Anticipation is growing for intensified efforts from the Chinese government to address the ongoing stock market turmoil, with regulators set to brief President Xi Jinping on market conditions as early as Tuesday.

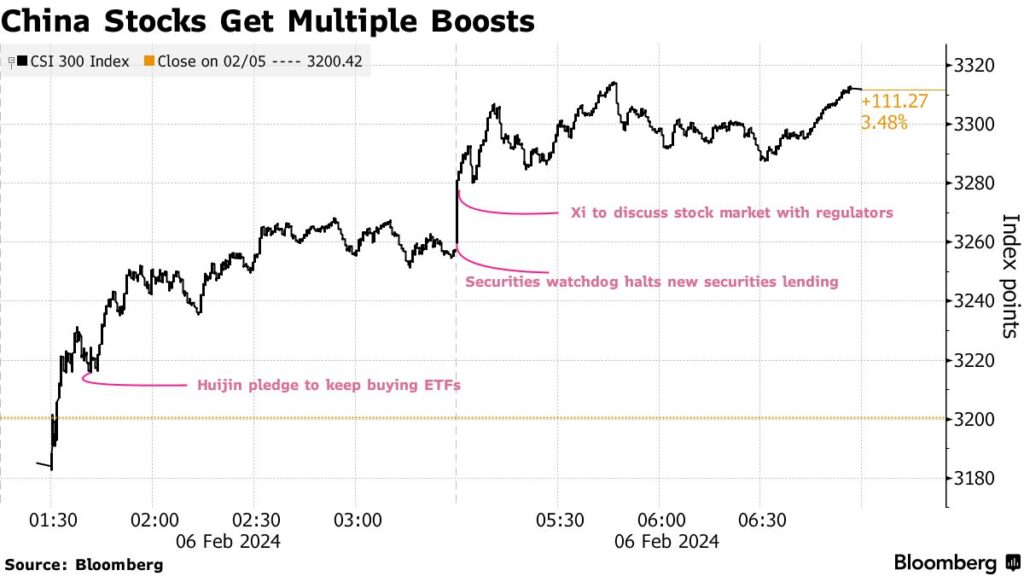

Following reports that regulators, led by the China Securities Regulatory Commission, will update top leadership on market conditions and policy initiatives, Chinese stocks saw an extension of their rebound. The CSI 300 benchmark recorded a 3.5% surge, marking its most significant gain since late 2022. Additionally, small-cap equities, which have been heavily impacted by the downturn, surged, with the CSI 1000 gauge climbing 7%, the most significant increase since 2008.

While the outcome of the Xi meeting remains uncertain in terms of potential new support measures, traders are optimistic that this time may yield different results. The significant losses of approximately $7 trillion in Hong Kong and China equities since their 2021 peaks, coupled with the limited success of piecemeal support measures, have failed to buoy sentiment. For policymakers, stabilizing the stock market ahead of the weeklong Lunar New Year holiday is crucial to prevent further erosion of consumer confidence.

“The news of the nation’s leader convening a meeting is an encouraging sign, indicating that the market decline is approaching a threshold that concerns authorities,” said Li Weiqing, fund manager at JH Investment Management Co. “It suggests that every effort is being made, short of directly intervening in the market — now could be an opportune time to buy.”

The report on the Xi meeting followed a series of supportive announcements earlier in the day, including Central Huijin Investment Ltd.’s commitment to purchasing more exchange-traded funds. The securities watchdog emphasized its commitment to maintaining stable market operations.

Foreign inflows surged, with overseas funds injecting over 12 billion yuan ($1.7 billion) into mainland shares on Tuesday, marking the highest influx this year.

Chinese stocks listed in the US also experienced gains, with the Nasdaq Golden Dragon China Index surging by as much as 4.8%. Major internet stocks, including Alibaba Group Holding Ltd. and PDD Holdings Inc., rose by at least 2%. This uptick followed a brisk rally in a tech shares gauge listed in Hong Kong, the most significant since December 2022.

One concern for buyers is the possibility that the outcome of the meeting may fail to meet expectations, potentially leading to another wave of selling. The volatile market has experienced numerous false recoveries over the past year, with short-lived rebounds driven by stimulus measures quickly overshadowed by negative economic indicators and unexpected policy shifts, denting investor confidence.

The stock market crash of 2015 serves as a cautionary tale, indicating that any rescue efforts may not yield immediate results. Despite authorities’ efforts to curb speculative trading, address market manipulation, and discourage stock sales, the market took months to stabilize, ultimately reaching a peak significantly lower than its 2015 high.

“Our assessment suggests that while state intervention could prompt a temporary rebound, it may not be sufficient for a sustained uptrend,” remarked Rajat Agarwal, Asia equity strategist at Societe Generale SA. “Even drawing parallels with 2015, the buying began in the summer, yet the subsequent rebound was short-lived, and the market only found its footing in early 2016.”

As the market downturn persists, President Xi has exhibited a growing involvement in the nation’s financial and economic policies, including an unprecedented visit to the central bank late last year.

Authorities have been diligently working to devise market stabilization measures in recent months, according to sources. The China Securities Regulatory Commission (CSRC) and the National Financial Regulatory Administration (NFRA) have reportedly convened numerous meetings, including weekends, to address the challenges facing capital markets.

Both the CSRC and NFRA have not responded immediately to requests for comment from Bloomberg.

This week, officials implemented tighter trading restrictions, imposing bans on certain quantitative hedge funds from placing sell orders and others from reducing stock positions in their leveraged market-neutral funds, aiming to mitigate losses. Additionally, the securities regulator announced on Monday its intention to guide brokerages in adjusting their margin call levels and maintaining “flexible” liquidation lines to curb forced selling.

Previous efforts have included restrictions on short-selling and state intervention through share purchases in major banks. However, these measures have yielded limited success in restoring investor confidence, which has been eroded by economic deceleration and President Xi’s increasing influence over private enterprise, coupled with extensive regulatory crackdowns.

Despite the recent market rebound, equity indices remain among the poorest performers globally this year, according to Bloomberg’s tracking of over 90 global gauges. The CSI 300 index plummeted to a five-year low last Friday and remains more than 40% below its 2021 peak.

“The convening of a special meeting may suggest that the situation has deteriorated to a degree that requires reporting to the highest levels,” noted Xu Dawei, fund manager at Jintong Private Fund Management in Beijing. “If there were to be official media coverage of this meeting, it could signify a turning point, as coordinated actions are now being observed.”