Apr 9, 2024,06:30am EDT

“Speed is of the essence,” remarks Justin Ishbia with a grin during a recent tour of Shore Capital Partners, his Chicago-based private equity firm, emphasizing his rapid pace. Sporting a blazer, jeans, and Nikes, the 46-year-old billionaire swiftly navigates through a packed agenda—attending the Bulls game courtside the previous night with his younger brother, Mat, the billionaire owner of the Phoenix Suns; a brief catered lunch with Forbes and his top lieutenants followed by a portfolio company board meeting; then off to Oregon on a private flight to catch the U of O’s football team clash with USC alongside his law school pals. Prompt in responding to texts and emails at all hours, he quips, “I don’t sleep very much.”

Shore Capital matches its founder’s pace. The microcap investment firm, focusing on healthcare, closed 801 deals between 2020 and 2023, cementing its status as one of the world’s busiest buyout firms. During this period, its assets under management surged sevenfold to $7 billion, enticing early investors like the University of Notre Dame and Sequoia Capital’s wealth management division to steadily increase their commitments. However, despite its 15th anniversary this year, Shore remains a minnow in the vast ocean of private equity, where giants like Apollo, Blackstone, and KKR manage over $500 billion each. This intentional choice, Ishbia explains, reflects their strategy. “We’ve turned away billions of dollars,” he states. “In private equity, success often means raising a larger fund. My belief was, ‘Who remains in microcap?’ The answer is essentially nobody.”

The decision to stay small has paid off significantly: Shore boasts an average internal rate of return of 53% on its 14 exits, all within the healthcare sector, surpassing the average net IRR of U.S. buyout funds raised since 2009. With Shore’s exits delivering profits that multiply investors’ money by 5.5 times on average, it stands as a testament to the firm’s exceptional performance in private equity—an achievement noted by an anonymous investor, who described the returns as “top 1% in private equity,” resembling more the realm of venture capital than traditional buyout firms.

Ishbia and his team have acquired over 1,000 small businesses nationwide since Shore’s inception in 2009, amalgamating them into 61 larger chains encompassing a diverse range of sectors, including autism treatment clinics, bakeries, and exterminators. “We’re acquiring businesses in Akron, Ohio, Pittsburgh, and Birmingham, Alabama,” Ishbia remarks. “There’s plenty of low-hanging fruit for us. It’s Main Street America.”

Shore injects capital into these businesses, enhances their operational capabilities, and seeks synergistic acquisitions in adjacent markets. Emphasizing growth over cost-cutting, Ishbia asserts, “We’re about growth—we employ nearly 35,000 individuals and hire thousands annually.”

Despite his accomplishments, Ishbia remains overshadowed by his younger, wealthier brother, Mat, CEO of the nation’s largest home lender, United Wholesale Mortgage (UWM). Yet, Shore’s portfolio companies employ five times as many people and have arguably made a comparable impact on the U.S. economy by bolstering small businesses nationwide. Dismissing criticisms that private equity diminishes competition and quality while inflating prices, Ishbia contends, “It’s not as though there’s only one PE-owned company in veterinary or dental or urgent care.”

Ishbia’s introduction to private equity occurred during his teenage years through his best friend’s father, igniting his interest in the field. After completing his studies at Michigan State and Vanderbilt Law School, Ishbia gained experience at a Chicago law firm and a private equity firm. Despite his father’s urging to join UWM’s predecessor in 2009, Ishbia opted to pursue his entrepreneurial aspirations, co-founding Shore with his friends Ryan Kelley, John Hennegan, and Mike Cooper at age 31.

Launching Shore amid a recession may have seemed daunting, but Ishbia trusted his mentor’s advice that challenging times present investment opportunities. To establish a track record, he secured $10 million for his first deal from family and acquaintances, gradually proving Shore’s ability to add value and generate profits. By 2014, the firm expanded, raising $113 million for its inaugural institutional fund.

One individual whose trajectory intersected with Ishbia’s is veterinarian Jay Price, who, initially skeptical about private equity, eventually sold a majority stake in his clinics to Shore. Today, Southern Veterinary Partners, a Shore acquisition, competes with industry giants, boasting over 400 locations and $1.3 billion in annual revenue under Price’s leadership.

Similarly, BrightView, a chain of addiction treatment centers, flourished following Shore’s investment, now operating over 80 locations with annual revenue exceeding $200 million. CEO Chad Smith attributes their success to Shore’s upfront investment in improving operations and its commitment to growth.

Shore’s systematic approach to acquisitions and scaling has earned praise from Harvard Business School professor Boris Groysberg, who likens the firm to “special forces,” executing precise strategies to achieve results efficiently.

Despite concerns about an impending private equity downturn, Ishbia remains optimistic, asserting Shore’s resilience due to its focus on recession-resistant industries and conservative debt usage.

Beyond Shore, Ishbia’s familial background instilled in him a deep understanding of entrepreneurship, inspired by his father’s diverse ventures spanning various industries. Jeff Ishbia, Justin and Mat’s father, founded UWM’s predecessor in 1986, carving a path that would ultimately influence his sons’ entrepreneurial journeys.

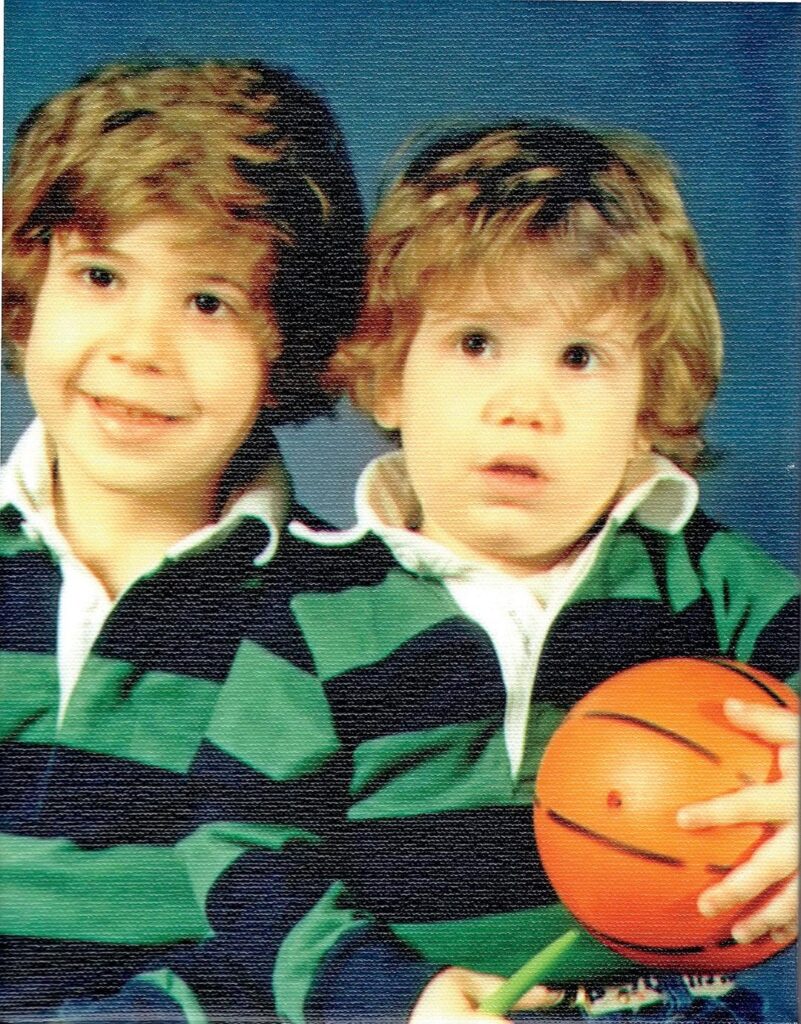

Justin Ishbia (left) at age 4, with his younger brother, Mat, in their preschool class photo in Southfield, Michigan. “We’d pretend to be stars and pretend to be the guy taking the shot at the buzzer,” Justin says.COURTESY JUSTIN ISHBIA

The family was close-knit, and the brothers shared a deep bond as best friends, yet their relationship was tinged with a healthy dose of competitiveness. When they weren’t engaging in one-on-one basketball matches, channeling NBA legends like Magic Johnson and Isiah Thomas (the latter now a UWM director), they were embroiled in spirited debates over the Sega Genesis. “If I was winning with just seconds left, Mat would slyly turn off the console to avoid the game being counted towards the standings,” Ishbia recalls with a chuckle. “We were both guilty of that.”

Inspired by Detroit’s sports prowess, with teams like the Pistons, Tigers, and Red Wings clinching five championships combined during the ’80s and ’90s, the brothers took their athletic pursuits seriously, supporting and challenging each other in their respective sports. Justin favored baseball, while Mat excelled on the basketball court. “We’d constantly push each other to strive for excellence,” Mat reminisces. “Our shared extreme competitiveness has undoubtedly shaped our work ethic.”

While Justin’s athletic aspirations culminated upon entering Michigan State, Mat, trailing his elder brother to East Lansing, secured a spot on the university’s basketball team, albeit as a popular benchwarmer. Despite rooming together, Mat’s newfound campus fame skyrocketed after the team clinched the NCAA championship in 2000, his freshman year. “Justin used to joke that during his initial years on campus, he was known as Justin Ishbia,” shares Shore co-founder Hennegan. “But after that, he became ‘Mat’s brother.’ I think that’s stuck with him.”

Kelley adds with a grin, “Seeing his little brother’s net worth nearly triple his own must provide some extra motivation for Justin.” (The actual difference is closer to double.)

Justin Ishbia (right) and his younger brother Mat: The two, who own the Phoenix Suns together, are very close — and extremely competitive.MICHAEL REAVES/GETTY IMAGES

The ongoing sibling rivalry shows no signs of abating. Presently, both brothers are engaged in constructing extravagant trophy homes. In Winnetka, Illinois, Justin is overseeing the development of a megamansion expected to command a price tag nearing $80 million, setting a local record, complete with indoor and outdoor pools. Describing the construction, future neighbor Kelley remarks, “It’s like a bomb went off on Lake Michigan.” Not to be outdone, Mat’s residence in Bloomfield Township, Michigan, will feature amenities such as a trampoline park, an enchanted forest, and a lazy river.

Despite the competitive spirit, Justin expresses unwavering pride in his younger brother. Adorned with family photos and sports memorabilia, Justin’s office across the Chicago River from Trump Tower showcases his admiration. Among the mementos are a Phoenix Suns jersey, a photo capturing Mat and Jeff ringing the NYSE’s opening bell during UWM’s public debut in 2021, and a poster commemorating Mat’s Michigan State national championship team.

Yet, perhaps the most significant trophy of all resides just outside Justin’s office—the “Shore Cup.” Resembling the NHL’s Stanley Cup and crafted by the same manufacturer, this colossal silver goblet bears the engraved names of all of Shore’s portfolio companies. In the early days, Ishbia and his team would proudly parade the cup around town. “They’d fill it up with champagne,” recalls Shore chairman Jim Forrest, “and embark on a bar-hopping extravaganza, toasting from one establishment to another.”