In 2018, twenty-four women assembled in a California living room for a financial discussion.

Britt Williams Baker, a Harvard Business School graduate and former consultant, had been providing instructional sessions on investing to friends. Recognizing the need for basics in budgeting, she was joined by her best friend, Laurie-Anne King, a women’s empowerment coach who had successfully paid off $40,000 of debt.

The circle was named Dow Janes by Baker.

Over the years, Dow Janes evolved from a small group of friends helping each other to a business offering paid online courses. Baker and King now teach women in the United States and Canada how to seize control of their finances, driven by a bold mission.

“More money,” said King, “in the hands of more women.”

By various metrics, this vision is becoming a reality. The economic influence of women gained prominence in 2023 with the success of the “Barbie” movie, Taylor Swift’s Eras Tour, and Beyoncé’s Renaissance Tour, all led by women and breaking records. This phenomenon, described by UBS as the “Summer of Women,” indicates a substantial and lasting shift in the United States. Women are acquiring more economic power, initiating more businesses than men, earning as much as or more than their husbands in 45 percent of heterosexual marriages, and possessing more homes in solo households. A 2020 study by McKinsey projects that by the end of the decade, women will likely control a significant portion of the anticipated $30 trillion in wealth owned by baby boomers. To emphasize the magnitude of this figure, researchers compare it to the annual U.S. gross domestic product.

However, there is significant ground to cover in a society that frequently underestimates women as an economic force. Gender norms and industry demographics persist in fostering a perception among girls and women that finance is not suited for them, both in their domestic lives and professional careers.

Addressing this issue requires more than superficial changes, experts assert—it demands systemic transformation beyond merely incorporating pink hues into promotional materials.

The anticipated monumental shift by 2030 will not only transform the lives of women but also potentially have profound implications for the entire nation due to variations in how women wield their economic influence. According to Sallie Krawcheck, CEO of the women’s investment platform Ellevest and a former Wall Street executive, the scenario where women control the majority of wealth could be a catalyst for global change.

“When women have the majority of the money and when they step into their power — I don’t want to say be empowered — but when they recognize the power that money gives them, everything changes,” she emphasized.

Carter Guthrie, 23, has a tattoo that reads, “In woman we trust.” (Paola Chapdelaine for The Washington Post)

Demographic Transformations

The significant influx of trillions of dollars into the hands of women is primarily propelled by shifting demographics. Currently, women command approximately one-third, equivalent to $10 trillion, of the total U.S. household assets, as reported by McKinsey. In affluent households, defined by possessing $100,000 to $10 million in personal investable assets, men still predominantly serve as the financial decision-makers in two-thirds of cases. However, with the passing of male baby boomers, their assets will be bequeathed to their wives, who are typically younger and have more years ahead of them—an average of six years, according to recent research published in JAMA Internal Medicine.

Simultaneously, younger affluent women are assuming greater control over their finances. The workforce now sees a record number of women, and the labor force participation rate for those aged 25 to 54 reached an all-time high during the summer, standing at 77.8 percent, according to the Bureau of Labor Statistics. McKinsey’s research also reveals that, among married women, 30 percent more were making financial and investment decisions by 2020 compared to five years prior.

For Laurie-Anne King, a 35-year-old resident of Washington state, money posed a significant stressor early in her marriage. While her husband came from a background of three generations of financial planners, King lacked financial literacy, initially viewing carrying a credit card balance monthly as inconsequential. Realizing the potential strain on her marriage, King decided to educate herself about personal finance. After a crash course involving an app called You Need a Budget, extensive reading on money management, and collaborative budgeting sessions with her husband, she successfully paid off substantial credit card and student loan debt.

Empowered by her journey, King extended her knowledge to other women, starting with informal sessions in Britt Williams Baker’s living room and later formalized through Dow Janes. Since its launch in 2020, over 20,000 women have enrolled in Dow Janes’ flagship program, Million Dollar Year, according to the company.

King emphasized the evident hunger for financial education among women and the existence of an underserved market segment where trust is crucial, and women prefer not to be condescended to by financial experts.

Britt Williams Baker, left, and Laurie-Anne King, co-founders of Dow Janes, in 2022. (Elaine Drabik/Dow Janes)

This is a genuine concern. Women have expressed extensive and enduring grievances against the financial services industry, feeling marginalized, patronized, and their priorities misunderstood. A 2009 study by Boston Consulting Group, published in Harvard Business Review, straightforwardly declared the financial services sector as the “industry least sympathetic to women.”

More than a decade later, this issue persists. In a particularly revealing statistic, a study by BNY Mellon revealed that 86 percent of asset managers acknowledged that their default customer, the individual automatically targeted with their products, is a man.

Women still experience exclusion from financial conversations and perceive a lack of attention from financial advisers. A prevailing belief among financial advisers over the past decade is that 70 percent of widows switch to a new financial institution after their spouse’s death. The frustration is even more pronounced among Black and Latina women, who are three times as likely as White women to express that financial services do not align with their needs, according to research by J.P. Morgan.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lacy Garcia, founder and CEO of Willow. (Sophie Park for The Washington Post)

Garcia leads a training session at a client’s office in Boston. (Sophie Park for The Washington Post)

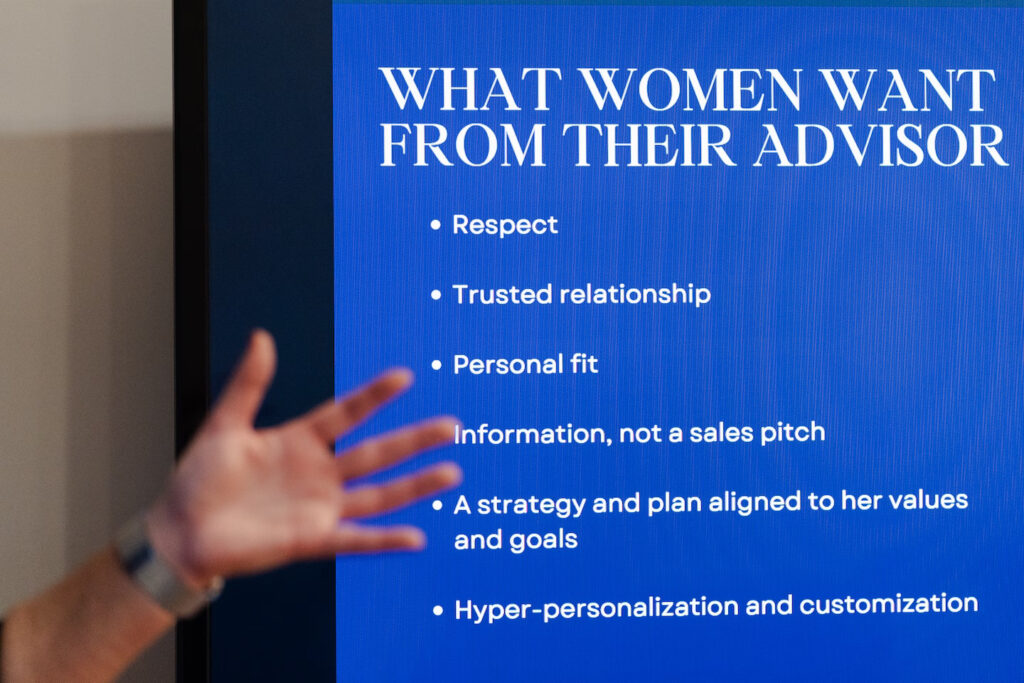

“It’s a sense of lacking respect,” stated Lacy Garcia, CEO of Willow, a Boston-based company dedicated to training financial professionals to better serve female clients. “In many meetings, the person giving advice is solely focused on the man — neglecting to engage the woman in the conversation. And often, she’s the one holding the purse strings. I hear that consistently: ‘They’re not even acknowledging me.'”

To improve service for what Garcia terms the “New Majority,” her company advocates for advisers to establish connections with the wives and daughters of their male clients, ensuring their active participation in discussions.

Advisers can’t simply repurpose offerings tailored for male investors when dealing with females. Instead, they must grasp the unique financial challenges that women commonly face, encompassing earning less, living longer, and taking more career breaks.

Some of the advice is straightforward: Use “women” instead of “females.” Maintain eye contact. Avoid presuming what she desires — inquire. For advisers completing a training program, Willow bestows a credential: “Certified Advisor for Women.” “We’re striving to instigate systemic change from within,” Garcia emphasized.

Women walk in the Financial District in New York. Ninety-eight percent of U.S. dollars invested in mutual funds are managed by men. (Paola Chapdelaine for The Washington Post)

Fostering Confidence

A significant aspect of the hurdle for women stems from the persistent male dominance in the finance sector. The majority of financial planners are White and male, with over 45 percent being over 50 years old. Men manage 98 percent of the money invested in mutual funds in the country.

Women who have shattered the glass ceiling share tales of being the sole woman in a room filled with suits, facing job rejections due to pregnancies, and being held to different standards. Stacy Francis, the president and CEO of Francis Financial, recounts her experiences starting her career in the ’90s as an investment banker, where she was the lone woman in the investment banking division.

Initially pursuing a major in French, Francis envisioned a career translating documents and humorously remarked, “eating lots of baguettes with Nutella.” Her trajectory changed when a conversation with her grandmother Myra at 18 shed light on the crucial role of financial security for women.

“That’s what pivoted my entire life,” reflected Francis.

Stacy Francis with her grandmother Myra. (Stacy Francis)

Her company caters to women navigating life changes and produces the Financially Ever After podcast, which delves into topics such as divorce and widowhood. Additionally, she oversees a nonprofit called Savvy Ladies, offering free financial guidance to women through services like a helpline staffed by certified financial planners.

Francis has identified a common theme in both her firm and nonprofit: “Across the board, the vast majority of people who come to us really lack financial confidence. And the other piece they come with is shame,” she noted. “And it’s the shame of not knowing more.”

Research supports this observation. According to BNY Mellon, only 28 percent of women globally feel confident about investing some of their money. McKinsey’s findings indicate that merely a quarter of affluent women express comfort in making investment and savings decisions independently, a notable contrast to the 40 percent reported by men.

Karen Dressel chose to educate herself about money and enrolled in a program last year to help women become more financially literate. (Matt Roth for The Washington Post)

Karen Dressel, a 47-year-old vice president at a Pennsylvania transportation company, described her longstanding financial approach as resembling an “ostrich in the sand.” She received emails about her 401(k) but chose not to open them, questioning the effort when lacking understanding, and simply hoped the money would be available when needed. Despite considering herself smart and educated, she felt lost when attempting to comprehend finances, fearing the appearance of ignorance.

However, last year, Dressel enrolled in a workplace session titled “Make Your Money Work for You.” Subsequently, she started maximizing her 401(k) match, opened a new savings account, and consulted with a Willow-certified financial life coach. Together, they devised a plan to allocate funds for a three-month emergency fund, with a trip to Mexico as a reward upon achieving the goal. “For the first time,” she expressed, “I felt like I was in control of my money, and my money wasn’t in control of me.”

Sallie Krawcheck, CEO of Ellevest. (Paola Chapdelaine for The Washington Post)

Even within circles of friends, finances are often considered a sensitive and avoided topic for women, described by King of Dow Janes as “the last taboo.” Additionally, while financial media tailored for men is generally positive and encouraging, media targeting women tends to adopt a scarcity mindset, according to Krawcheck.

From childhood, women have received messages suggesting that finance isn’t their domain, Krawcheck noted. However, women have proven to be formidable money managers, with multiple studies indicating that female investors achieve better returns than their male counterparts. Krawcheck attributes this to women’s ability to remain composed and maintain a longer-term perspective, resisting the impulse to trade hastily during market fluctuations.

Krawcheck commented on the apparent contradiction in the percentage of mutual funds run by women, stating, “would make you think women just aren’t good at this. Then you look at the number”

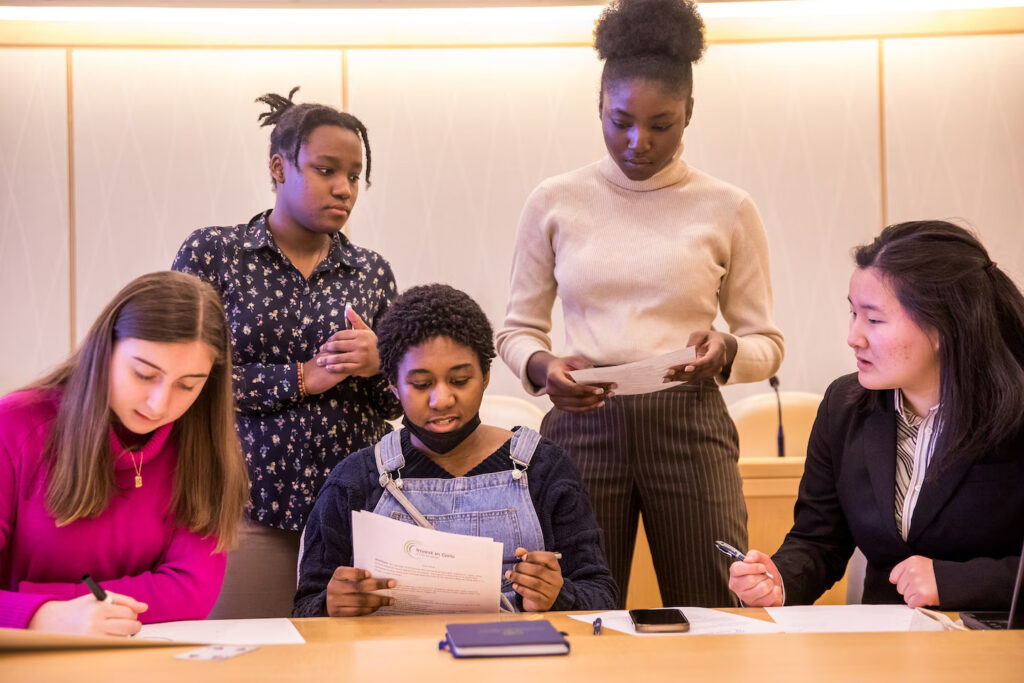

Students in the Boston area visit Wellington Management as part of a finance program created by the organization Invest in Girls. (Invest in Girls)

Several initiatives are in progress to encourage greater female participation. The Invest in Girls program by the Council for Economic Education starts early, imparting fundamental personal finance knowledge to teenage girls and connecting them with women in the industry. Shannan Taylor, the director of development, reflected on her past role as a finance center manager, noting the absence of women, especially Black women.

Taylor emphasized that connecting with women in the industry can be transformative for girls, inspiring them with the realization, “Oh, this is cool. If they can do this, I can do this.”

The program has a dual objective: cultivating a generation of financially literate girls and increasing the representation of women in the industry.

Rebecca Patterson, the board chair of the Council for Economic Education, emphasized the potential impact, stating, “If we can expose younger girls to this and open their eyes to the possibilities, think of all the talent out there that we could unleash.”

Jenny Just, center, a self-made billionaire, began an organization called Poker Power to teach girls and women the art of strategy and risk in business through the game of poker. (Tonje Thilesen)

A unique initiative, Poker Power, spearheaded by Peak6 co-founder Jenny Just, aims to enhance women’s confidence and risk tolerance through the traditionally male-dominated activity of poker. The mission is to educate a million women on negotiating, assessing risk, and making decisions confidently, spanning from classrooms to boardrooms and every seat in between.

Initially skeptical, Erin Lydon, president of Power Poker and a former colleague of Just in Chicago’s finance industry, changed her perspective after learning to play poker. She discovered that poker is not merely a game of chance but a game of skill, with skills that translate into real-life attributes like problem-solving, risk-taking, and strategic thinking.

Now, Lydon imparts these skills to other women, emphasizing their applicability to various aspects of life. According to Dow Janes’s King, when women take control of their finances, the impact reverberates across all areas of their lives, providing them with stronger voices and expanded options. For King, it represents a significant definition of freedom.