Feb 19, 2024,06:30am EST

For nearly 20 months leading up to January 2024, investors seeking exposure to U.S. exchange-traded bitcoin funds were constrained to engage in the futures market. The Securities and Exchange Commission (SEC) rejected over 30 applications for funds that sought to purchase the leading cryptocurrency directly and divide their holdings into easily tradable shares on major stock exchanges. The SEC cited concerns about the susceptibility of the digital-assets market to manipulation.

Under a rationale eventually deemed “arbitrary and capricious,” the SEC approved futures-based bitcoin funds since the prices were verified under the rules of regulated commodity exchanges, despite being based on the spot-market for bitcoin itself. Consequently, starting with the ProShares Bitcoin Strategy ETF (BITO) in October 2021, 13 futures-based bitcoin ETFs were introduced. ProShares, headquartered in Bethesda, MD, led the charge and raised over $1 billion on its debut day, marking the most successful ETF launch to date. Since then, it has amassed approximately $2.5 billion in assets as of January 10, the day the SEC authorized 10 spot ETFs to commence trading.

The emergence of spot bitcoin ETFs, which have accumulated $34 billion in assets (including over $28 billion converted from the closed-end fund GBTC), has cast uncertainty over the future of futures-based crypto funds. Kyle DaCruz, VanEck’s director of digital-assets products, believes that investor appetite will shift from products offering bitcoin futures exposure to direct bitcoin exposure, as spot products are expected to more closely track the price of bitcoin.

VanEck has swiftly responded to this shift by shuttering its $43 million Bitcoin Strategy Fund (XBTF) futures ETF last month in favor of a new spot offering, the VanEck Bitcoin Trust (HODL), which currently holds $176 million.

In contrast, ProShares is steadfast in its approach, opting to double down on its strategy. It has no intentions to retire its Bitcoin Strategy ETF (BITO), which boasts $2 billion in assets, or convert it into a spot offering. Instead, it has recently filed to introduce a suite of complementary futures-based ETFs that add leverage to the funds’ indirect bitcoin investments. ProShares’ BITO carries an expense ratio equivalent to 0.95% of the fund assets, roughly triple the level of the new spot offerings.

BITCOIN FUTURES ETFs Data as of February 14, 2024

| Inception date | Trust firm | ETF ticker | NAV 1/31 | Expense ratio | AUM, $m | AUM chg since 1/10 | Daily volume $m |

|---|---|---|---|---|---|---|---|

| 10/19/21 | ProShares | BITO | $24.56 | 0.95% | $2,092 | -8% | $398 |

| 10/21/21 | Valkyrie | BTF | $16.44 | 1.20% | $39 | 9% | $0.9 |

| 10/25/21 | VanEck | XBTF | $- | 0.66% | $43 | -26% | $- |

| 11/15/21 | Global X | BITS | $62.45 | 0.65% | $21 | -21% | $0.2 |

| 6/21/22 | ProShares | BITI | $10.42 | 1.33% | $66 | 21% | $26 |

| 9/15/22 | Hashdex | DEFI | $62.00 | 0.90% | $21 | 659% | $0.2 |

| 9/29/22 | Simplify | MAXI | $23.31 | 0.85% | $12 | -64% | $0.5 |

| 10/2/23 | ProShares | EETH | $65.57 | 0.95% | $29 | 30% | $3.0 |

| 10/2/23 | ProShares | BETH | $70.61 | 1.33% | $5 | 48% | $0.1 |

| 10/2/23 | ProShares | BETE | $68.06 | 1.33% | $3 | 33% | $0.1 |

| 11/14/23 | Ark 21Shares | ARKA | $51.29 | 0.70% | $12 | 56% | $0.2 |

| 11/15/203 | Ark 21Shares | ARKC | $33.31 | 0.93% | $2 | 280% | $0.0 |

| 11/15/203 | Ark 21Shares | ARKY | $34.38 | 1.00% | $3 | 44% | $0.1 |

| Total | $2,346 | $429 |

| Inception date | Trust firm | ETF ticker | NAV 1/31 | Expense ratio | AUM, $m | AUM chg since 1/10 | Daily volume $m |

|---|---|---|---|---|---|---|---|

| 10/19/21 | ProShares | BITO | $24.56 | 0.95% | $2,092 | -8% | $398 |

| 10/21/21 | Valkyrie | BTF | $16.44 | 1.20% | $39 | 9% | $0.9 |

| 10/25/21 | VanEck | XBTF | $- | 0.66% | $43 | -26% | $- |

| 11/15/21 | Global X | BITS | $62.45 | 0.65% | $21 | -21% | $0.2 |

| 6/21/22 | ProShares | BITI | $10.42 | 1.33% | $66 | 21% | $26 |

| 9/15/22 | Hashdex | DEFI | $62.00 | 0.90% | $21 | 659% | $0.2 |

| 9/29/22 | Simplify | MAXI | $23.31 | 0.85% | $12 | -64% | $0.5 |

| 10/2/23 | ProShares | EETH | $65.57 | 0.95% | $29 | 30% | $3.0 |

| 10/2/23 | ProShares | BETH | $70.61 | 1.33% | $5 | 48% | $0.1 |

| 10/2/23 | ProShares | BETE | $68.06 | 1.33% | $3 | 33% | $0.1 |

| 11/14/23 | Ark 21Shares | ARKA | $51.29 | 0.70% | $12 | 56% | $0.2 |

| 11/15/203 | Ark 21Shares | ARKC | $33.31 | 0.93% | $2 | 280% | $0.0 |

| 11/15/203 | Ark 21Shares | ARKY | $34.38 | 1.00% | $3 | 44% | $0.1 |

| Total | $2,346 | $429 |

Background

BITO and similar ETFs purchase cash-settled futures contracts at regulated exchanges like the Chicago Mercantile Exchange (CME) and package them as shares that freely trade on the stock market. These products differ from the new spot ETFs, whose issuers procure physical bitcoin and then offer shares that represent fractional interests in the portfolios of bitcoins. Futures ETFs can be more complicated and expensive because issuers need to keep purchasing new contracts at each expiry (usually at the end of a month), and hidden rollover costs can eat into profits if the bitcoin price starts to climb.

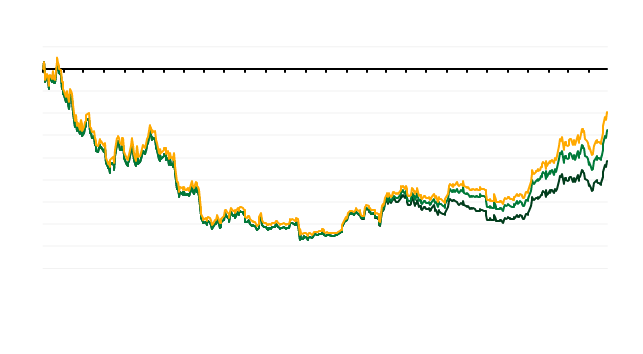

As the chart below demonstrates, BITO has trailed its benchmark, the Bloomberg Galaxy Bitcoin Index, since inception by eight percentage points through January 30. Note that there is a difference between the cumulative and spot price returns because the cumulative return includes additional factors such as dividend payments and interest on the fund’s cash. Pure spot ETFs do not yet pay dividends.

BITO PERFORMANCE Performance since inception relative to its BTC Index benchmark

Given these extra mechanics and added costs, it may surprise some observers that the SEC approved futures products first. However, Chairman Gary Gensler (who used to oversee the Commodity Futures Trading Commission, regulator of the futures market) felt more comfortable with ETFs that track products traded on a regulated exchange rather than the largely unregulated world of cryptocurrency trading.

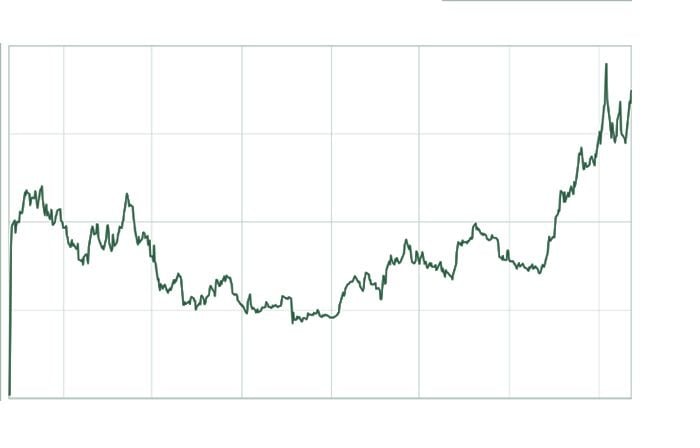

Thanks to its strong launch ProShares’ BITO has a 90% market share among bitcoin futures funds. BITO’s assets under management decreased by $126 million between January 10 and February 16, but its total is still up by $1.3 billion from mid-October 2023, when institutional investors started buying into the ETF as a bullish bet on bitcoin in anticipation of the SEC approving the long-awaited spot ETFs.

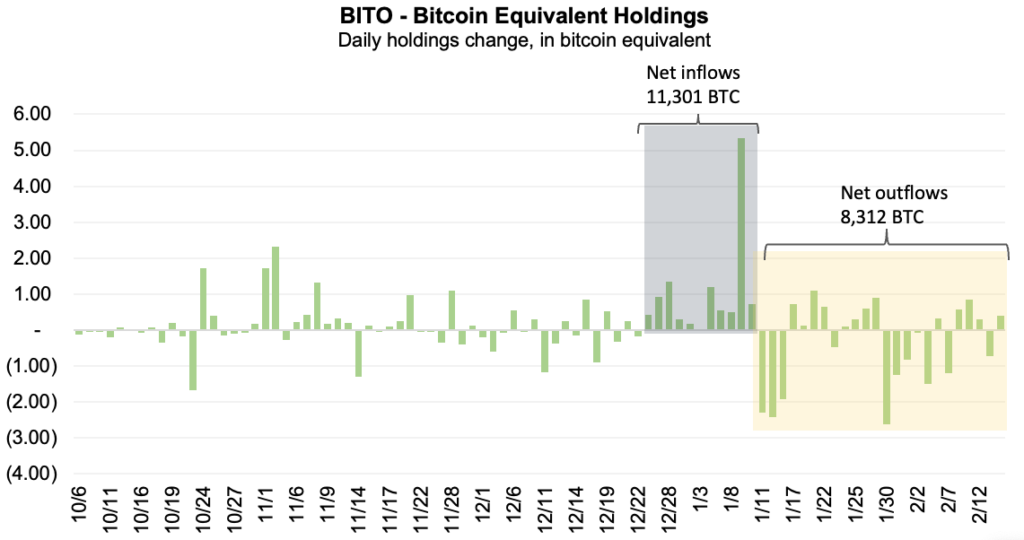

It is difficult to determine the precise reasons for the significant BITO outflows since January 11, and a good portion may be due to profit-taking by short-term buyers. Some $93 million can be attributed to Cathie Wood’s Ark Invest moving holdings from BITO into her firm’s spot ETF, Ark 21Shares Bitcoin ETF.

BITO ETF ASSETS UNDER MANAGEMENT AUM since October 2021

KEY STATS BITO - Bitcoin Equivalent Holdings Daily holdings change, in bitcoin equivalent

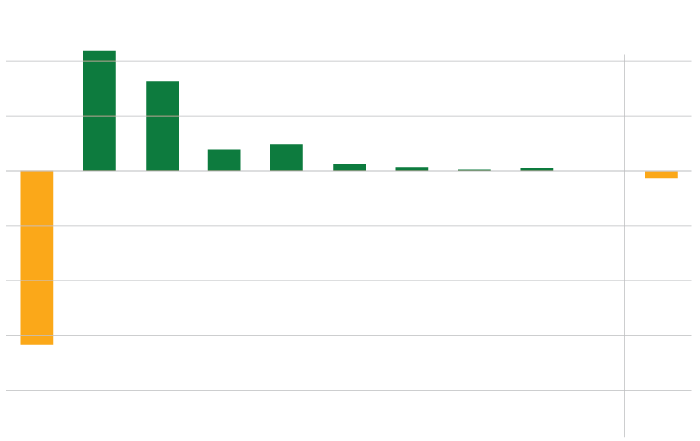

BITCOIN OR EQUIVALENT ADDED Bitcoin or bitcoin equivalent acquired (lost) from Jan. 11, 2024 to February 14, 2024

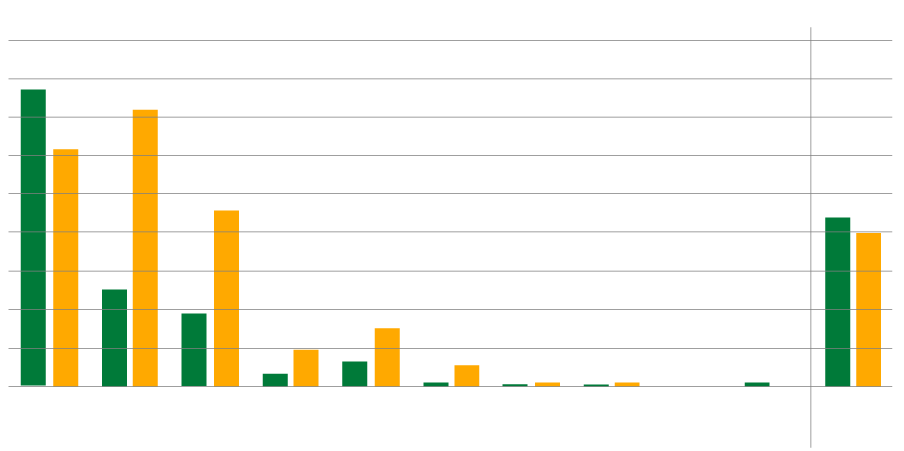

TRADING VOLUME COMPARISON Daily volume in $ millions, average from 1/11 and volume on 2/14

Outlook And Implications

ProShares’ BITO enjoys a robust revenue stream driven by its 0.95% expense ratio on assets totaling approximately $2 billion, yielding around $19 million annually. Should ProShares transition to a spot ETF, it would likely need to slash the expense ratio by two-thirds, although its costs would correspondingly decrease, aligning with competitors. BITO represents just one of over 40 exchange-traded products offered by ProShares, with a total AUM of $64 billion. The company seems to be following a similar trajectory as Bitcoin Trust (GBTC), which maintained a 2% expense ratio as a closed-end fund and only reduced it to 1.5% upon transitioning to an ETF format. This contrasts with the expense ratios of around 0.26% for most new spot ETF competitors. ProShares’ rationale echoes sentiments expressed by Grayscale CEO Michael Sonnenshein, who defends GBTC’s higher costs by emphasizing experience, operational efficiency, liquidity, and tight bid-ask spreads.

ProShares CEO Michael Sapir asserts, “We believe the continued success of BITO is due to many investors wanting to gain bitcoin exposure through a fund that invests in an orderly, efficient, and highly regulated marketplace and custodies with one of the world’s largest banks [JPMorgan].”

BITO’s elevated expense ratio compared to its spot ETF counterparts may not necessarily trigger a mass exodus. Inertia has historically wielded considerable influence in investment management, with approximately “75% to 80% of AUM in exchange-traded funds over 15 years old,” notes hanETF founder Hector McNeil. These funds are deeply entrenched in financial platforms and systems, consistently attracting capital.

Tax considerations, particularly regarding capital gains taxes, may also deter BITO holders with substantial paper profits from redeeming their investments.

However, when considering new allocations, investors may question the rationale for opting into futures ETFs over spot bitcoin funds. This is a nuanced discussion. Futures-based commodity ETFs may be more suitable for certain assets than others. For instance, crude oil, due to its storage challenges, incurs costs associated with warehousing physical products. Conversely, spot gold ETFs face fewer hurdles, given gold’s high value, compact nature, and the existence of a liquid spot market. Given bitcoin’s portrayal as digital gold and its ease of storage, the comparison with gold is pertinent.

A futures-based fund might outperform bitcoin in a declining cryptocurrency market. While BITO may struggle to track spot prices during periods of contango, when futures prices for long-term contracts are highest, it may fare better during bearish periods characterized by increasingly cheaper rollover costs, known as backwardation. “A futures ETF is a more sophisticated product, so it’s going to be less appropriate for the majority of people,” explains Ophelia Snyder, co-founder and president of 21.co. “It’s a tactical strategic product, not a buy-and-hold product.”

What Is Ahead For ProShares

Although ProShares Bitcoin Strategy ETF remains the firm’s primary cryptocurrency fund, the asset manager has recently submitted filings to introduce five additional ETFs that would operate with swap agreements, representing a unique form of bitcoin exposure. These proposed funds would utilize North American spot ETFs instead of direct cryptocurrency holdings, aiming to offer leveraged daily returns linked to the Bloomberg Galaxy Bitcoin Index:

Investment objective of proposed ProShares ETF

ProShares Ultra Bitcoin ETF

2.0 times the index.

ProShares Plus Bitcoin ETF

1.5 times the index.

ProShares Short Bitcoin ETF

1.0 times the inverse of the index.

ProShares ShortPlus Bitcoin ETF

1.5 times the inverse of the index.

ProShares UltraShort Bitcoin ETF

2.0 times the inverse of the index.

SOURCE: U.S. SEC, PROSHARES FILINGS

ProShares is aiming to attract traders in search of financial leverage, setting its offerings apart from spot ETFs that do not utilize leverage for amplifying returns. While these higher-risk funds are awaiting approval to commence trading, it is likely they will receive approval, considering the SEC’s prior authorization of other products providing multi-directional bets and leverage on bitcoin prices.

ProShares’ second-largest crypto futures ETF, ProShares Short Bitcoin Strategy ETF (BITI) with $58 million in assets, also seeks a 1.0 times inverse return on bitcoin’s price but distinguishes itself by primarily selling bitcoin futures contracts to achieve its investment objective.

Despite the associated higher costs, ProShares BITO’s dominant position among bitcoin futures ETFs positions it strongly among sophisticated crypto traders. ProShares is working on establishing a suite of leveraged products designed to appeal to institutional investors seeking to amplify gains or hedge against risk. ProShares faces competition from similar products offered by other issuers such as Hashdex, GlobalX, and Ark21 Shares, assuming their continued operation.