Fintech Startup Secures $10M to Integrate AI for Streamlined Small Business Accounting

In a significant move, a fintech startup dedicated to automating accounting and finance tasks for businesses has raised an additional $10 million in venture capital funding.

Initially covered by TechCrunch in 2022 when it secured $95 million in equity and debt financing, the company, founded in 2018 by Felix Rodriguez, his wife Glennys Rodriguez, and Edwin Mejia, has since evolved its focus. Now headquartered in Miami, the startup has shifted its attention towards consolidating various business processes, including bookkeeping, expense management, bill payment, and payroll, into a single automated solution tailored for small businesses, according to Felix Rodriguez.

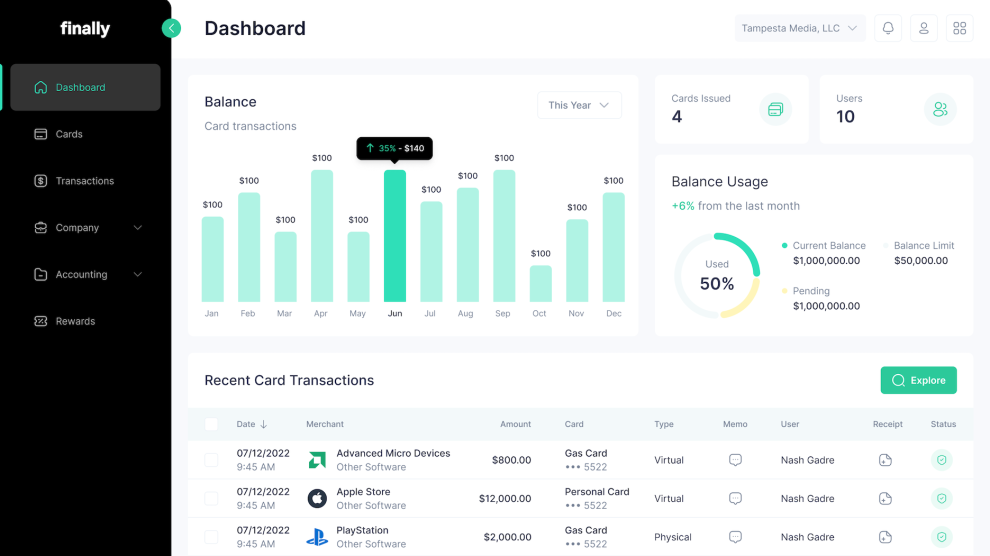

Recent advancements include the introduction of an AI-powered ledger, enhanced business banking capabilities, and the development of a new iteration of its bookkeeping application. Moreover, the company offers a corporate card to assist small businesses in managing their cash flow while providing valuable insights into their financial performance.

The response from small businesses has been noteworthy, with Rodriguez noting a substantial increase in customer acquisition, from just over 1,000 customers to over 1,000 new businesses per month. Although specifics regarding Finally’s valuation and revenue growth remain undisclosed, the company’s trajectory is evidently promising.

With the latest funding round led by PeakSpan Capital and featuring participation from Active Capital, Finally plans to allocate the capital towards bolstering its workforce, expanding its go-to-market strategies, and enhancing its technological infrastructure. This includes the development of mobile versions for its bookkeeping, expense management, and business banking applications.

Jack Freeman, Partner at PeakSpan Capital, expressed enthusiasm about Finally’s evolution into a comprehensive fintech platform supporting small businesses. He emphasized the potential of the company’s expanded product portfolio and anticipated further growth and innovation in the coming year.