The S&P 500 has surged to record levels, marking its first ascent to such heights in two years. However, among the index’s 11 sectors, only information technology shares this achievement.

Featuring prominent names like Microsoft, Apple, and Nvidia, the technology sector is capitalizing on the fervor surrounding artificial intelligence, propelling the broader market to record highs in five out of the last six trading sessions. While the S&P 500 has seen a 2.5% increase since the beginning of 2024, the technology segment has soared by 5.9%.

In contrast, the remaining 10 sectors are trading on average approximately 15% below their all-time peaks, with none reaching new records in January. The equal-weighted S&P 500, which assigns equal importance to both the smallest and largest companies in the index, has experienced a 0.3% decline this year.

Comparatively, the market’s rally was far broader two years ago. During the two weeks leading up to the S&P 500’s record in January 2022, seven other sectors—industrials, financials, consumer staples, real estate, healthcare, utilities, and materials—joined technology in reaching new highs.

For some investors and strategists, a narrow rally raises concerns. They argue that when a select few large stocks drive most of the market’s gains, it becomes more susceptible to downturns if any of those major players stumble.

As an illustration, an analysis from Bespoke Investment Group suggests that if six of the largest technology stocks were to retreat to their 200-day moving averages—a widely monitored technical indicator used to assess longer-term price trends—it could potentially shave about 5% off the S&P 500.

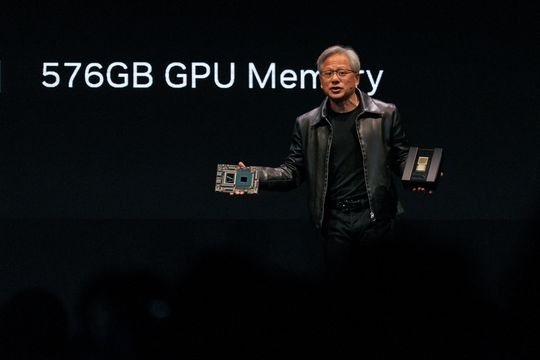

Nvidia President and CEO Jensen Huang PHOTO: WALID BERRAZEG/ZUMA PRE

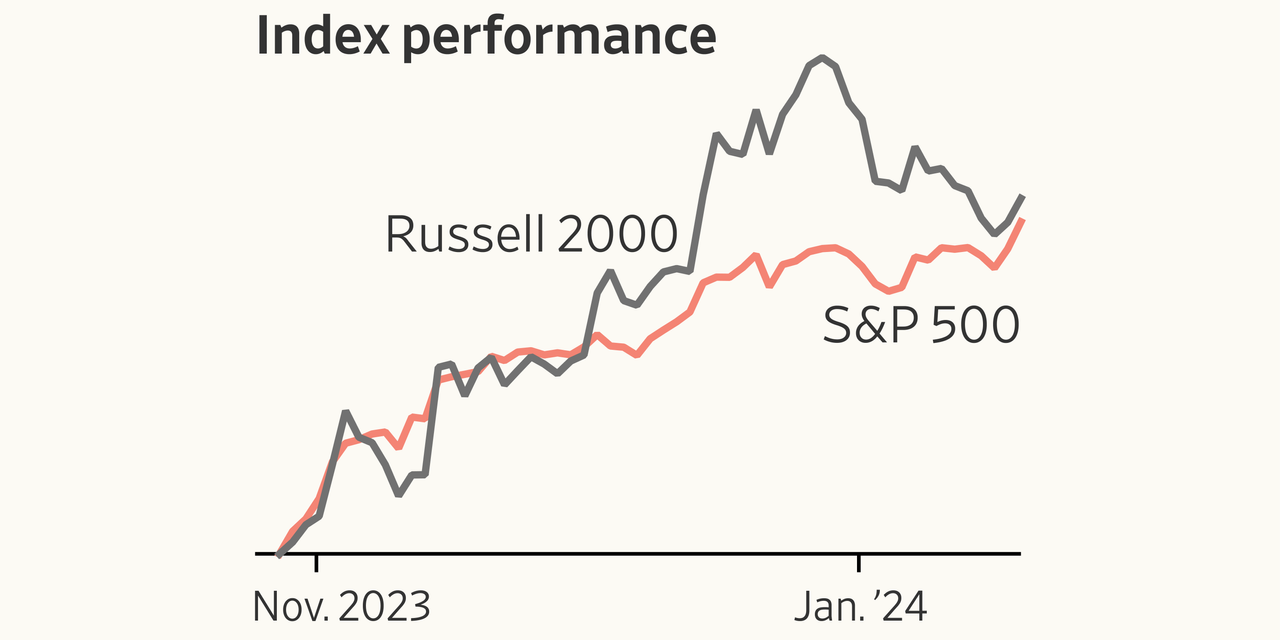

Throughout most of last year, Big Tech held sway over the market. In the final weeks of 2023, investors found solace in the belief that the Federal Reserve would soon slash interest rates, prompting an “everything rally” that elevated the prices of assets ranging from small-cap stocks to gold and bonds.

Anticipating a continuation of this trend into 2024, some of the enthusiasm from the market’s shift seems to be waning. The resurgence of economic data exceeding expectations has driven the yield on the benchmark 10-year Treasury note back above 4%. Consequently, investors have recalibrated their expectations for the timing of the initial rate cut, potentially complicating the extension of the stock market’s ascent.

All eyes are now on the Federal Reserve’s policy meeting scheduled for Wednesday, as investors seek clues regarding the timing and magnitude of potential interest rate cuts. Additionally, Friday’s monthly jobs report will offer fresh insights into the labor market’s strength. Furthermore, earnings reports from tech giants such as Microsoft, Meta Platforms, and Amazon.com may shed light on whether the market’s recent gains are sustainable.

David Rosenberg, President at Rosenberg Research & Associates, remarked, “The notion of a recession has been completely obliterated from the mind and the positioning of most portfolio managers. There is tremendous confidence in the soft landing—perhaps confidence that is now bordering on complacency.”

While Big Tech stocks aren’t the sole entities reaching new highs in early 2024, others such as Berkshire Hathaway, Visa, McDonald’s, and Marriott International have joined the ranks of Microsoft, Meta, Google parent Alphabet, and Nvidia.

However, smaller companies have largely missed out on the rally. The small-cap focused Russell 2000 index is approximately 20% below its November 2021 peak.

Caitlin Frederick, Director of Financial Planning and Wealth Adviser at Ullmann Wealth Partners, advocates for small-cap value stocks, suggesting they possess greater growth potential compared to larger growth stocks.

Technical indicators of market breadth are also raising concerns. The NYSE advance-decline line, a popular cumulative indicator, has not reached a new all-time high for 556 trading days, marking the longest such stretch since a 647-day period that concluded in 2009, according to Dow Jones Market Data.

Yet historical data indicate that gains often beget more gains. According to ClearBridge Investments, in the previous 14 instances when the S&P 500 set a new all-time high after more than a year, the rally persisted over the following year more than 90% of the time, with an average return of 13.9%.

Ken Mahoney, CEO of Mahoney Asset Management, revealed that he has increased his exposure to large-cap growth recently, emphasizing that market advancement with concentrated leadership is acceptable. He remarked, “No one said you had to buy the unweighted S&P 500. That hasn’t really done much of anything.”