The week concluded positively on Wall Street, witnessing stocks reach unprecedented highs amid speculation that the Federal Reserve will initiate rate cuts this year, thereby enhancing the outlook for Corporate America.

A surge in the technology sector, the most influential group in the S&P 500, propelled the index to a record high for the first time in two years. Fueled by optimism that the ongoing artificial intelligence boom will sustain market growth, the benchmark surpassed the 4,800 mark, challenging concerns that the rally is concentrated in a narrower set of shares.

On Friday, equities experienced an upward trajectory as a decrease in Treasury volatility indicated favorable conditions for risk-taking on Wall Street. Additionally, sentiment received a boost from a report widely regarded as “Fed-friendly,” showcasing a blend of high consumer confidence and lower inflation expectations.

The S&P 500 recorded a 1.2% gain, effectively erasing losses incurred earlier in the week. The Nasdaq 100, weighted towards technology, outperformed, with Advanced Micro Devices Inc. achieving a record and Nvidia Corp. leading the way for megacaps. Treasury 10-year yields saw minimal changes, while the dollar witnessed a decline.

“As we step into 2024, the underlying economic data reveals more positive than negative news, particularly with inflation cooling,” commented Art Hogan at B Riley Wealth. “We’re witnessing a credible path towards a gradual easing of inflation, an end to Fed rate hikes, and a resurgence of economic growth in the latter part of 2024.”

Since reaching a low point in October 2022, the S&P 500 has surged by approximately 35%, surpassing its previous closing high of 4,796.56 on Friday. This milestone makes the gauge the last among the three major US equity benchmarks to achieve a record.

Examining historical patterns, there is potential for further gains ahead. The gauge went through 512 trading days without a record through Thursday, ranking as the sixth-longest streak since 1928, according to Ned Davis Research. Historically, one year after achieving new highs, the index has risen 13 out of 14 times, with a median increase of 13% in that period.

Nicholas Bohnsack at Strategas remarked, “The equity market’s path of least resistance seems to be higher until the consumer pulls back and/or the labor market buckles.” Bohnsack remains positive on the equity market, anticipating increased exposure to stocks into year-end, but acknowledges a suspicion that the same mix that led the market last year, known as the ‘Magnificent Seven,’ will continue to dominate.

The “Magnificent Seven,” a group of companies that propelled a remarkable stock run last year, is once again leading the way in 2024. In January, Nvidia, Microsoft Corp., and Meta Platforms Inc., all part of this cohort, are the top point gainers in the S&P 500. Meta shares also achieved a record, marking a full recovery from a selloff that, at one point, had wiped out more than three-fourths of its value.

Simultaneously, semiconductor shares received a boost this week from a bullish forecast by Taiwan Semiconductor Manufacturing Co.

“Despite concerns surrounding the Federal Reserve’s timeline for initiating rate cuts and the potential increase in Treasury’s funding requirements, markets, once again, are rewarding mega-technology as the promise of generative AI increasingly becomes a reality,” stated Quincy Krosby at LPL Financial.

Investors are returning to owning growth, technology, and the “AI bubble” as the 10-year Treasury yield stabilizes in a range of 3.75% to 4.25%, according to Michael Hartnett at Bank of America Corp.

While US shares experienced redemptions totaling $4.3 billion in the week through January 17, tech-stock funds witnessed the largest two-week inflow since August at $4 billion, as reported by BofA, citing EPFR Global data.

“In summary, we’re off the bullish boil, and the boat is less full, but it’s still leaning firmly positive,” commented Peter Boockvar, author of the Boock Report.

After being caught off guard early last year, fund managers have heavily invested in technology stocks, prompting warnings that the Nasdaq 100 is increasingly vulnerable to investor pullbacks.

Hedge funds currently hold the highest level of net-long Nasdaq 100 futures in nearly seven years, according to Societe Generale’s weighted analysis of data on the Nasdaq 100 Index futures and e-mini contracts provided by the Commodities Futures Trading Commission. Meanwhile, a global fund manager survey from Bank of America this month revealed that the most crowded trade is being long the so-called “Magnificent Seven” stocks and other tech-related growth shares as a way to play the prospect of Fed easing.

“Based on the recent price action, Nasdaq 100 traders don’t seem particularly concerned about the upcoming earnings reports,” remarked Matthew Weller at Forex.com and City Index. With the “Magnificent Seven” stocks collectively trading at an “eye-watering” valuation, he noted, “the only thing that could drag down the Nasdaq 100 may be poor earnings results.”

While specific segments of the US equity markets are impressing investors with new highs, this activity conceals a widening divergence beneath the surface, signaling persistent “technical disease,” according to Dan Wantrobski at Janney Montgomery Scott.

“Narrow leadership such as this is a throwback to last year (mega-cap/AI/Mag 7), and our belief is that if it persists, it will trigger a wider bout of volatility not too far down the road,” Wantrobski added.

The combination of better-than-expected growth and a significant improvement in inflation, providing the Fed with flexibility to cut interest rates, strengthens UBS’s Chief Investment Office’s conviction in its base case for an economic soft landing. While this positive outcome is largely factored into equity markets, UBS notes that market gains can extend a bit further.

“Our June and December S&P 500 price targets are 4,900 and 5,000, respectively,” said David Lefkowitz at UBS Global Wealth Management. “We maintain a neutral preference for US equities in our tactical asset allocation. With S&P 500 valuations full, in our view, we look for a pickup in earnings growth to be the primary driver of the somewhat modest upside that we expect.”

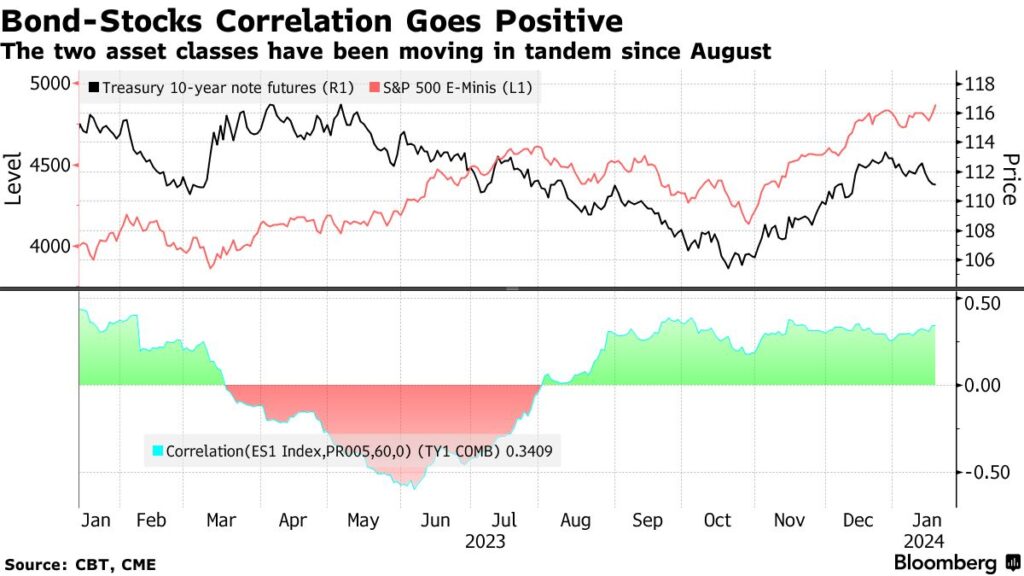

A double-digit stock rally led by megacaps in 2023 results in an ever-growing portion of the benchmark index being closely tied to long-term earnings prospects, making it more sensitive to rising yields.

With inflation concerns lingering, positive stock-bond correlations have strengthened again. The 60-day correlation between the S&P 500 and benchmark Treasuries has turned positive again, posing a threat to bonds’ hedging role since August of last year.

“The good news is the market has done a decent job of working off some of the extremes in price and sentiment through a correction in time and through churning, as opposed to intense selling pressure,” commented Keith Lerner at Truist Advisory Services. “Economic, earnings, and credit trends continue to show resilience.”

“Valuations have seen an uptick driven by three primary factors: the avoidance of a recession in 2023, a Federal Reserve pivot lowering borrowing costs, and higher earnings expectations for 2024,” stated Rob Swanke at Commonwealth Financial Network. Despite these factors, Swanke cautioned that interest rates are considerably higher than at the beginning of 2022, and expectations for 2024 earnings are already elevated, urging a tempered outlook.

Traders closely monitored statements from policymakers, delivered just hours before the Fed’s traditional pre-meeting communications blackout period. Three Fed officials emphasized that their decision on when to cut interest rates will be guided by incoming data and clarified that they haven’t witnessed sufficient evidence to initiate easing.

Fed Bank of Chicago President Austan Goolsbee mentioned that a continued decline in inflation would warrant discussions on reducing rates but emphasized that the central bank will make decisions meeting by meeting. Raphael Bostic, the Atlanta Fed counterpart, expressed openness to revising views on the timing of cuts depending on data but stressed the need for inflation to be “well” on the way to the 2% goal before easing policy. San Francisco Fed chief Mary Daly asserted that it’s premature to declare victory on inflation.

Economist Mohamed El-Erian warned that markets are overestimating the pace and extent of Fed-rate cuts, overlooking persistent high inflation. El-Erian believes that while a pivot is likely, it won’t be as rapid or deep as anticipated by the market.

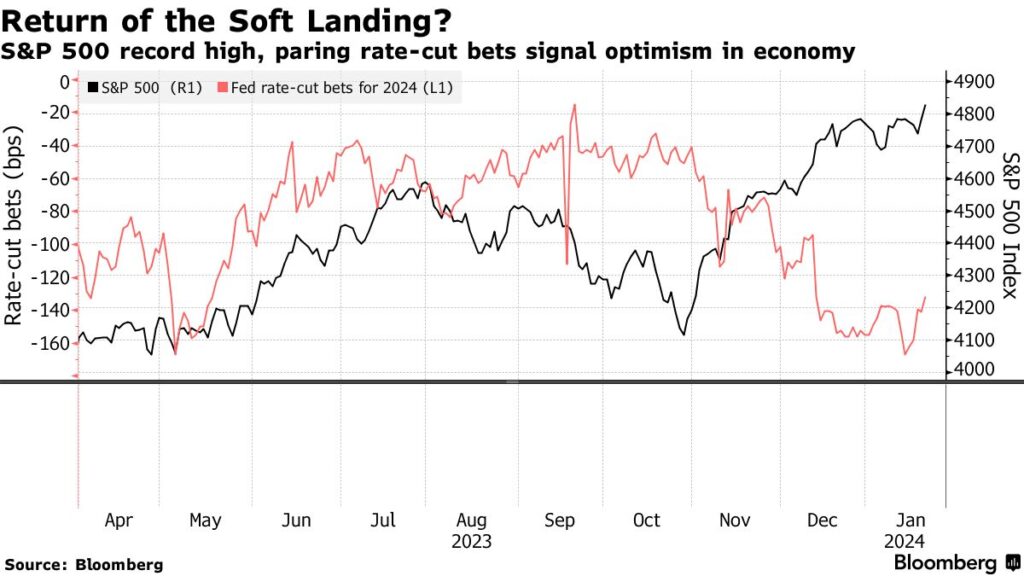

Traders have adjusted their expectations for rate cuts as US economic data continues to demonstrate resilience, and Fed officials emphasize the importance of taming inflation before considering cuts. Markets are currently pricing in approximately 1.4 percentage points of reductions this year, down from expectations of as much as 1.7 percentage points of easing just last week.

In corporate news:

- Apple Inc. pledged to open its tap-to-pay technology on iPhones to rivals to navigate potential EU antitrust fines.

- The proposed $1.4 billion acquisition of Roomba maker iRobot Corp. by Amazon.com Inc. faces potential rejection by the EU antitrust regulator.

- Ford Motor Co. reduced production of its F-150 Lightning electric truck due to waning demand for electric vehicles.

- J.B. Hunt Transport Services Inc. exceeded Wall Street expectations in hauling containers of freight in Q4, indicating potential recovery in the sector.

- JetBlue Airways Corp. and Spirit Airlines Inc. appealed a federal judge’s ruling blocking their planned $3.8 billion merger.

- Schlumberger (SLB) will increase its payout to shareholders by 10%, marking the highest dividend since 2020, buoyed by increased drilling outside North America.

- Ally Financial Inc. reported Q4 results beating estimates and announced the sale of a point-of-sale financing business to Synchrony Financial.

- Comerica Inc. projected an 11% decline in net interest income this year and reported a fourth-quarter profit plunge due to one-time charges.

WATCH: Ralph Schlosstein, Evercore chairman emeritus, talks about Fed policy.

Market Updates:

Stocks:

- S&P 500 increased by 1.2% as of 4 p.m. New York time.

- Nasdaq 100 saw a 2% rise.

- Dow Jones Industrial Average rose by 1.1%.

- MSCI World index experienced a 1.1% increase.

Currencies:

- Bloomberg Dollar Spot Index fell by 0.2%.

- Euro rose by 0.2% to $1.0895.

- British pound remained largely unchanged at $1.2701.

- Japanese yen showed minimal change at 148.14 per dollar.

Cryptocurrencies:

- Bitcoin rose by 1.4% to $41,638.5.

- Ether increased by 1% to $2,479.65.

Bonds:

- Yield on 10-year Treasuries remained relatively stable at 4.14%.

- Germany’s 10-year yield saw minimal change at 2.34%.

- Britain’s 10-year yield remained largely unchanged at 3.93%.

Commodities:

- West Texas Intermediate crude experienced a 0.4% decline, reaching $73.82 a barrel.

- Spot gold rose by 0.2% to $2,028.23 an ounce.