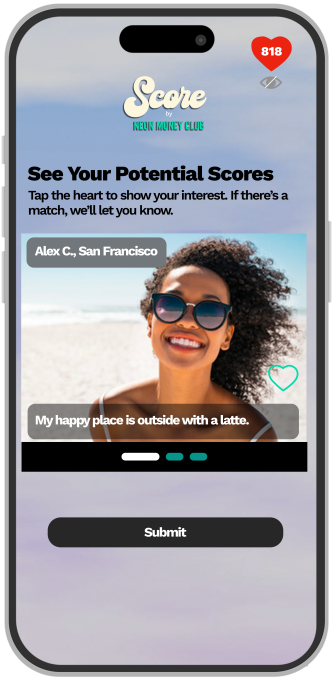

A new dating app has emerged just in time for Valentine’s Day, but it comes with a unique requirement: Users must boast a minimum credit score of 675 to join. Score, the brainchild of financial platform Neon Money Club, is tailored for individuals with good to excellent credit scores, aiming to spotlight the significance of financial well-being in relationships.

Luke Bailey, co-founder and CEO of Neon Money Club, emphasized the necessity of expanding financial discussions beyond traditional realms. He believes that conventional methods of raising financial awareness are outdated and that innovative approaches are needed to captivate individuals’ attention. With Score, Bailey stated that they aim to integrate financial conversations into the dating scene.

Discussing financial matters can often be uncomfortable, yet it remains a crucial aspect for many relationships. According to CNBC, a significant number of U.S. citizens perceive debt as a valid reason for divorce, highlighting the substantial impact of financial issues on relationships.

The concept for Score was conceived during last year’s AfroTech event. Neon Money Club, already dedicated to promoting credit health, sought to engage with attendees in discussions about finances. As hundreds of people gathered in Downtown Austin for a Neon Money Club event, Bailey and his team pondered how to broach the topic of finances with partygoers in a comfortable manner.

Neon Money Club is a creative studio that focuses on fintech products. Image Credits: Neon Money Club

“We decided to ask one question: ‘What should the minimum credit score be for someone you’re dating?’” Bailey recounted. “That question later became Score.”

The app will have a limited availability window, estimated to be around 90 days, and interested users must apply for access. Upon registration, Neon Money Club will conduct a soft credit check, ensuring it doesn’t impact users’ credit reports, and the score won’t be visible on the app, Bailey assured. Once approved, users can connect with others who share similar financial mindsets. Matches aren’t based on specific credit tiers, allowing individuals with varying credit scores to connect freely. It’s a standard swipe left or right process from there.

The exclusivity of the app may raise eyebrows, particularly considering that the average U.S. citizen’s credit score is 716, with Black and Hispanic individuals more likely to have scores below 640. Responding to concerns about perpetuating class distinctions, Bailey maintained that possessing good credit is more aspirational than class-based. He emphasized that a high income doesn’t always equate to a high credit score. Those declined access to Score will receive guidance on enhancing financial literacy and access to credit-building resources like Grow Credit to improve their credit scores. Bailey highlighted the intentionality of creating a positive cycle, noting, “There needs to be more awareness about the doors that can be opened with a good credit history.”

Neon Money Club, established in 2021 with a focus on enhancing financial literacy, made waves last year by becoming the first Black-owned tech business to introduce a credit card in collaboration with AMEX. The card enables users to convert credit card points into cash for investment in the stock market.

According to PitchBook, the company has secured over $10 million in venture capital.

“We need more creative and diverse voices in the world of finance,” Bailey stressed. “We aren’t the only people who think like this. The industry just needs to open more doors for others like us.”